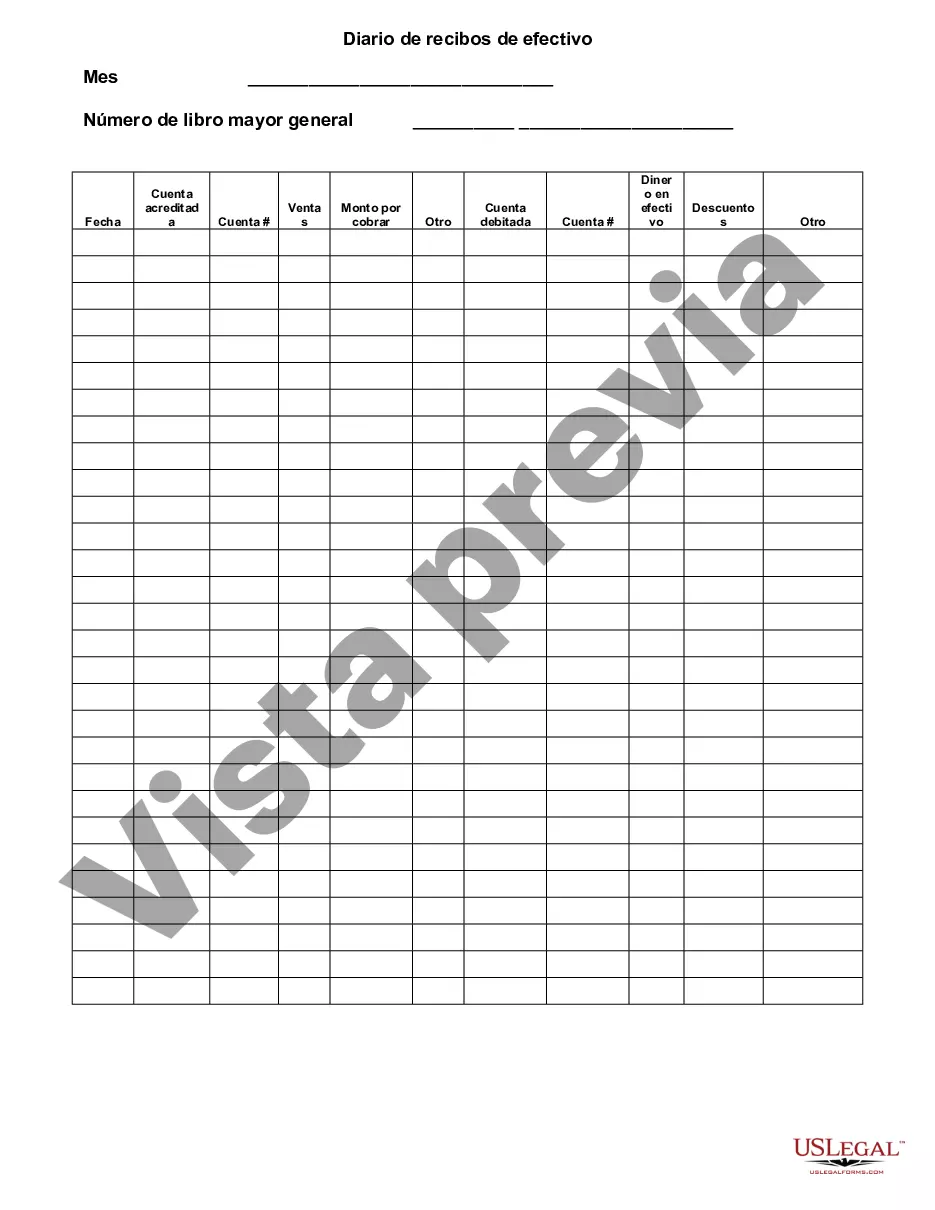

The Cuyahoga County Cash Receipts Journal serves as a comprehensive record of all cash inflows received by the county government in Cuyahoga, Ohio. This journal is essential for maintaining accurate financial records and tracking the sources and amounts of cash received. Keywords: Cuyahoga County, Cash Receipts Journal, Ohio, cash inflows, accurate financial records, sources of cash, amounts received. The Cuyahoga Ohio Cash Receipts Journal is categorized into different types based on the various sources of cash inflows: 1. Tax Receipts Journal: This section of the cash receipts journal records all cash inflows relating to taxes collected by the Cuyahoga County government. It includes payments received for property taxes, sales taxes, income taxes, and other types of taxes levied within the county. 2. Fines and Penalties Journal: This type of cash receipts journal focuses on recording cash inflows generated from fines and penalties imposed by the county government. It includes payments received for traffic violations, parking tickets, court fines, and other penalties. 3. Licenses and Permits Journal: This section tracks cash inflows associated with licenses and permits issued by the county. It includes payments received for business licenses, building permits, professional certifications, and other permits required for various activities within Cuyahoga County. 4. Fees and Services Journal: This type of cash receipts journal records cash inflows generated from fees charged for services provided by the county government. It includes payments received for services like birth and death certificates, marriage licenses, park entry fees, waste management services, and others. 5. Grants and Contributions Journal: This section focuses on recording cash inflows received in the form of grants and contributions from external sources. It includes funds provided by federal, state, and private entities for specific projects, programs, or initiatives undertaken by Cuyahoga County. 6. Miscellaneous Cash Receipts Journal: This category covers all other types of cash inflows that do not fall under the aforementioned journals. It includes payments received for miscellaneous items such as sale of assets, refunds, reimbursements, donations, and any other unclassified sources of cash. By utilizing separate journals for different sources of cash inflows, the Cuyahoga Ohio Cash Receipts Journal ensures a well-organized and detailed record of all funds received by the county government. This information is crucial for financial analysis, budgeting, auditing, and ensuring transparency in the financial operations of Cuyahoga County, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Cuyahoga Ohio Diario De Recibos De Efectivo?

Preparing legal documentation can be burdensome. Besides, if you decide to ask a legal professional to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce papers, or the Cuyahoga Cash Receipts Journal, it may cost you a fortune. So what is the best way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any scenario accumulated all in one place. Consequently, if you need the current version of the Cuyahoga Cash Receipts Journal, you can easily find it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample using the Download button. If you haven't subscribed yet, here's how you can get the Cuyahoga Cash Receipts Journal:

- Glance through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the document format for your Cuyahoga Cash Receipts Journal and download it.

When done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms allows you to use all the paperwork ever obtained many times - you can find your templates in the My Forms tab in your profile. Try it out now!