Fairfax Virginia Cash Receipts Journal is a financial document used by businesses, organizations, and individuals in Fairfax, Virginia, to record all cash receipts received within a specific period. It serves as a detailed record of all incoming cash transactions and is vital for tracking and managing financial activities. The Cash Receipts Journal plays an essential role in the accounting system of any Fairfax-based entity and provides valuable information for financial analysis, taxation, and auditing purposes. The primary purpose of the Fairfax Virginia Cash Receipts Journal is to accurately record the details of each cash inflow. This includes the date of the receipt, the source of the payment, the amount received, the payment method (cash, check, credit card, etc.), and any relevant description or reference number. By documenting this information, the Cash Receipts Journal ensures transparency and accountability in financial operations. There are several types of Fairfax Virginia Cash Receipts Journals, depending on the nature of the business and its specific needs: 1. Sales Cash Receipts Journal: This type of journal primarily records cash receipts generated from the sales of goods or services. It includes cash received from customers, whether in-person, through online transactions, or via mail. 2. Rental Cash Receipts Journal: If a business or individual rents out properties or assets, a Rental Cash Receipts Journal is used to record cash received from tenants or lessees. This journal helps in tracking rental income and managing financial obligations related to property ownership. 3. Donations Cash Receipts Journal: Non-profit organizations, religious institutions, or charities often maintain a separate Cash Receipts Journal to document cash donations received from individuals, corporations, or other funding sources. This journal is crucial for maintaining transparency and ensuring compliance with tax regulations. 4. Miscellaneous Cash Receipts Journal: For businesses or individuals that receive cash from various sources and do not fit into the categories mentioned above, a Miscellaneous Cash Receipts Journal may be utilized. This journal compiles cash receipts from sources such as refunds, rebates, reimbursements, and other miscellaneous income. The Fairfax Virginia Cash Receipts Journal, regardless of its type, is an essential tool in maintaining accurate financial records. It provides an overview of the cash flow within an organization or individual's financial operations, ensuring that all transactions are recorded systematically and transparently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Diario de recibos de efectivo - Cash Receipts Journal

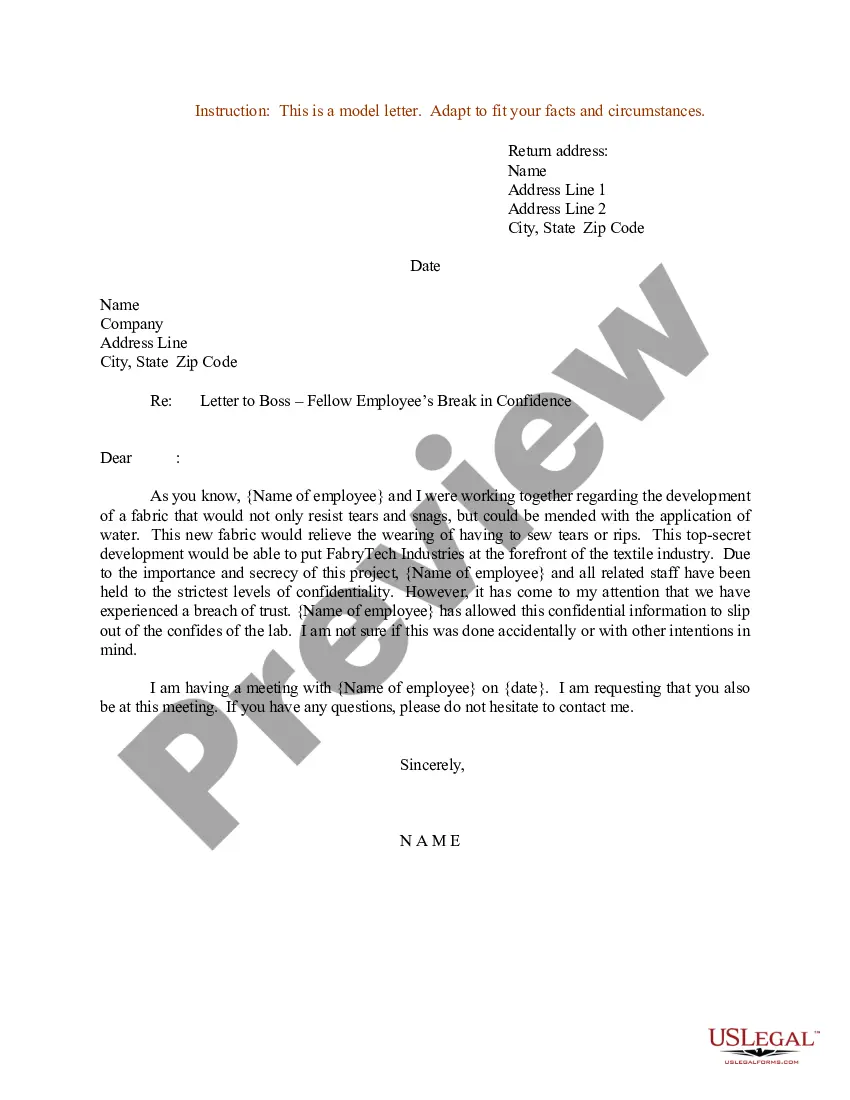

Description

How to fill out Fairfax Virginia Diario De Recibos De Efectivo?

Creating legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including Fairfax Cash Receipts Journal, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to select from in different types varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less overwhelming. You can also find information resources and tutorials on the website to make any tasks associated with paperwork execution straightforward.

Here's how you can locate and download Fairfax Cash Receipts Journal.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the validity of some records.

- Examine the related document templates or start the search over to locate the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the option, then a needed payment method, and buy Fairfax Cash Receipts Journal.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Fairfax Cash Receipts Journal, log in to your account, and download it. Needless to say, our website can’t take the place of a lawyer entirely. If you have to cope with an exceptionally difficult situation, we recommend getting a lawyer to review your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Become one of them today and purchase your state-specific paperwork effortlessly!