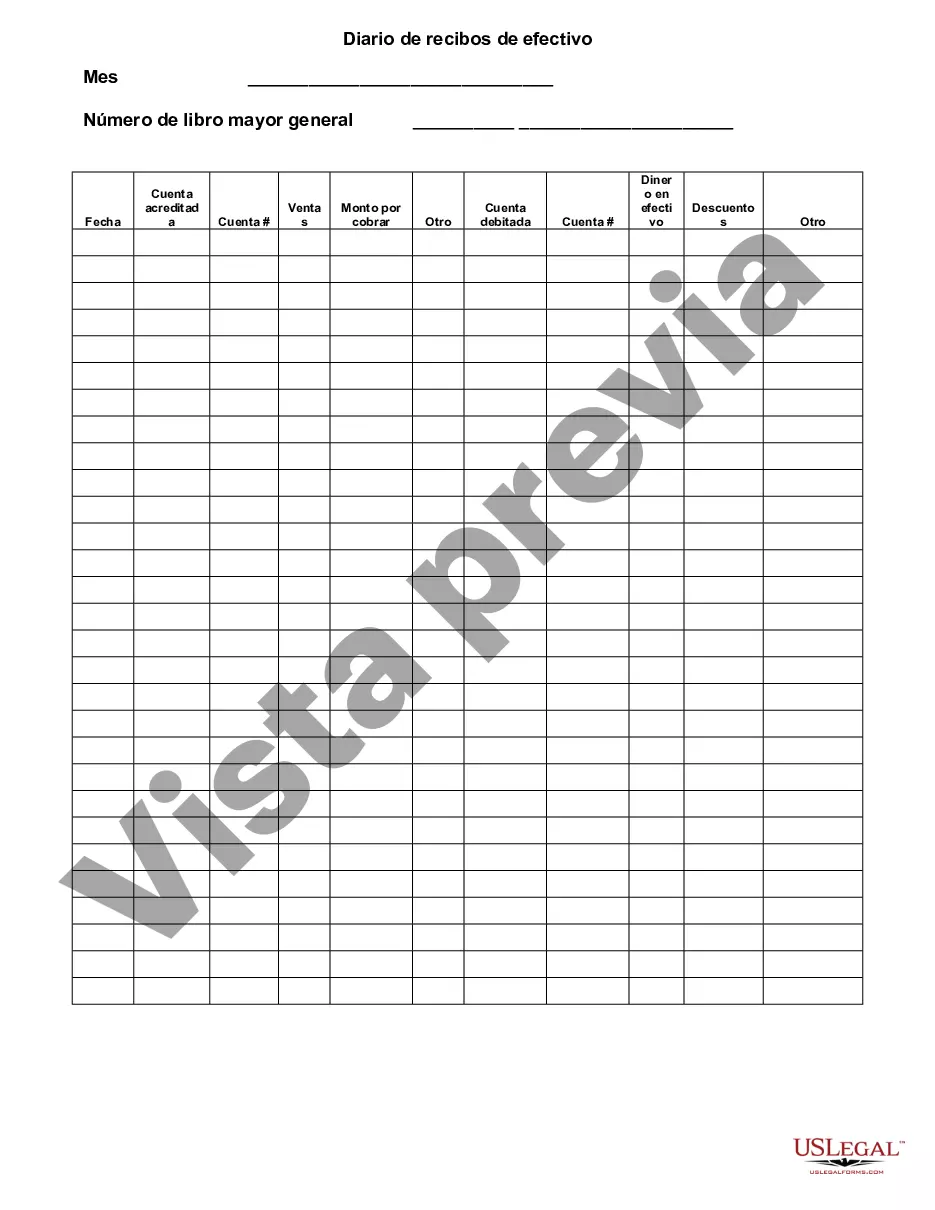

The Franklin Ohio Cash Receipts Journal is a critical accounting tool used by businesses in Franklin, Ohio, to systematically record all incoming cash transactions. This journal is a subsidiary ledger that maintains a record of each cash receipt, ensuring accurate and organized financial reporting. It plays a pivotal role in maintaining the financial health of businesses and allows them to track and manage their cash flow effectively. Keywords: Franklin Ohio, cash receipts journal, accounting tool, incoming cash transactions, subsidiary ledger, record, financial reporting, businesses, financial health, cash flow. There are typically two types of Franklin Ohio Cash Receipts Journals: 1. Sales Cash Receipts Journal: This type of journal is used to record cash receipts received from customer sales. It tracks all cash transactions resulting from sales made by the business, including cash payments, debit or credit card transactions, and any other monetary forms received from customers. The Sales Cash Receipts Journal provides essential information to keep track of revenue and enables businesses to reconcile sales records with their bank deposits. 2. Miscellaneous Cash Receipts Journal: Unlike the Sales Cash Receipts Journal, the Miscellaneous Cash Receipts Journal captures any cash received that does not directly relate to customer sales. It includes cash received from various sources such as refunds, interest income, loan repayments, rent payments, or any other non-sales related revenue. This journal ensures that all incoming cash is consistently recorded and properly categorized, aiding in accurate financial reporting and maintaining transparency. Keywords: Franklin Ohio, cash receipts journal, sales cash receipts journal, miscellaneous cash receipts journal, cash receipts, customer sales, cash transactions, revenue, bank deposits, miscellaneous sources, refunds, interest income, loan repayments, rent payments, non-sales related revenue, financial reporting, transparency. In conclusion, the Franklin Ohio Cash Receipts Journal is an essential accounting tool used in Franklin, Ohio, to systematically record all incoming cash transactions. It consists of two main types, namely the Sales Cash Receipts Journal and the Miscellaneous Cash Receipts Journal. These journals facilitate accurate financial reporting, proper categorization of cash receipts, and efficient cash flow management for businesses in Franklin, Ohio. Keywords: Franklin Ohio, cash receipts journal, accounting tool, incoming cash transactions, Sales Cash Receipts Journal, Miscellaneous Cash Receipts Journal, financial reporting, categorization, cash flow management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Franklin Ohio Diario De Recibos De Efectivo?

Preparing documents for the business or personal demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to generate Franklin Cash Receipts Journal without professional assistance.

It's possible to avoid spending money on attorneys drafting your documentation and create a legally valid Franklin Cash Receipts Journal by yourself, using the US Legal Forms web library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary document.

In case you still don't have a subscription, adhere to the step-by-step guideline below to get the Franklin Cash Receipts Journal:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are available.

- To find the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a few clicks!