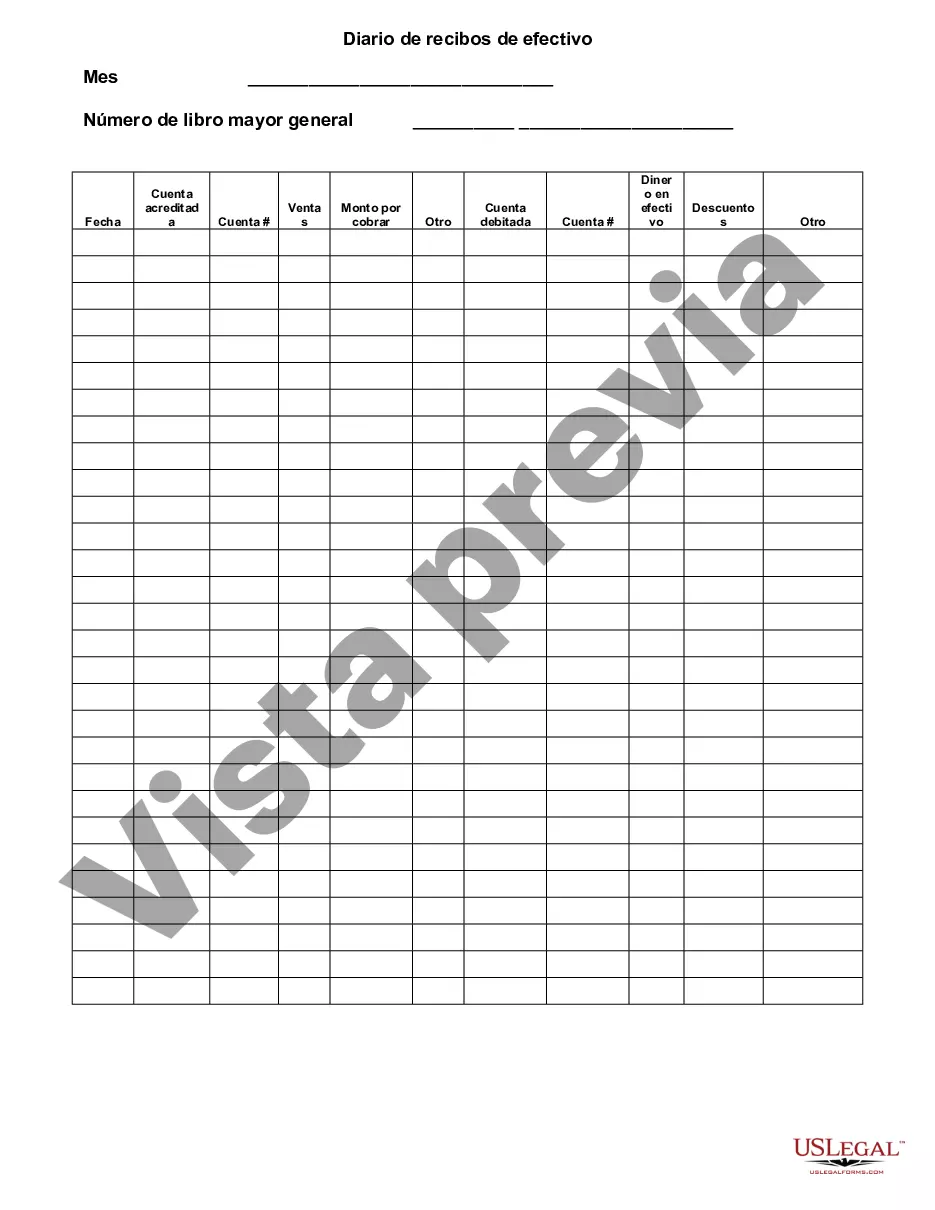

King Washington Cash Receipts Journal is a vital accounting tool used by businesses to record and track all cash inflows. It serves as a comprehensive ledger that documents all cash payments received by an organization. The journal consists of multiple columns that capture various important details such as the date of the transaction, customer name or account number, payment method, purpose of payment, invoice or reference number, and the amount received. This journal plays a significant role in maintaining accurate financial records and enables businesses to have a clear overview of their cash flow. It also assists in the efficient management of customer accounts, provides a detailed reference for potential audits, and aids in the reconciliation process. King Washington offers various types of Cash Receipts Journals to cater to different business needs. Some of these specialized versions include: 1. Basic Cash Receipts Journal: This is the standard version, suitable for small to medium-sized businesses. It allows for the recording of general cash receipts across various categories. 2. Retail Cash Receipts Journal: Specifically designed for businesses operating in the retail industry. It includes additional columns to record specific details such as sales tax, item descriptions, and discounts offered. 3. Services Cash Receipts Journal: Tailored for service-based businesses. It focuses on capturing relevant information such as client names, service description, hours worked, and rates. 4. Rental Cash Receipts Journal: Geared towards organizations involved in rental services. It provides columns for rental period, property/unit details, lease terms, and rent received. 5. Wholesale Cash Receipts Journal: Meant for wholesale businesses. It allows for the recording of bulk sales, discounts, invoice numbers, and details of the wholesale customers. The different types of King Washington Cash Receipts Journals offer flexibility and customization options to suit the unique requirements of diverse businesses. By utilizing these journals effectively, businesses can ensure accurate financial reporting, improved bookkeeping, and enhanced cash management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out King Washington Diario De Recibos De Efectivo?

Preparing documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws and regulations of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to draft King Cash Receipts Journal without expert assistance.

It's easy to avoid wasting money on attorneys drafting your documentation and create a legally valid King Cash Receipts Journal on your own, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the needed form.

In case you still don't have a subscription, follow the step-by-step instruction below to get the King Cash Receipts Journal:

- Look through the page you've opened and verify if it has the document you require.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, use the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!