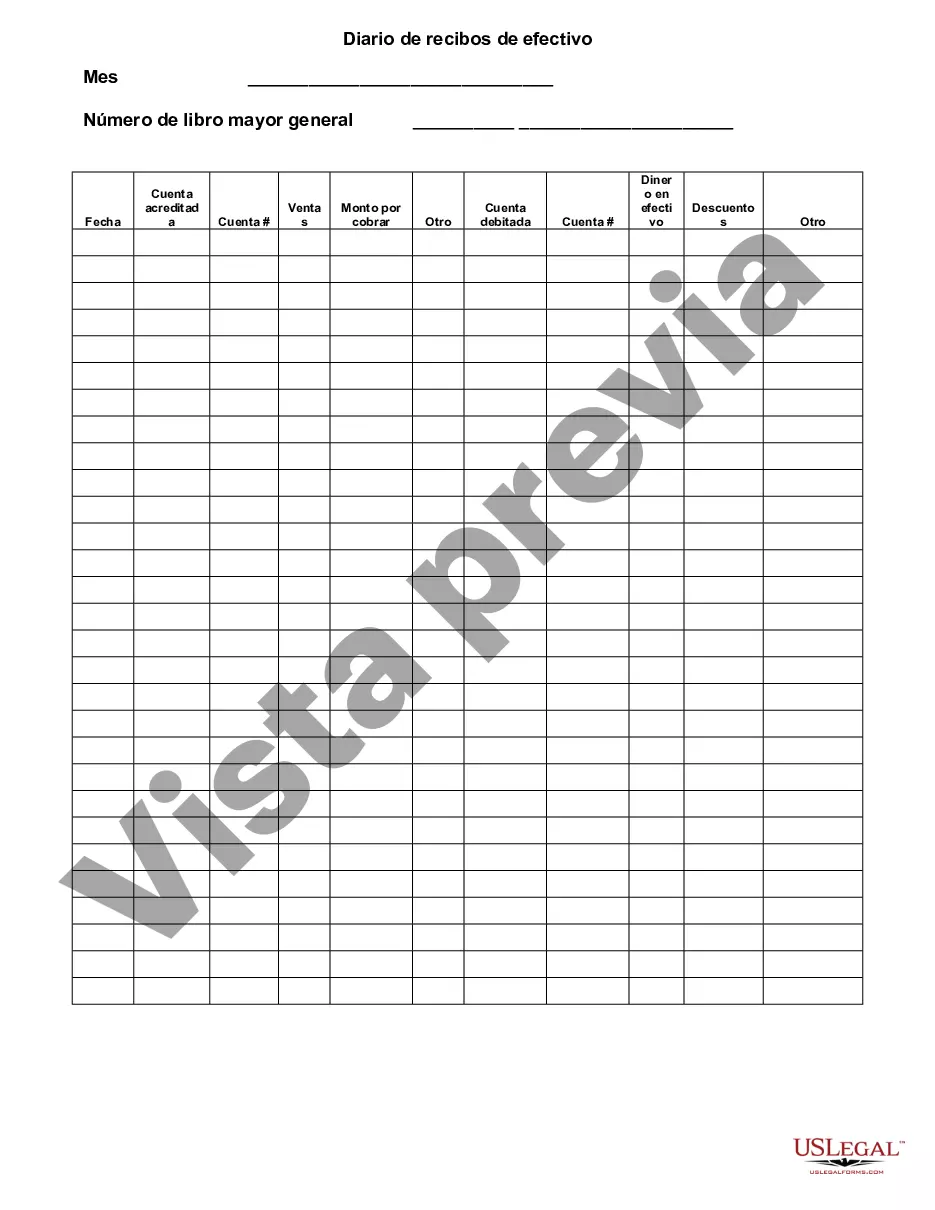

The Maricopa Arizona Cash Receipts Journal is a financial record-keeping tool used by businesses and organizations in Maricopa, Arizona to track and document cash transactions. It is designed to monitor and record the inflow of cash from various sources, such as sales, services rendered, and other miscellaneous income. The primary purpose of the Cash Receipts Journal is to maintain an accurate record of all cash received, ensuring that the business remains organized and compliant with financial regulations. Each entry in the journal includes important details, such as the date of the transaction, the amount received, the source of cash (customer name or income category), and a brief description of the purpose of the payment. By utilizing the Maricopa Arizona Cash Receipts Journal, businesses can effectively track their cash inflow, reconcile transactions with bank statements, and maintain a transparent financial trail for auditing purposes. It allows for better financial control and aids in creating accurate financial reports. There are several types of Maricopa Arizona Cash Receipts Journals, including: 1. Sales Cash Receipts Journal: This type of journal records cash received from the sales of goods or services. It helps track customer payments, invoice numbers, and any applicable taxes or discounts. 2. Miscellaneous Cash Receipts Journal: This journal handles cash from various sources other than sales. It includes income generated from sources like rent, royalties, interest, donations, or any other miscellaneous revenue streams. 3. Petty Cash Receipts Journal: Petty cash is used for small, day-to-day expenses. This journal records any cash disbursed from the petty cash fund and tracks the amount, date, purpose, and recipient. 4. Cash Over and Short Journal: This specialized journal records discrepancies between the cash on hand and the amount recorded in sales or receipts. It helps identify errors, theft, or other irregularities in the cash handling process. 5. Cash Receipts Reconciliation Journal: This journal is used to reconcile the discrepancies between cash receipts recorded in the cash receipts journal and the bank deposits. It ensures that all cash receipts are accurately recorded and deposited. Overall, the Maricopa Arizona Cash Receipts Journal is an essential tool for businesses and organizations operating in Maricopa, Arizona. It provides a systematic and organized approach to tracking cash inflow, ensuring accuracy, transparency, and financial control.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Maricopa Arizona Diario De Recibos De Efectivo?

Are you looking to quickly draft a legally-binding Maricopa Cash Receipts Journal or probably any other form to handle your own or business matters? You can select one of the two options: contact a professional to draft a valid paper for you or create it entirely on your own. Luckily, there's an alternative solution - US Legal Forms. It will help you receive professionally written legal paperwork without paying unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-specific form templates, including Maricopa Cash Receipts Journal and form packages. We provide documents for a myriad of use cases: from divorce papers to real estate documents. We've been out there for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and get the needed document without extra troubles.

- First and foremost, double-check if the Maricopa Cash Receipts Journal is tailored to your state's or county's laws.

- If the document comes with a desciption, make sure to check what it's suitable for.

- Start the search over if the template isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, find the Maricopa Cash Receipts Journal template, and download it. To re-download the form, simply go to the My Forms tab.

It's effortless to find and download legal forms if you use our services. In addition, the documents we offer are reviewed by industry experts, which gives you greater peace of mind when dealing with legal matters. Try US Legal Forms now and see for yourself!