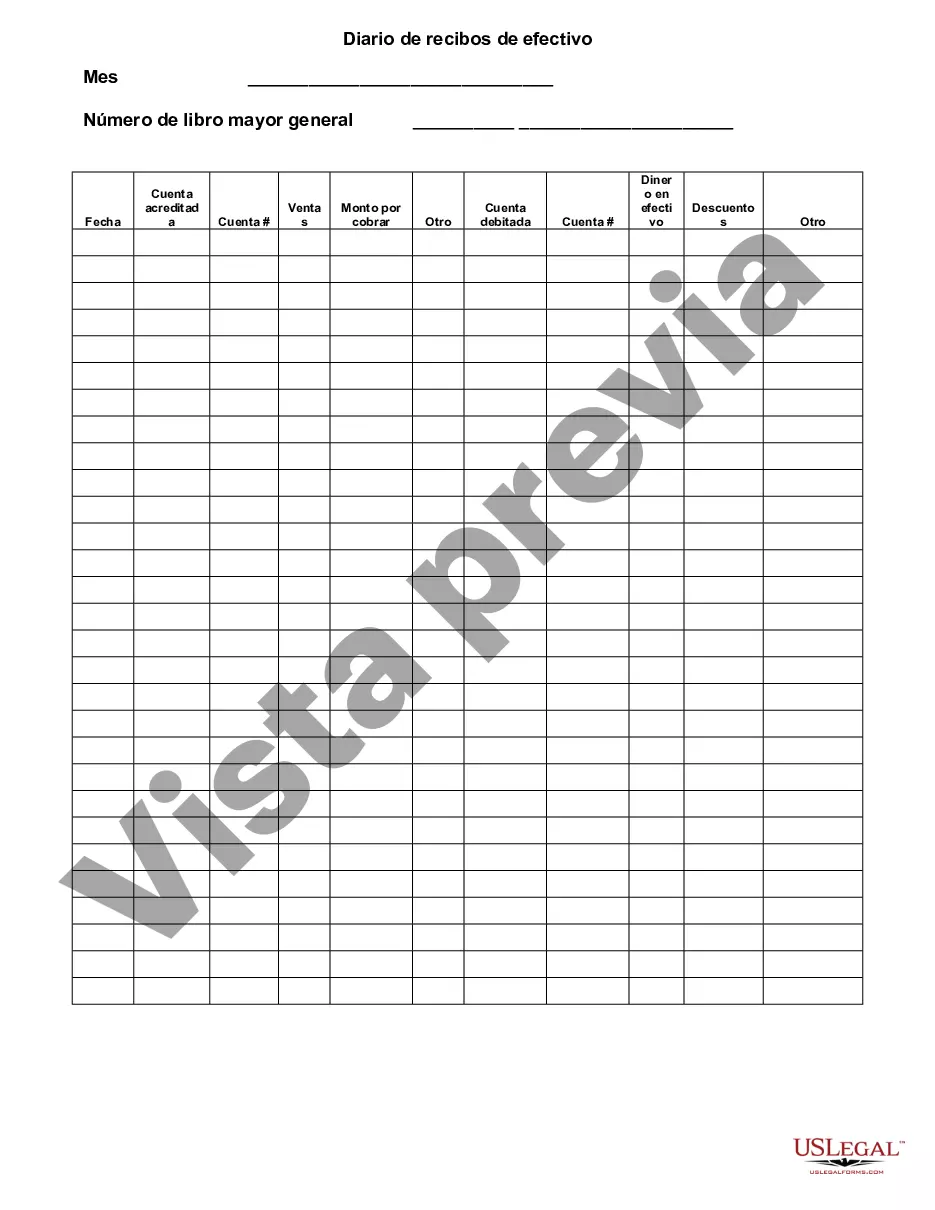

The Mecklenburg North Carolina Cash Receipts Journal is a document used by various businesses and organizations in Mecklenburg County, North Carolina, to record all incoming cash transactions. It serves as a crucial tool for monitoring and tracking the inflow of cash from various sources, ensuring accurate financial records and efficient cash management. Keywords: Mecklenburg North Carolina, Cash Receipts Journal, organizations, businesses, incoming cash transactions, monitoring, tracking, financial records, cash management. There are typically two types of Cash Receipts Journals used in Mecklenburg North Carolina: 1. General Cash Receipts Journal: This journal is utilized by most businesses in Mecklenburg County to record cash received from various sources, including sales, services, loans, or any other cash inflow. It provides a comprehensive overview of all cash transactions, helping businesses and organizations stay organized and maintain accurate financial records. 2. Non-Profit Cash Receipts Journal: This specific cash receipt journal is primarily used by non-profit organizations operating in Mecklenburg North Carolina. It aids in tracking donations, grants, membership fees, fundraisers, and other monetary contributions received by the non-profit entity. The journal ensures transparency and accountability in managing the funds for their specific causes. Both types of Cash Receipt Journals in Mecklenburg North Carolina typically include the following information: — Date of the transaction: The exact date when the cash is received. — Description: A brief description or reference of the purpose of the cash inflow, such as the product, service, or reason for the receipt. — Amount: The total amount of cash received for each transaction, categorized by source or type of income. — Customer or Payer Details: The name or identification of the customer, client, donor, or any other source from which the cash is received. — Payments Method: The mode of payment used, whether it's cash, credit card, check, or any other form. — Account Reference: The account number or code used for internal accounting purposes, facilitating easy tracking and reconciliation. — Receipt Number: A unique identifier given to each receipt, enabling easy cross-referencing and retrieval of specific transactions. Businesses and organizations in Mecklenburg North Carolina must maintain an accurate and up-to-date Cash Receipts Journal to ensure proper bookkeeping, facilitate financial reporting, and comply with tax regulations. The journal also serves as a valuable reference for internal auditing, performance analysis, and budgeting purposes. In conclusion, the Mecklenburg North Carolina Cash Receipts Journal is a crucial tool for businesses and non-profit organizations alike. It enables efficient tracking and monitoring of all cash inflows, ensuring accurate financial records and effective cash management. By maintaining well-organized and detailed Cash Receipts Journals, entities in Mecklenburg County can streamline their financial operations and make informed decisions to support their growth and sustainability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Mecklenburg North Carolina Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Mecklenburg North Carolina Diario De Recibos De Efectivo?

Preparing documents for the business or individual demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it tense and time-consuming to draft Mecklenburg Cash Receipts Journal without professional help.

It's possible to avoid spending money on lawyers drafting your documentation and create a legally valid Mecklenburg Cash Receipts Journal by yourself, using the US Legal Forms online library. It is the biggest online collection of state-specific legal documents that are professionally verified, so you can be sure of their validity when selecting a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Mecklenburg Cash Receipts Journal:

- Examine the page you've opened and verify if it has the sample you need.

- To achieve this, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly get verified legal templates for any scenario with just a couple of clicks!