The Nassau New York Cash Receipts Journal is a vital financial document used to record and track all cash transactions in Nassau County, New York. It serves as a comprehensive record of incoming cash, ensuring proper documentation and easy retrieval of financial information. The Cash Receipts Journal plays a crucial role in maintaining accurate financial statements and providing transparency in financial operations. The Cash Receipts Journal captures various kinds of cash inflows, including payments from customers, rental income, grants, donations, fines, and miscellaneous receipts. Each entry in the journal denotes the date, source, and amount of cash received, ensuring meticulous record-keeping and facilitating future audits. As for the different types of Nassau New York Cash Receipts Journal, there might be variations based on the entity or organization utilizing it. Examples include: 1. Governmental Cash Receipts Journal: This type of journal pertains to cash transactions within Nassau County's government agencies, including tax collections, public service payments, licensing fees, etc. It is essential for tracking revenue streams and ensuring compliance with financial regulations. 2. Non-profit Organization Cash Receipts Journal: Non-profit organizations in Nassau County, such as charities, NGOs, or community organizations, utilize this journal to monitor donations, membership dues, event ticket sales, and other cash inflows. It helps them maintain financial transparency required for charitable operations. 3. Small Business Cash Receipts Journal: Small businesses in Nassau County can employ this journal to record cash receipts from sales, services rendered, and other revenue sources. It enables them to track their cash flow, manage inventory, reconcile bank statements, and facilitates accurate financial reporting. 4. Real Estate Cash Receipts Journal: Property management companies or real estate firms in Nassau County may adopt this journal to log rental payments, security deposits, and other cash inflows related to property rentals. It aids in tracking tenant payments, ensuring proper allocation to property owners, and maintaining a clear financial record. The Nassau New York Cash Receipts Journal, regardless of its type, plays a valuable role in maintaining accurate financial records, supporting financial decision-making, and ensuring compliance with financial regulations in Nassau County, New York.

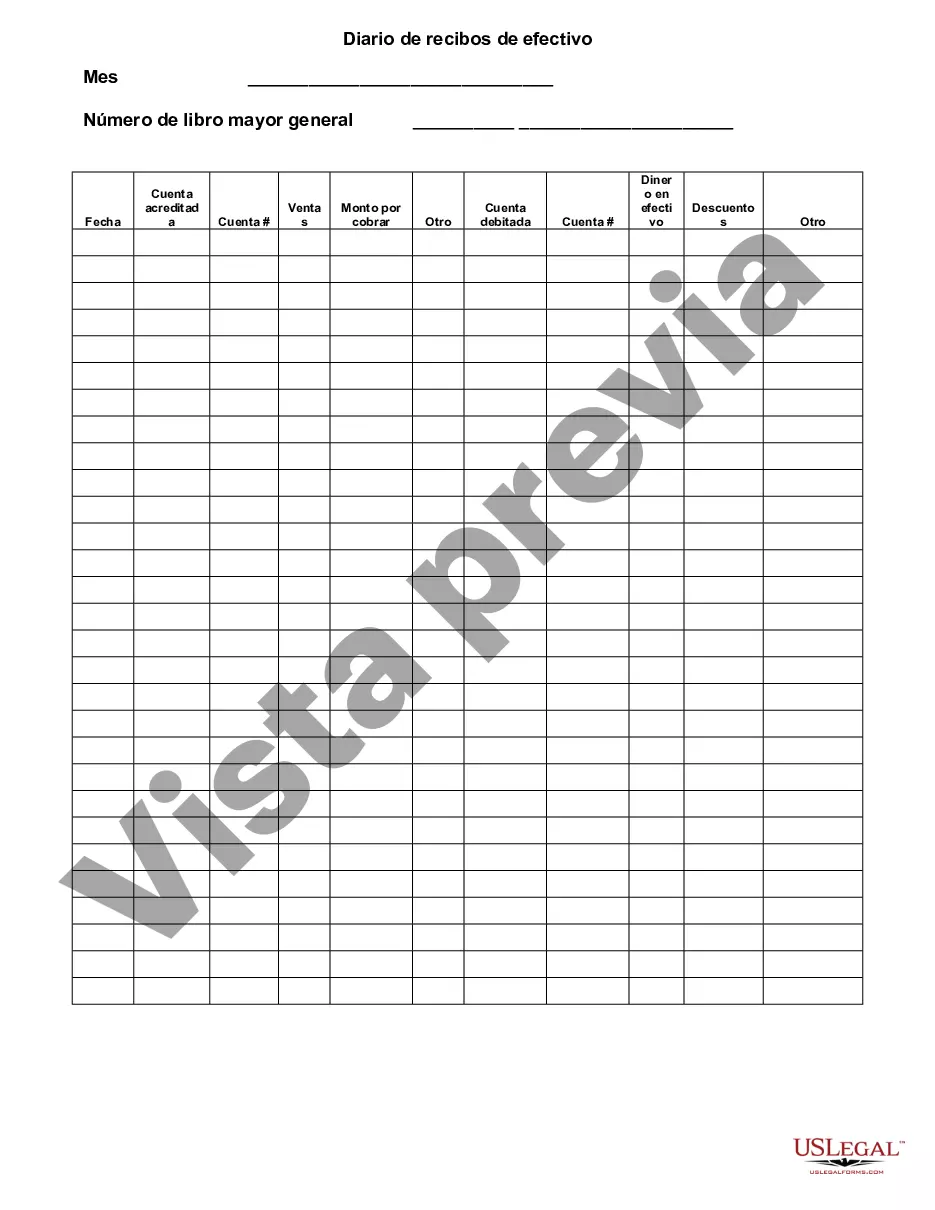

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nassau New York Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Nassau New York Diario De Recibos De Efectivo?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from scratch, including Nassau Cash Receipts Journal, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information resources and tutorials on the website to make any tasks associated with paperwork completion straightforward.

Here's how you can locate and download Nassau Cash Receipts Journal.

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after getting the document.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the legality of some documents.

- Check the similar forms or start the search over to locate the right document.

- Click Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Nassau Cash Receipts Journal.

- Choose to save the form template in any offered file format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the needed Nassau Cash Receipts Journal, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional entirely. If you need to cope with an exceptionally difficult situation, we advise using the services of an attorney to check your form before signing and filing it.

With more than 25 years on the market, US Legal Forms became a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!