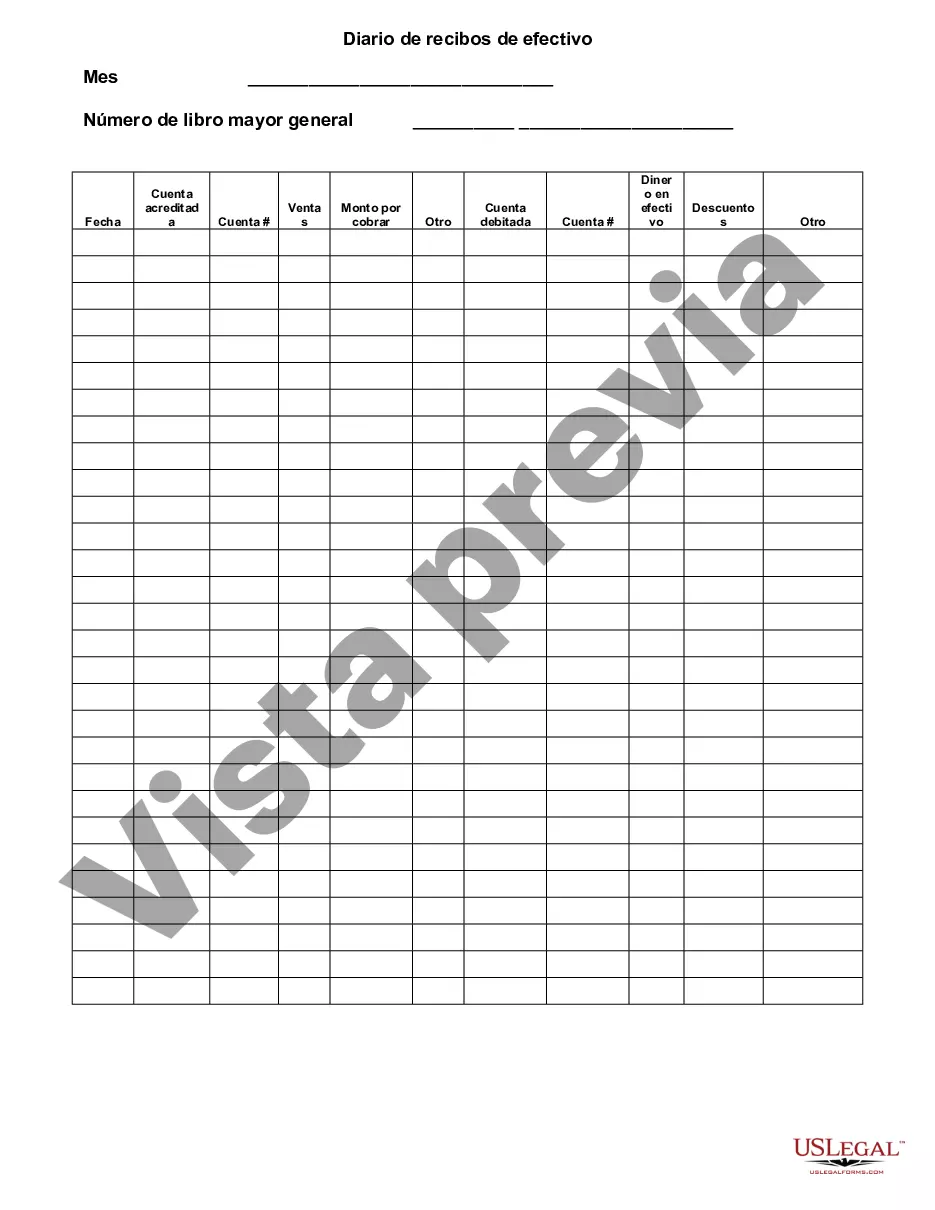

Riverside California Cash Receipts Journal is a crucial financial document that businesses in Riverside, California used to track and record all cash transactions they receive. It serves as a primary record-keeping tool and helps ensure accuracy and reliability in financial transactions. The Riverside California Cash Receipts Journal facilitates efficient tracking of cash inflows from various sources such as sales, payments from customers, and other types of cash receipts. This journal allows businesses to maintain transparent records of all incoming funds, providing a detailed overview of their financial activities. Key features of the Riverside California Cash Receipts Journal include columns to record the following information: 1. Date of the transaction: This column allows businesses to record the date on which the cash receipt was received. 2. Account name or source: This column helps identify the source of the cash receipt, whether it is from sales, loan repayments, investments, or any other type of income. 3. Check or transaction number: This column provides space to record the check number or any other transaction reference number associated with the cash receipt. 4. Total amount received: The total cash amount received is recorded in this column, ensuring accurate tracking of funds. 5. Additional notes or details: Businesses can use this column to add any relevant notes or details regarding the cash receipt. Different types of Riverside California Cash Receipts Journal may include specialized columns to cater to specific industries or businesses. For instance, a retail store may have additional columns to record cash receipts from different sales categories such as apparel, electronics, and accessories. Similarly, a service-based business might have separate columns for different services offered, such as consultation fees, maintenance charges, or subscription payments. In conclusion, the Riverside California Cash Receipts Journal is a fundamental financial tool that supports businesses in Riverside, California in effectively managing their cash transactions. It enables accurate monitoring of cash inflows, ensuring transparency and aiding in financial decision-making.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Riverside California Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Riverside California Diario De Recibos De Efectivo?

Are you looking to quickly draft a legally-binding Riverside Cash Receipts Journal or maybe any other document to take control of your personal or business matters? You can go with two options: contact a legal advisor to write a legal document for you or create it completely on your own. Thankfully, there's an alternative option - US Legal Forms. It will help you receive professionally written legal documents without having to pay sky-high prices for legal services.

US Legal Forms provides a rich catalog of more than 85,000 state-compliant document templates, including Riverside Cash Receipts Journal and form packages. We offer templates for an array of use cases: from divorce papers to real estate document templates. We've been on the market for more than 25 years and gained a spotless reputation among our clients. Here's how you can become one of them and obtain the needed template without extra hassles.

- First and foremost, double-check if the Riverside Cash Receipts Journal is adapted to your state's or county's laws.

- If the form comes with a desciption, make sure to verify what it's suitable for.

- Start the searching process over if the document isn’t what you were seeking by using the search bar in the header.

- Choose the plan that is best suited for your needs and proceed to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Riverside Cash Receipts Journal template, and download it. To re-download the form, just head to the My Forms tab.

It's stressless to find and download legal forms if you use our services. In addition, the paperwork we offer are updated by industry experts, which gives you greater confidence when dealing with legal matters. Try US Legal Forms now and see for yourself!