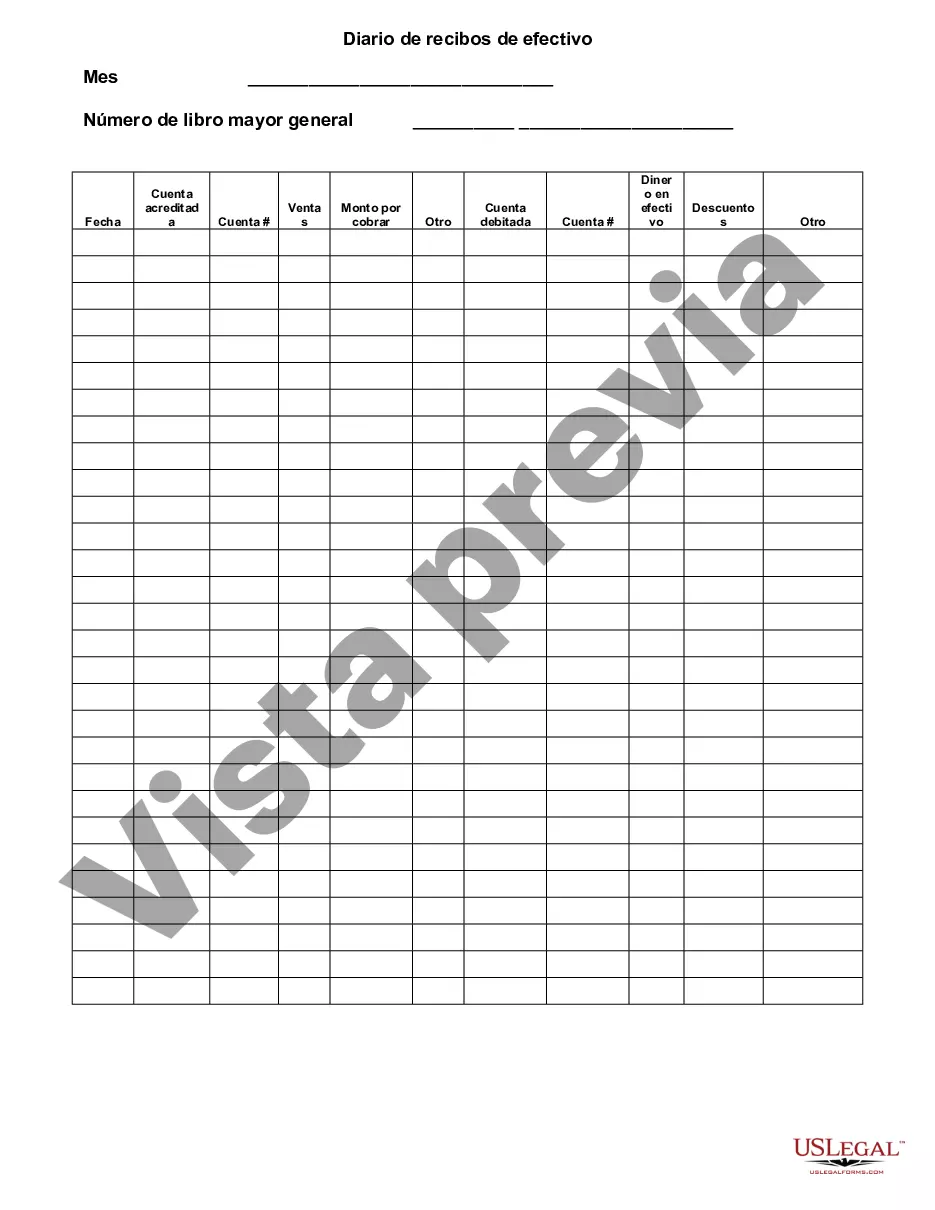

The Travis Texas Cash Receipts Journal is a crucial accounting tool used for recording all incoming cash transactions within the Travis Texas state. It serves as a detailed record of the amount of cash received, the source of the cash, and the purpose for which it was received. This journal plays a vital role in accurately tracking and managing cash inflows, enabling businesses and organizations to maintain transparency and ensure that their financial records align with their operations. The Travis Texas Cash Receipts Journal contains various columns that capture specific information related to each transaction. These include the date of receipt, the customer or payer's name, a description of the payment, the amount received, and any relevant reference numbers. The journal provides a comprehensive overview of all cash received during a particular period, offering a snapshot of the organization's financial performance. Keywords: Travis Texas, Cash Receipts Journal, accounting tool, incoming cash transactions, record, amount of cash received, source of cash, purpose, tracking, managing cash inflows, transparency, financial records, operations, columns, date of receipt, customer, payer's name, description of payment, amount received, reference numbers, comprehensive overview, financial performance. Different Types of Travis Texas Cash Receipts Journal: 1. General Cash Receipts Journal: This type of cash receipts journal is generally used by businesses of all sizes and industries to record all types of cash receipts, including sales, services rendered, rent received, or any other sources of income. 2. Petty Cash Receipts Journal: Unlike the general cash receipts journal, the petty cash receipts journal specifically focuses on recording small transactions that involve petty cash, such as office supplies, employee reimbursements, or other minor expenses. 3. Revenue-specific Cash Receipts Journal: Some businesses may maintain separate cash receipts journals for specific revenue streams, such as a rent cash receipts journal for property management companies or a membership cash receipts journal for organizations that collect membership fees. 4. Donation Cash Receipts Journal: Non-profit organizations or entities that rely heavily on donations may keep a separate cash receipts journal to meticulously track donations received, including the donor's name, amount, purpose, and any special instructions. 5. Electronic Cash Receipts Journal: With the increasing prevalence of digital transactions, many businesses and organizations now utilize electronic cash receipts journals to record and track cash inflows received through online payment gateways, mobile payment apps, or other digital platforms. Keywords: General Cash Receipts Journal, Petty Cash Receipts Journal, Revenue-specific Cash Receipts Journal, Donation Cash Receipts Journal, Electronic Cash Receipts Journal, businesses, industries, sales, services, rent, income, petty cash, office supplies, employee reimbursements, minor expenses, revenue streams, rent cash receipts journal, membership cash receipts journal, donation cash receipts journal, non-profit organizations, digital transactions, online payment gateways, mobile payment apps, digital platforms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Travis Texas Diario De Recibos De Efectivo?

If you need to find a reliable legal form provider to find the Travis Cash Receipts Journal, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can browse from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, variety of learning resources, and dedicated support team make it easy to locate and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

You can simply type to look for or browse Travis Cash Receipts Journal, either by a keyword or by the state/county the document is intended for. After locating required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Travis Cash Receipts Journal template and check the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be instantly ready for download as soon as the payment is completed. Now you can execute the form.

Taking care of your legal matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our comprehensive collection of legal forms makes these tasks less expensive and more affordable. Set up your first company, organize your advance care planning, draft a real estate agreement, or complete the Travis Cash Receipts Journal - all from the convenience of your home.

Join US Legal Forms now!