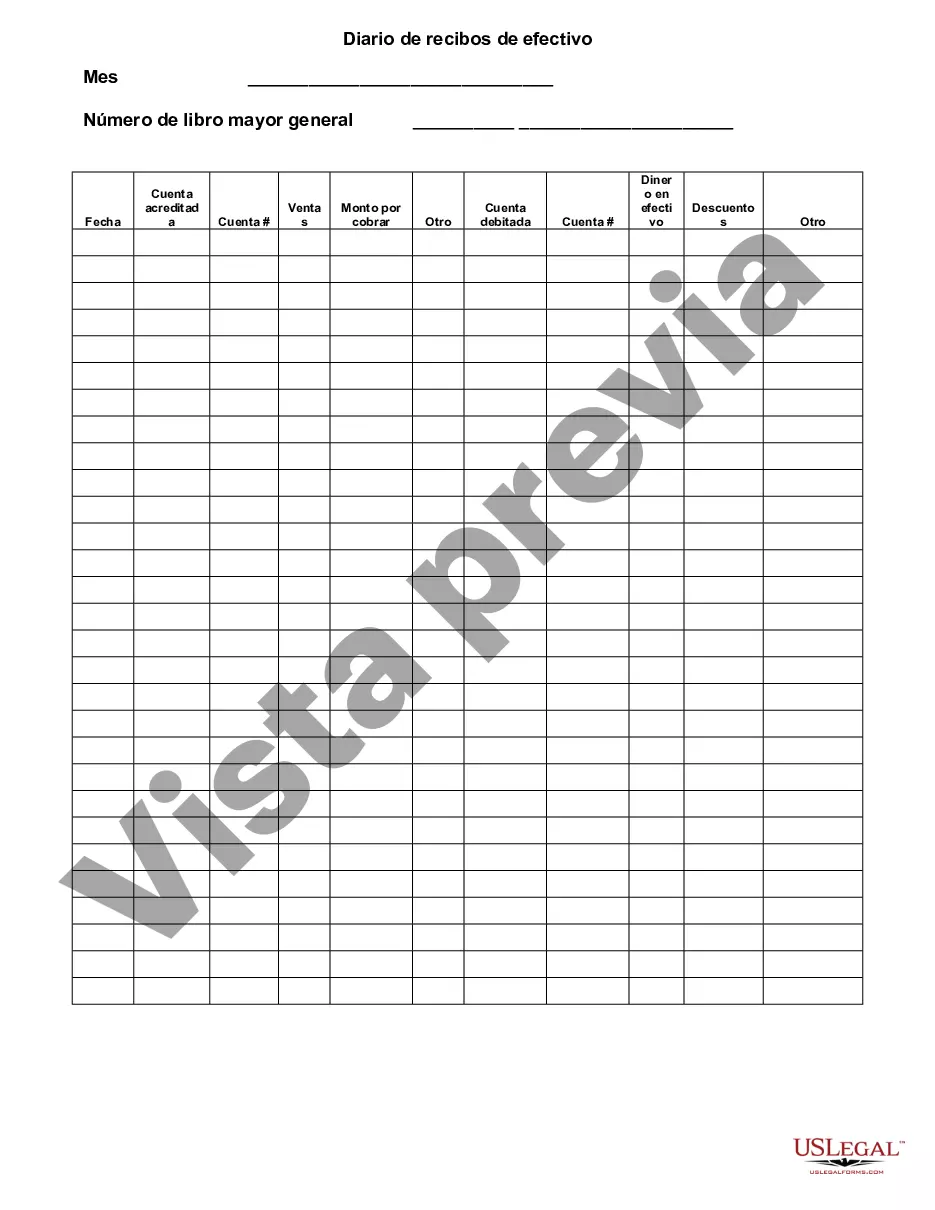

The Wake North Carolina Cash Receipts Journal is a specialized financial document used to record all cash transactions made by a business or organization in Wake County, North Carolina. It serves as an essential tool for accurately tracking and organizing incoming cash flow. The primary purpose of the cash receipts journal is to provide a comprehensive record of cash received from various sources, including customer payments, loans, investments, and other income. Each entry in the journal typically includes relevant details such as the date of the transaction, the source of the payment, the amount received, and any related notes or references. By maintaining a cash receipts journal, businesses in Wake North Carolina can ensure proper documentation and transparency in their financial operations. This journal helps maintain accurate accounting records, simplifies the reconciliation process, and provides a clear trail of financial transactions for auditing and reporting purposes. In Wake County, there may be different types of cash receipts journals depending on the specific needs and nature of the business. Some of these variations could include: 1. Sales Cash Receipts Journal: This type of journal focuses primarily on recording cash received from customer sales or services provided. It tracks individual customer payments, allowing businesses to monitor revenue sources, identify outstanding balances, and track sales trends. 2. Miscellaneous Cash Receipts Journal: This journal captures cash received from various sources other than customer sales, such as interest income, rent payments, dividend payments, or donations. It enables businesses to keep detailed records of non-sales-related cash flow. 3. Petty Cash Receipts Journal: If a business maintains a petty cash fund to cover small daily expenses, a separate journal may be used to record the disbursements from the fund as well as the replenishments of cash into the fund. This journal helps track petty cash usage and maintain proper accountability. 4. Online Cash Receipts Journal: In today's digital era, businesses may also have an online cash receipts journal specifically designed to record cash received through online platforms, payment gateways, or electronic payment methods. This journal allows businesses to track digital transactions and reconcile them with their online sales records. In summary, the Wake North Carolina Cash Receipts Journal is a vital accounting tool used to systematically record and track all cash received by a business. By categorizing transactions into different types of journals, businesses can effectively analyze their cash flow, maintain accurate financial records, and comply with regulatory requirements in Wake County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Wake North Carolina Diario De Recibos De Efectivo?

How much time does it usually take you to draft a legal document? Given that every state has its laws and regulations for every life scenario, locating a Wake Cash Receipts Journal suiting all regional requirements can be exhausting, and ordering it from a professional attorney is often pricey. Many web services offer the most common state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Wake Cash Receipts Journal, here you can get any specific form to run your business or individual affairs, complying with your county requirements. Professionals verify all samples for their validity, so you can be sure to prepare your documentation correctly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, select the needed form, and download it. You can pick the document in your profile at any moment in the future. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your Wake Cash Receipts Journal:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the selected document.

- Decide on the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wake Cash Receipts Journal.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired document, you can locate all the files you’ve ever saved in your profile by opening the My Forms tab. Try it out!