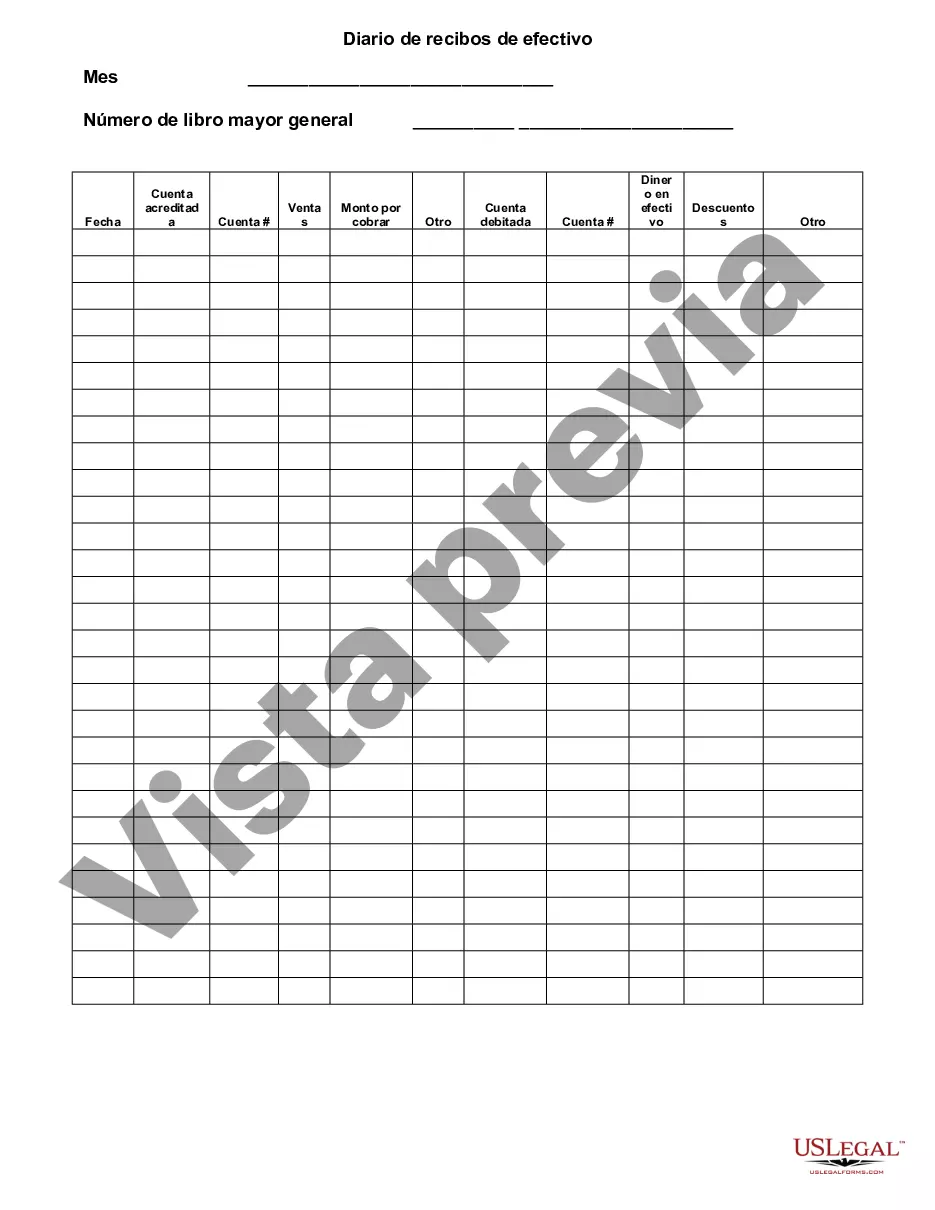

The Wayne Michigan Cash Receipts Journal is a vital tool used by businesses in Wayne, Michigan to record and track all cash transactions accurately. This financial document is designed to provide a comprehensive overview of all cash received by a company, allowing for easy monitoring and analysis of the organization's financial health. The Cash Receipts Journal showcases detailed information about each cash transaction, including the date, amount, and source of the cash received. In Wayne, Michigan, there are several types of Cash Receipts Journals used, depending on the specific business needs and requirements. Let's explore some of these variants: 1. General Cash Receipts Journal: The General Cash Receipts Journal is the most commonly used type, accommodating various types of cash inflow such as sales receipts, cash refunds, loan repayments, or any other cash received by the business. It serves as a comprehensive record of all cash transactions, ensuring accuracy and transparency in financial reporting. 2. Sales Receipts Journal: Specifically used by retail businesses, the Sales Receipts Journal focuses solely on recording cash inflow related to customer purchases. This journal helps in reconciling sales revenue with cash received, enabling accurate tracking of sales performance. 3. Rental Cash Receipts Journal: Many businesses in Wayne, Michigan, such as property management companies or equipment rental firms, utilize the Rental Cash Receipts Journal to monitor the collection of rental payments. This journal allows for simple tracking of rental income, outstanding payments, and any associated fees or penalties. 4. Donation Cash Receipts Journal: Non-profit organizations and charitable institutions in Wayne, Michigan maintain a Donation Cash Receipts Journal to systematically record all cash donations received. This journal helps in maintaining transparency, tracking donor contributions, and providing accurate receipts for tax purposes. 5. Miscellaneous Cash Receipts Journal: For businesses that receive cash from multiple sources or for various miscellaneous reasons, the Miscellaneous Cash Receipts Journal proves beneficial. It serves as a catch-all journal to document any cash inflow not covered by the other specialized journals mentioned above. Regardless of the type of Cash Receipts Journal used, maintaining accurate and up-to-date cash records is crucial for a robust financial management system. Implementing a well-structured journaling system allows businesses in Wayne, Michigan, to analyze their cash flow, identify potential issues, make informed financial decisions, and ensure compliance with relevant tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Diario de recibos de efectivo - Cash Receipts Journal

Description

How to fill out Wayne Michigan Diario De Recibos De Efectivo?

How much time does it typically take you to draw up a legal document? Considering that every state has its laws and regulations for every life scenario, finding a Wayne Cash Receipts Journal meeting all local requirements can be stressful, and ordering it from a professional lawyer is often costly. Numerous web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most comprehensive web collection of templates, grouped by states and areas of use. Apart from the Wayne Cash Receipts Journal, here you can find any specific form to run your business or individual deeds, complying with your regional requirements. Professionals verify all samples for their actuality, so you can be sure to prepare your paperwork properly.

Using the service is pretty straightforward. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the required sample, and download it. You can get the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra steps to complete before you get your Wayne Cash Receipts Journal:

- Check the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Wayne Cash Receipts Journal.

- Print the sample or use any preferred online editor to fill it out electronically.

No matter how many times you need to use the acquired document, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Try it out!