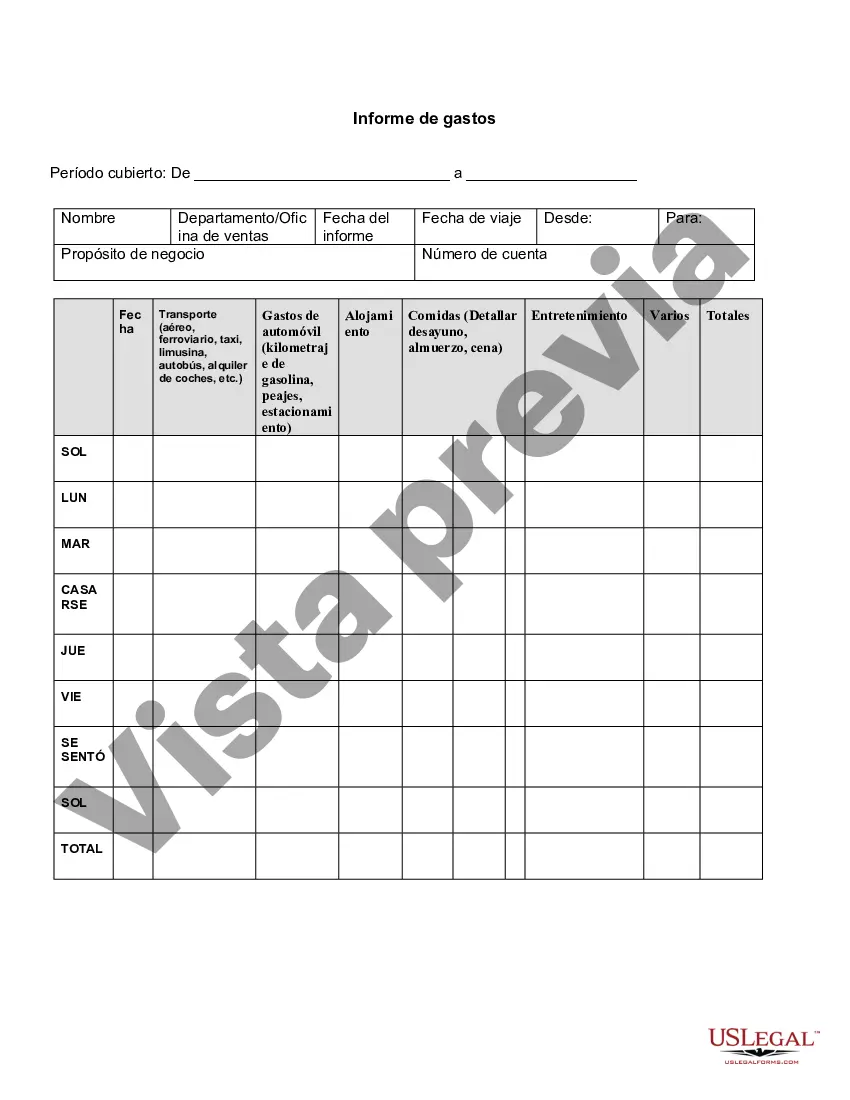

Allegheny Pennsylvania Expense Report is a comprehensive document that outlines the details of any expenses incurred during a specific timeframe or project in Allegheny County, Pennsylvania. This report serves as an important tool for individuals or businesses to track and analyze their expenditures accurately. It provides transparency, accountability, and helps in budgeting and financial planning. The Allegheny Pennsylvania Expense Report includes various elements to ensure a thorough representation of expenditures. Some essential components are: 1. Date: The date when the expense was incurred or the specific duration for which the report is being generated. 2. Purpose: A brief description of why the expense was necessary or the purpose behind it. 3. Expense Category: Expenses are organized into different categories to easily identify the type of expense, such as travel, accommodation, meals, office supplies, transportation, etc. 4. Vendor/Supplier: The name and contact information of the vendor or supplier from whom the goods or services were obtained. 5. Description: Detailed information about the expense, including the items purchased, services rendered, or an explanation of the expenditure. 6. Amount: The cost associated with each expense item. It could be a fixed amount or an itemized list with individual costs. 7. Supporting Documents: Attachments like receipts, invoices, bills, or any other relevant documents that validate the expenses listed. 8. Total Expenses: The sum of all expenses incurred within the specified timeframe or project. Different types of Allegheny Pennsylvania Expense Reports can be generated based on various factors: 1. Individual Expense Report: For personal expenses incurred by individuals residing or working in Allegheny County. This could include daily expenditures, travel expenses, or work-related costs. 2. Business Expense Report: For business-related expenses incurred by companies operating in Allegheny County. This report could include costs related to employee travel, client meetings, office supplies, equipment, etc. 3. Project Expense Report: For expenses associated with a specific project undertaken within Allegheny County. It provides a detailed breakdown of all costs incurred during the project's duration. 4. Department Expense Report: For businesses with multiple departments, this report captures the expenses incurred by each department separately, allowing for better budgeting and cost analysis. Overall, Allegheny Pennsylvania Expense Report is a crucial document that plays a vital role in financial management, providing clarity and visibility into expenditures in Allegheny County.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Informe de gastos - Expense Report

Description

How to fill out Allegheny Pennsylvania Informe De Gastos?

Preparing paperwork for the business or individual needs is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the specific area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Allegheny Expense Report without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Allegheny Expense Report on your own, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, follow the step-by-step guideline below to get the Allegheny Expense Report:

- Examine the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To find the one that satisfies your needs, utilize the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Select the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the documentation you've ever acquired never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal forms for any scenario with just a couple of clicks!

Form popularity

FAQ

Un grafico que muestra el gasto real, estimado y objetivo de todas las campanas de los grupos de presupuestos, aunque no haya aplicado ningun plan presupuestario a los grupos.

Un reporte de gastos, como su nombre lo dice, contempla los gastos de viaje realizados por el empleado. El proposito de este es notificar al area correspondiente sobre los gastos hechos y asi poder reembolsarlos o hacerlos deducibles.

Cualquier gasto debe estar justificado con las pruebas documentales que le correspondan: factura completa, nominas, recibos, escritura publica, etc.. Asi pues, es importantisimo disponer siempre de una factura original completa como documento justificativo.

Un gasto o egreso es el consumo de un bien o servicio a cambio de una contraprestacion, que suele hacerse efectiva mediante un pago monetario.

Inicie sesion en Power Apps. En el panel izquierdo, seleccione Crear. En el lado derecho de la pantalla, desplacese hacia abajo hasta la seccion Inicio desde una plantilla. Seleccione Informe de gastos de las plantillas de aplicaciones de ejemplo disponibles.

¿Como se hace un informe de gastos? Informacion general de la empresa. Esta seccion constituye el encabezado de tu modelo y es donde vas a poder presentar datos respectivos a:Fecha en la que se genero el gasto.Descripcion del gasto.Clasificacion del gasto.Monto del importe.

Los siguientes pasos pueden ayudarle a crear un presupuesto. Paso 1: calcule su ingreso neto. La base de un presupuesto eficaz es su ingreso neto.Paso 4: elabore un plan.Paso 5: ajuste sus gastos para mantenerse dentro del presupuesto.Paso 6: revise su presupuesto regularmente.

¿Como hacer un informe paso a paso? Identificar el tema.Identificar el objetivo y los destinatarios.Todo es un borrador.Seleccionar las fuentes que vamos a consultar.Pide opiniones.Redacta la informacion de forma clara y precisa, y sigue la estructura.Una imagen vale mas que mil palabras.

Para realizar la impresion de un reporte: Seleccione el Ejercicio Fiscal. Inicialmente se muestra el Ejercicio Fiscal actual....Imprimir Reporte: Mes. Marcar Al Mes o En el Mes. Fuentes de Financiamiento. Proyecto. Centro de Costo. Capitulo de Gasto. Partida de Gasto.

Formato de reporte de trabajo diario Fecha en que se realiza la actividad, asi como numero de la semana. Nombre del empleado al que pertenece el reporte. Hora de inicio y fin de la actividad. Descripcion de la actividad. Observaciones adicionales que se desee poner en el reporte.