The Bexar Texas Expense Report is a document used by Bexar County employees or individuals associated with the county to track and report their business-related expenses incurred during official duties. This report not only serves as a record of expenses but also ensures compliance with Bexar County's financial policies and procedures. Keywords: Bexar Texas, Expense Report, Bexar County, business-related expenses, official duties, compliance, financial policies, procedures. There are different types of Bexar Texas Expense Reports, which include: 1. Bexar Texas Travel Expense Report: This specific report is used by employees who travel on behalf of Bexar County for official purposes. It includes expenses related to transportation, lodging, meals, and other incidentals incurred during the trip. 2. Bexar Texas Reimbursement Expense Report: This type of report is used when employees or individuals associated with Bexar County have personally paid for expenses related to official duties and are seeking reimbursement. It includes categories such as supplies, equipment, transportation, or any other eligible expenses. 3. Bexar Texas Petty Cash Expense Report: When small, immediate expenses need to be covered without going through the regular reimbursement process, the Petty Cash Expense Report is utilized. It allows employees or individuals to document and record these small expenses, such as office supplies, emergency repairs, or minor travel expenses paid out of the petty cash fund. 4. Bexar Texas Project Expense Report: For projects or initiatives undertaken by Bexar County, this report allows individuals or teams to track and report project-related expenses. It includes items such as materials, contractors, equipment rentals, and any other expenses directly associated with the project. 5. Bexar Texas Entertainment Expense Report: For official events or occasions that involve entertainment expenses, this report is used to document and report the costs incurred. It typically includes expenses related to meals, venue rentals, tickets, and any other entertainment-related costs associated with official duties. By utilizing these different types of Bexar Texas Expense Reports, individuals associated with Bexar County can maintain accurate records of their expenses, ensure compliance with financial policies, and streamline the reimbursement process.

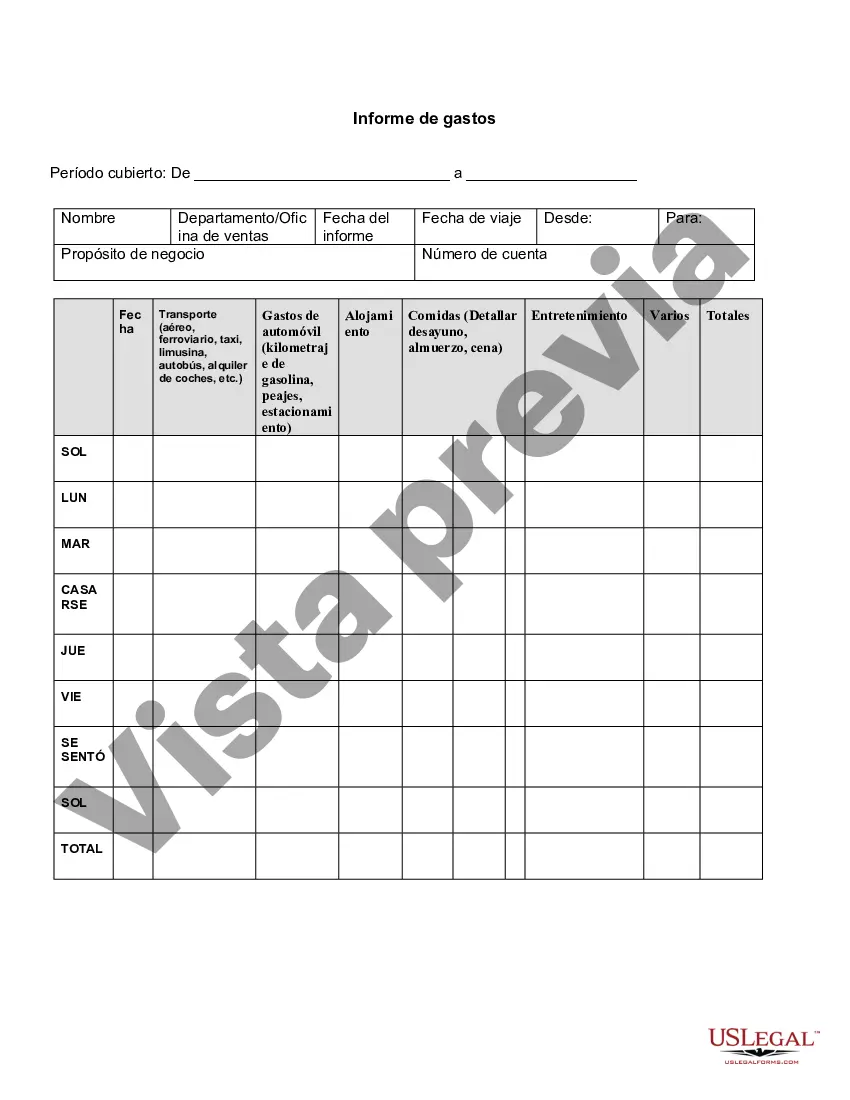

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Informe de gastos - Expense Report

Description

How to fill out Bexar Texas Informe De Gastos?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official paperwork that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your region, including the Bexar Expense Report.

Locating samples on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Bexar Expense Report will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guideline to get the Bexar Expense Report:

- Make sure you have opened the proper page with your local form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form satisfies your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Bexar Expense Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!