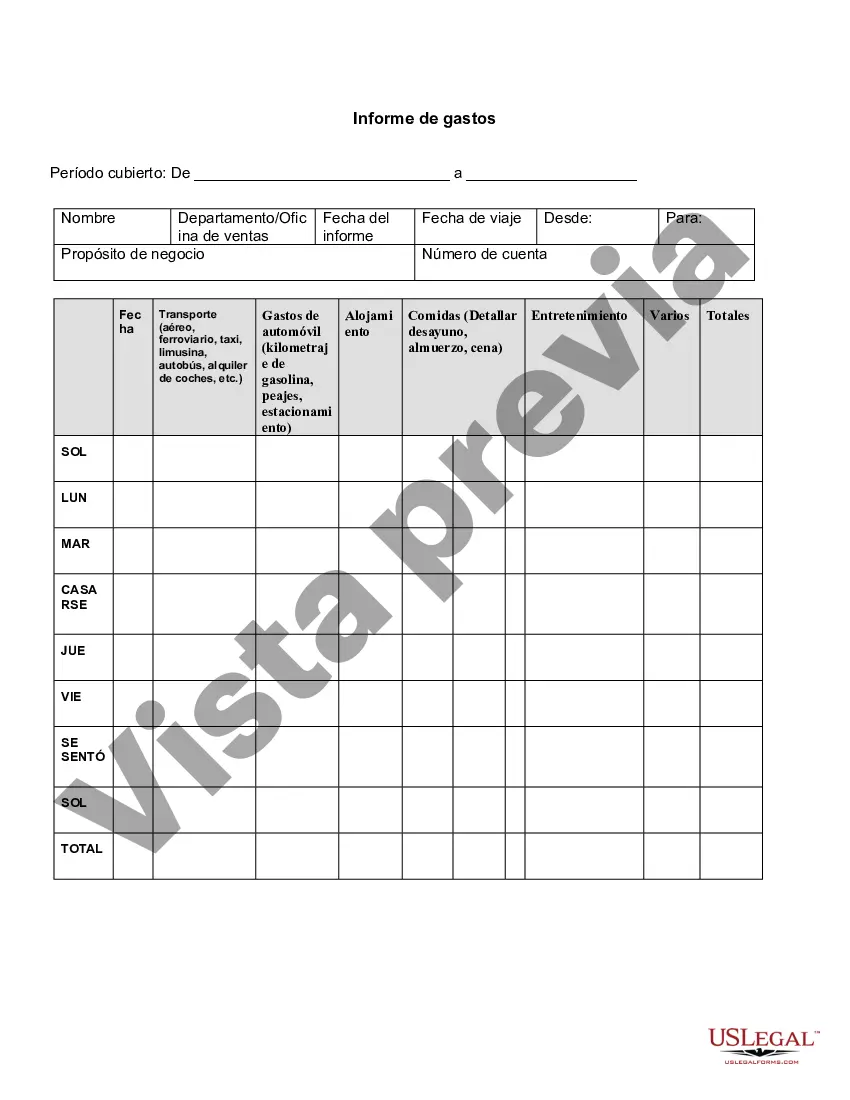

Clark Nevada Expense Report is a comprehensive financial document used by individuals, businesses, or organizations to track and record their expenses accurately. This report helps in maintaining transparency and accountability while managing finances. The key purpose of the Clark Nevada Expense Report is to track all incurred expenses, including travel, accommodation, meals, transportation, entertainment, and miscellaneous expenses. The Clark Nevada Expense Report serves as a vital tool for companies to control and monitor their expenditure, budget effectively, and analyze spending patterns. It facilitates timely reimbursement of expenses incurred during official travel, client meetings, conferences, or any other business-related activities. The report also ensures compliance with company policies, tax regulations, and audit requirements. There might be different types of Clark Nevada Expense Report designed to cater to specific needs or organizational structures. Some common variations include: 1. Individual Expense Report: This report is used by employees or individual contractors to document their expenses and claim reimbursement from their organization. 2. Departmental Expense Report: This report focuses on recording expenses made by specific departments within an organization. It helps in analyzing departmental spending patterns and controlling costs. 3. Project Expense Report: This report captures expenses related to a specific project or assignment. It allows project managers to monitor costs, evaluate project profitability, and enhance resource allocation. 4. Travel Expense Report: This specialized report primarily focuses on tracking expenses incurred during business travel, such as airfare, hotel accommodation, meals, car rentals, and other associated costs. 5. Client Expense Report: This report is utilized when expenses are incurred while meeting or entertaining clients. It aids in accurately billing clients or capturing expenses for reimbursement. 6. Vendor Expense Report: This type of report is used to record expenses associated with vendors or suppliers. It ensures proper recording and tracking of expenditures made to vendors for goods or services provided. The Clark Nevada Expense Report carries immense significance in financial management, enabling businesses and individuals to maintain accurate records, make informed decisions, and streamline expense control processes effectively. It promotes financial discipline, reduces financial leakage, and enhances overall financial accountability within an organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Informe de gastos - Expense Report

Description

How to fill out Clark Nevada Informe De Gastos?

Whether you plan to open your company, enter into an agreement, apply for your ID update, or resolve family-related legal concerns, you must prepare certain paperwork corresponding to your local laws and regulations. Locating the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 professionally drafted and checked legal documents for any individual or business occurrence. All files are grouped by state and area of use, so picking a copy like Clark Expense Report is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a few more steps to get the Clark Expense Report. Follow the guidelines below:

- Make sure the sample meets your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the file once you find the correct one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Clark Expense Report in the file format you require.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documentation. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form collection!