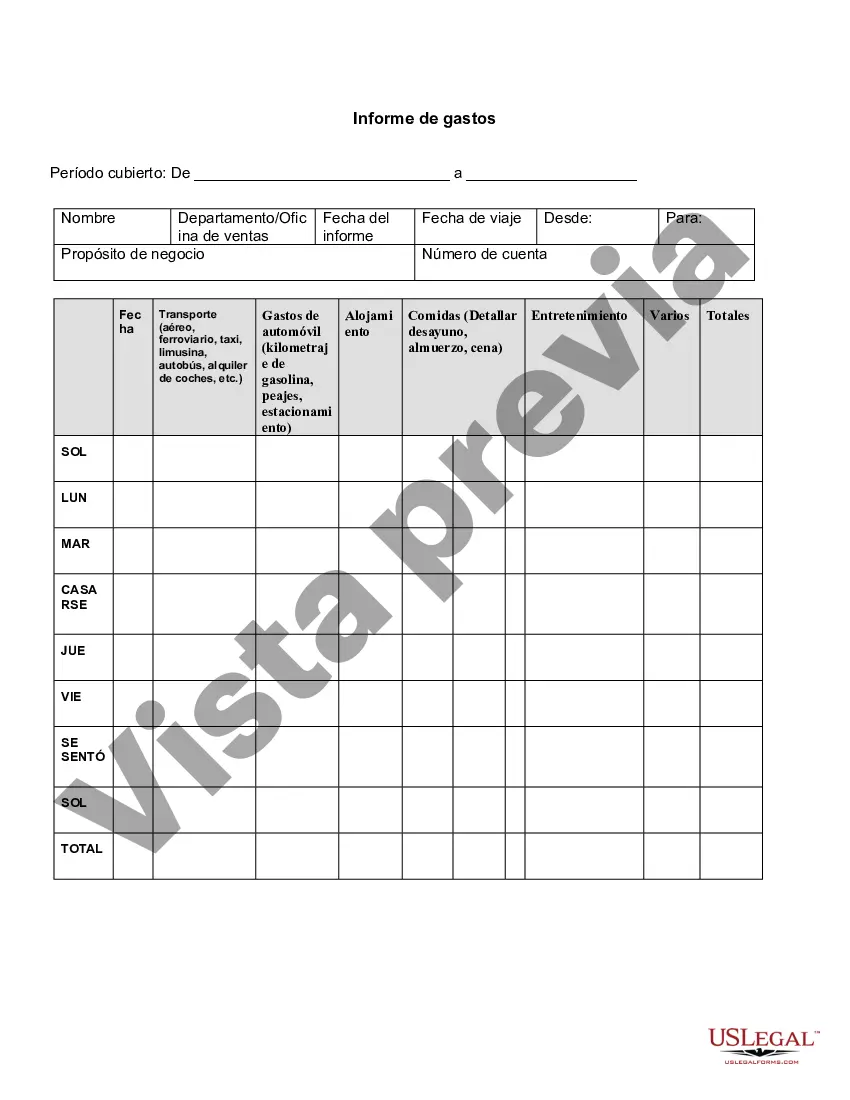

Title: Understanding Wake North Carolina Expense Report: Types and Detailed Description Introduction: The Wake North Carolina Expense Report is a crucial financial document used by organizations and businesses in Wake County, North Carolina. It helps track and record various expenses incurred during business operations, ensuring transparency and accurate financial management. In this article, we will provide a thorough overview of the Wake North Carolina Expense Report, highlighting its purpose, features, and types. I. Purpose of the Wake North Carolina Expense Report: The Wake North Carolina Expense Report aims to document, monitor, and reconcile expenses incurred by individuals or teams during official activities carried out within the county. It serves as a comprehensive tool for financial control and analysis, enabling organizations to budget effectively, identify cost-saving opportunities, and ensure compliance with financial policies. II. Features and Components of the Wake North Carolina Expense Report: 1. Expense Categories: The Wake North Carolina Expense Report typically includes a range of standard expense categories such as transportation, meals, lodging, entertainment, communication, supplies, and miscellaneous expenses. These categories offer a structured way to classify different types of expenses. 2. Expense Details: The report requires individuals to provide detailed information about each expense, including the date, purpose, vendor, description, and amount spent. Accurate and comprehensive details aid in reviewing and auditing expenses accurately. 3. Supporting Documents: To establish credibility and validate the expenses, supporting documents such as receipts, invoices, travel itineraries, and payment confirmations are often required to be attached alongside the report. III. Types of Wake North Carolina Expense Reports: 1. Travel Expense Report: This type of report concerns expenses incurred during official business travel within Wake County or outside it. It includes costs related to transportation, accommodation, meals, and other allowable expenditures. 2. Entertainment Expense Report: This report focuses on expenses related to entertaining clients, customers, or partners in Wake County. It encompasses costs associated with meals, event tickets, gifts, and other entertainment-related expenditures that align with business purposes. 3. Supply Expense Report: Designed specifically for tracking and recording costs associated with office supplies, equipment purchases, and other consumables necessary for daily operations within Wake County. Conclusion: The Wake North Carolina Expense Report is an essential financial tool that allows organizations to effectively manage, control, and analyze expenses incurred during official activities. By diligently maintaining accurate records and adhering to established financial policies, businesses and individuals in Wake County can ensure transparency, optimize budgeting, and achieve financial efficiency. Understanding the types and components of these expense reports is crucial for maintaining accurate financial records and future planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Informe de gastos - Expense Report

Description

How to fill out Wake North Carolina Informe De Gastos?

Creating legal forms is a necessity in today's world. However, you don't always need to seek qualified assistance to create some of them from the ground up, including Wake Expense Report, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to pick from in different categories ranging from living wills to real estate paperwork to divorce documents. All forms are organized according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any tasks related to document completion simple.

Here's how you can find and download Wake Expense Report.

- Go over the document's preview and description (if available) to get a general idea of what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state regulations can affect the validity of some documents.

- Examine the related document templates or start the search over to find the correct document.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a needed payment method, and purchase Wake Expense Report.

- Choose to save the form template in any offered file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Wake Expense Report, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you have to cope with an exceptionally complicated case, we advise using the services of an attorney to check your document before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!