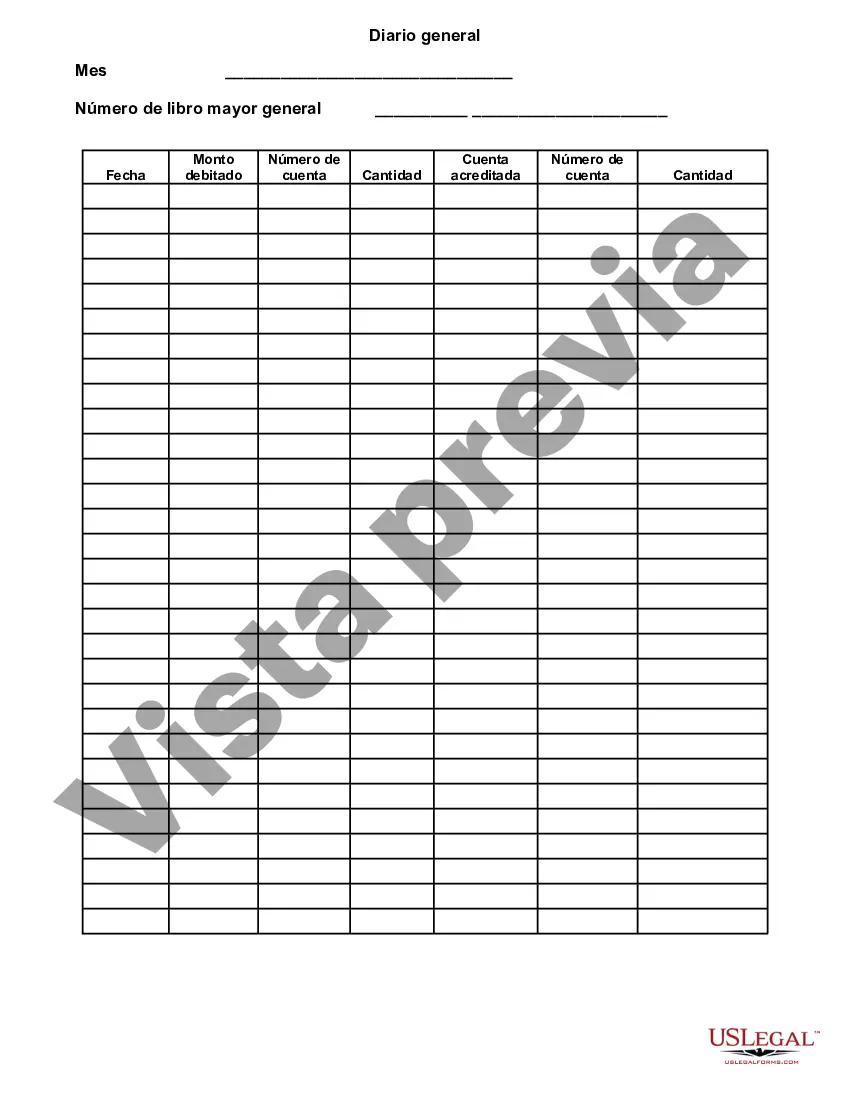

The Cook Illinois General Journal is a vital bookkeeping tool used by businesses to record financial transactions. It serves as a comprehensive record of daily business activities, including sales, expenses, and other financial events. This essential document allows the company to accurately track and monitor its financial health, handle tax obligations, and make informed decisions regarding operations and investments. The Cook Illinois General Journal is divided into multiple categories, each representing a distinct type of transaction. These categories include: 1. Sales Journal: The Sales Journal records all sales transactions made by the company. It typically includes information such as the customer's name, invoice number, date of sale, description of items sold, and the corresponding sales price. 2. Purchases Journal: The Purchases Journal documents all purchases made by the company. It comprises details such as the supplier name, invoice number, date of purchase, description of items bought, and the corresponding purchase price. 3. Cash Receipts Journal: The Cash Receipts Journal tracks all incoming cash received by the company. It includes details like the source of the cash (e.g., customer payments, loans), the date of receipt, the purpose (e.g., sales revenue, loan repayment), and the respective amounts. 4. Cash Disbursements Journal: The Cash Disbursements Journal records all outgoing cash payments made by the company. It encompasses information such as the recipient's name, the date of payment, the purpose (e.g., rent, utilities, salaries), and the corresponding amounts. 5. General Journal: The General Journal serves as a catch-all journal for any transactions not recorded in the other specialized journals. It is commonly used for unique or infrequent transactions, such as adjusting entries, depreciation, and other general ledger entries. By utilizing the Cook Illinois General Journal and its specialized journals, businesses can maintain accurate financial records while keeping transactions organized and easily traceable. These records enable the generation of various financial reports, such as income statements, balance sheets, and cash flow statements, necessary for analysis, decision-making, and meeting regulatory requirements. In summary, the Cook Illinois General Journal is an essential accounting tool that effectively consolidates and tracks financial transactions for a business. It encompasses various specialized journals, including the Sales Journal, Purchases Journal, Cash Receipts Journal, Cash Disbursements Journal, and General Journal. Implementing these journals ensures accurate financial accounting, enabling businesses to make informed decisions and meet their reporting obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Diario general - General Journal

Description

How to fill out Cook Illinois Diario General?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documentation. To avoid pricey legal assistance when preparing the Cook General Journal, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you pick a sample, it remains available in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cook General Journal from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cook General Journal:

- Take a look at the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the document on paper after printing it or do it all electronically.

That's the easiest and most economical way to get up-to-date templates for any legal reasons. Locate them all in clicks and keep your documentation in order with the US Legal Forms!