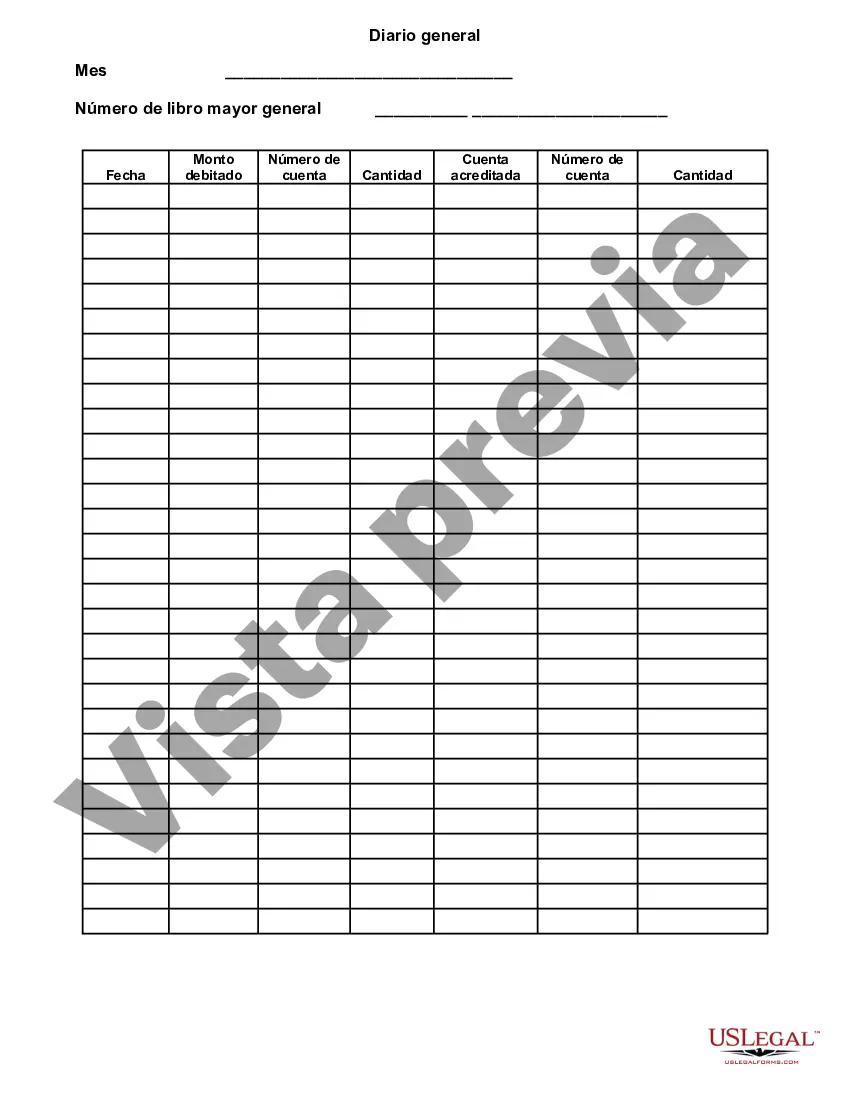

The Travis Texas General Journal is a crucial financial record-keeping tool utilized by businesses, organizations, and government agencies to ensure accurate and comprehensive accounting practices. This comprehensive and detailed description will outline the purpose, components, and types of Travis Texas General Journal, incorporating relevant keywords to provide a thorough understanding. The Travis Texas General Journal serves as a primary bookkeeping document that records all financial transactions, including both cash and credit transactions, in a chronological order. It functions as a central repository of financial information, documenting every business transaction that occurs within a given accounting period. In Travis Texas, this journal is often referred to as the "book of original entry," as it is typically the first place where transactions are recorded. The Travis Texas General Journal is designed to capture a wide range of financial activities, such as sales, purchases, expenses, revenues, and other monetary transactions. Each entry in the journal includes essential details such as the date, description of the transaction, the accounts involved, and corresponding monetary values for both debits and credits. By maintaining this meticulous record, businesses can track and analyze their financial activities, ensure accuracy, facilitate audits, and prepare financial statements. There are various types of Travis Texas General Journals, each serving specific purposes and catering to different transaction types. Some notable types include: 1. Sales Journal: Also known as the Sales Day Book, this type of journal specializes in recording all sales-related transactions, including cash sales, credit sales, sales returns, and allowances. It enables businesses to monitor sales patterns, customer behavior, and analyze sales performance. 2. Purchases Journal: The Purchases Journal, often referred to as the Purchases Day Book, exclusively records all purchases made by the entity. This includes both cash purchases and purchases made on credit. Tracking purchases through this journal helps in managing inventory, evaluating suppliers, and monitoring expenses. 3. Cash Receipts Journal: The Cash Receipts Journal concentrates on documenting all incoming cash transactions, such as customer payments, interest income, or other sources of revenue. This journal provides a clear view of the entity's cash flow, highlighting inflows and ensuring proper cash management. 4. Cash Disbursements Journal: The Cash Disbursements Journal focuses on recording all outgoing cash transactions, including payments made to suppliers, salaries, rent, utilities, and other expenses. Monitoring cash outflows through this journal promotes effective budgeting and expense control. 5. General Expense Journal: This type of journal caters to miscellaneous expenses that may not be covered by other specialized journals. It allows businesses to record and categorize various expenses, such as advertising costs, repairs and maintenance, office supplies, and other day-to-day operational expenses. By utilizing the Travis Texas General Journal and its various types, businesses can maintain accurate and organized financial records. These journals facilitate financial analysis, aid in decision-making processes, and ensure compliance with accounting standards and government regulations. The comprehensive documentation within these journals also plays a significant role during tax reporting and annual audits, providing a solid foundation for financial transparency and accountability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Diario general - General Journal

Description

How to fill out Travis Texas Diario General?

Laws and regulations in every area vary around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Travis General Journal, you need a verified template legitimate for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal templates. It's a great solution for specialists and individuals searching for do-it-yourself templates for various life and business occasions. All the documents can be used many times: once you pick a sample, it remains available in your profile for future use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Travis General Journal from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Travis General Journal:

- Examine the page content to ensure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to get the document when you find the proper one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your documentation in order with the US Legal Forms!