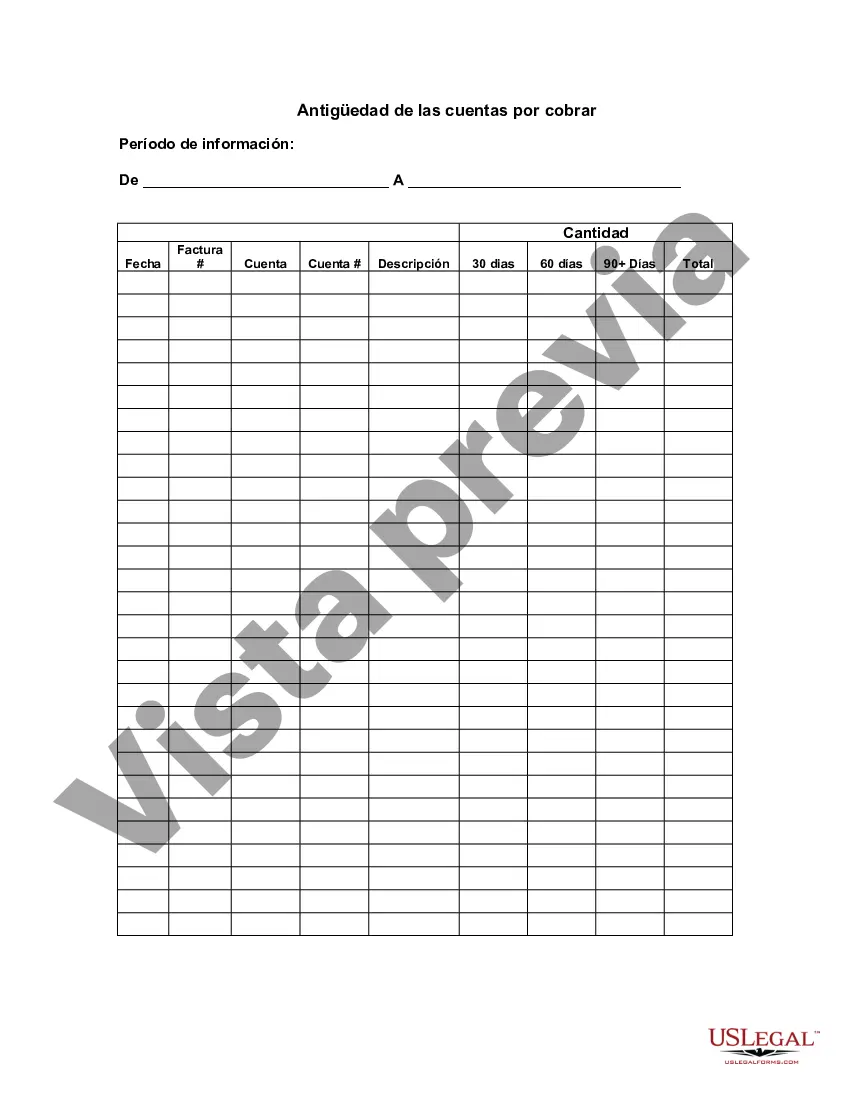

Alameda California Aging of Accounts Receivable is a crucial process undertaken by businesses to assess the payment status of their outstanding invoices. It helps track the time duration for which customer payments are pending and categorizes them into different time intervals, which enables businesses to gauge their cash flow and identify potential risks. This method is commonly used by companies in Alameda, California, and it entails the analysis of unpaid invoices. The first type of Alameda California Aging of Accounts Receivable is the "Current" category, which includes invoices that are due for payment within the current billing cycle. These are payments that are expected to be received promptly and reflect a healthy state of accounts receivable. The second category is the "30 days" segment, which represents invoices that have been outstanding for up to 30 days beyond the designated due date. This type indicates a slight delay in payment, but it can often be resolved without serious consequences for the business. The third category is the "60 days" segment, which comprises invoices overdue by 31-60 days. This stage indicates a moderate delay in payment and may require closer attention to ensure payments are received on time. The fourth type is the "90 days" segment, which represents invoices overdue by 61-90 days. At this stage, businesses need to take appropriate actions to collect outstanding payments promptly. Frequent follow-ups and reminders to the customers become necessary to reduce the chances of bad debt. The final category is the "over 90 days" segment, which indicates serious delinquency. Invoices falling within this segment are overdue by more than 90 days and require immediate attention from businesses. Proactive measures such as calling, emailing, and even involving debt collection agencies may be necessary to retrieve these payments. Conducting regular Alameda California Aging of Accounts Receivable analysis enables businesses to monitor their cash flow, identify potential payment bottlenecks, and take appropriate steps to resolve delinquent accounts. It also helps in providing accurate financial reporting by reflecting the true state of outstanding customer payments. Tracking these categories enables businesses in Alameda, California, to maintain a healthy account receivable cycle, improve cash flow, and minimize potential bad debt risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Alameda California Antigüedad De Las Cuentas Por Cobrar?

Preparing documents for the business or individual demands is always a big responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to generate Alameda Aging of Accounts Receivable without expert assistance.

It's possible to avoid wasting money on lawyers drafting your paperwork and create a legally valid Alameda Aging of Accounts Receivable by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal templates that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the required document.

In case you still don't have a subscription, follow the step-by-step instruction below to get the Alameda Aging of Accounts Receivable:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, use the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then log in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal templates for any use case with just a couple of clicks!