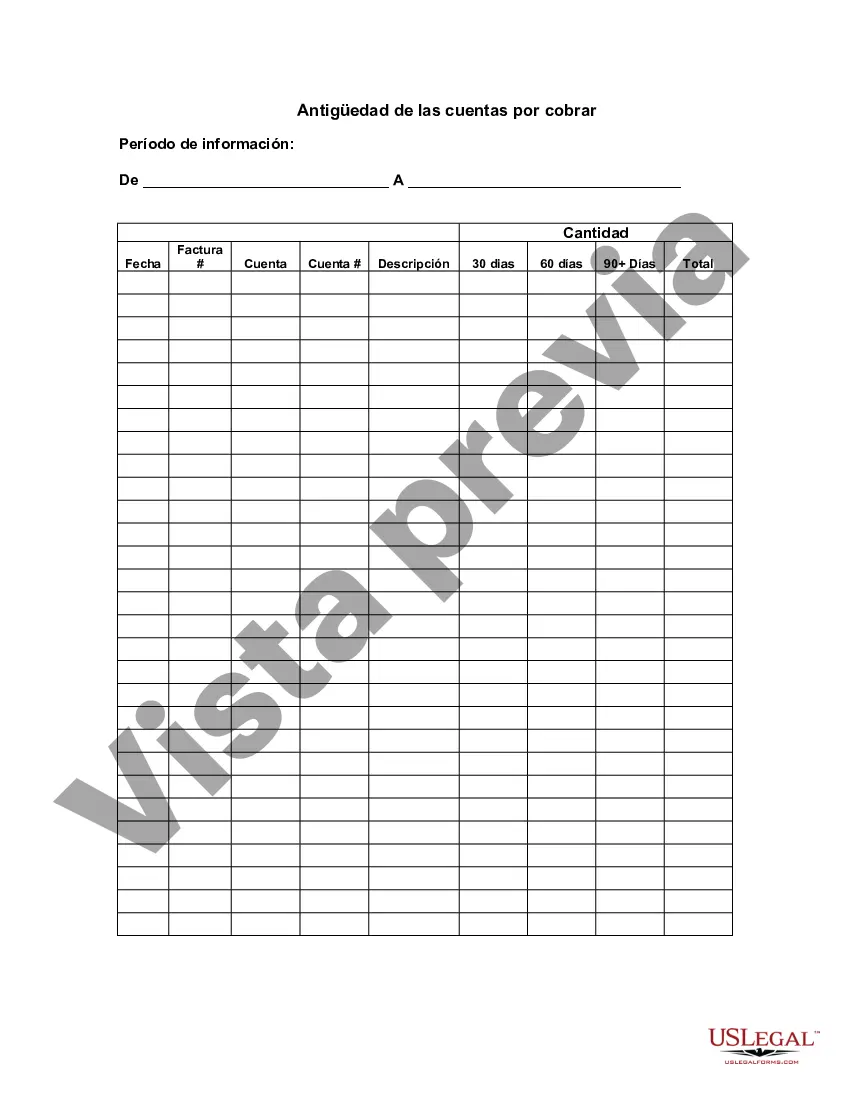

Allegheny Pennsylvania Aging of Accounts Receivable is a financial process that is widely used in the corporate and accounting sector to track and analyze the collection of outstanding customer payments. It assesses the time period for which invoices have been outstanding and categorizes them according to the length of time they have remained unpaid. This analysis is crucial for understanding the financial health of a business, managing cash flow, and implementing effective credit and collection policies. The Allegheny Pennsylvania Aging of Accounts Receivable process involves creating an aging analysis report with various categories or buckets representing different time intervals. The most commonly used categories are: 1. Current: This category includes invoices that are due for payment within the current billing cycle or within a short grace period. 2. 30 days: Invoices that have been due for 30 days since the billing cycle or grace period. These are considered moderately delinquent. 3. 60 days: Invoices that are 60 days past due. They indicate a higher level of delinquency and require immediate attention. 4. 90 days: Invoices that have been outstanding for 90 days. These are considerably overdue and require focused efforts for collection. 5. Over 90 days: This category comprises invoices that are severely overdue, extending beyond 90 days. These require urgent action to retrieve payment or initiation of legal proceedings. The Allegheny Pennsylvania Aging of Accounts Receivable report typically includes the customer's name, invoice number, invoice date, due date, aging period, outstanding amount, and contact details. By analyzing this report, businesses can identify trends, spot potential collection issues, prioritize collections efforts, track the effectiveness of collections strategies, and assess the need for adjustments in credit policies. Keywords: Allegheny Pennsylvania Aging of Accounts Receivable, invoice, collection, outstanding, cash flow, credit policies, aging analysis report, billing cycle, delinquent, grace period, financial health, corporate, accounting, customer payments, overdue, legal proceedings, collection issues, trends, collections strategies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Allegheny Pennsylvania Antigüedad De Las Cuentas Por Cobrar?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Allegheny Aging of Accounts Receivable, with a service like US Legal Forms.

US Legal Forms has over 85,000 templates to select from in various categories ranging from living wills to real estate papers to divorce documents. All forms are organized based on their valid state, making the searching process less overwhelming. You can also find information materials and guides on the website to make any activities related to document completion simple.

Here's how you can locate and download Allegheny Aging of Accounts Receivable.

- Take a look at the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the document of your choice is adapted to your state/county/area since state laws can affect the validity of some documents.

- Examine the similar document templates or start the search over to find the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment method, and buy Allegheny Aging of Accounts Receivable.

- Select to save the form template in any offered file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Allegheny Aging of Accounts Receivable, log in to your account, and download it. Of course, our platform can’t replace an attorney completely. If you need to cope with an exceptionally difficult situation, we advise getting a lawyer to check your document before executing and submitting it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and purchase your state-specific documents effortlessly!