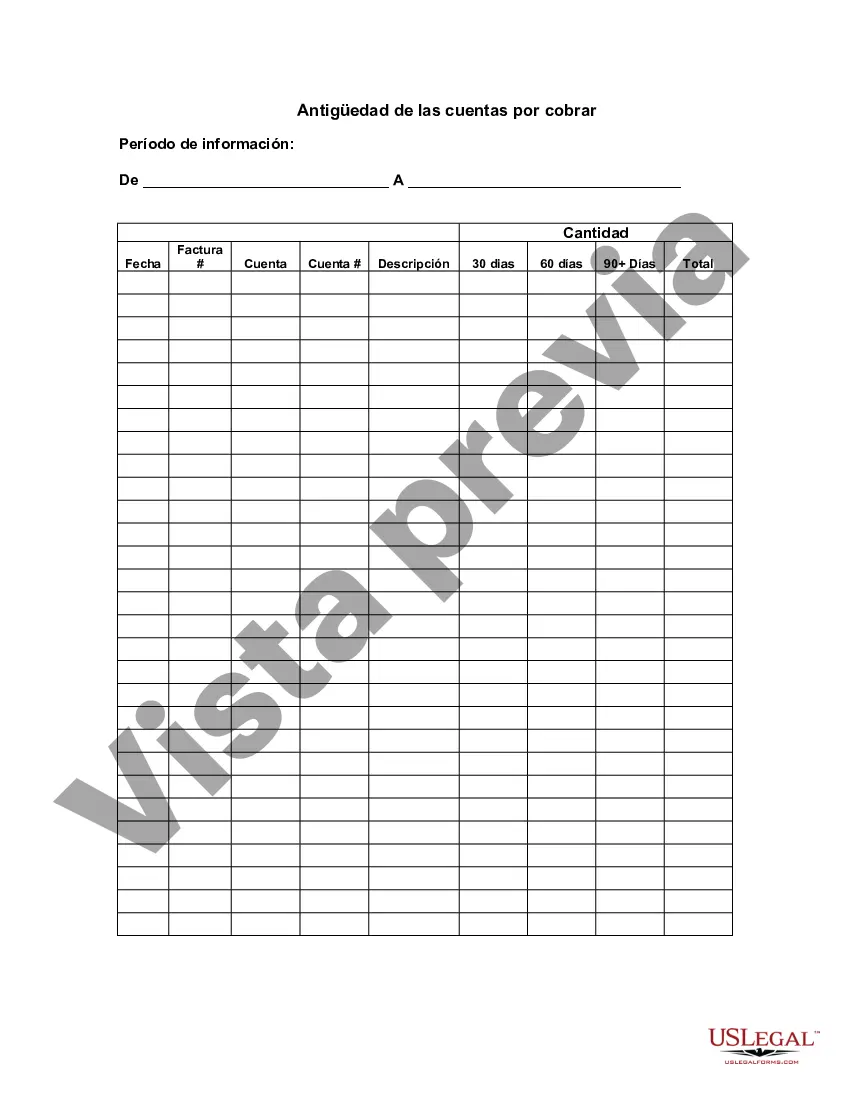

Bronx New York Aging of Accounts Receivable is a financial management term that refers to the process of categorizing and monitoring outstanding customer invoices or receivables based on their payment due dates. It provides valuable insights into the financial health and creditworthiness of a business by analyzing the timeliness of customer payments. In the context of Bronx, New York, the Aging of Accounts Receivable is an essential tool for businesses, organizations, or individuals operating in the Bronx area to effectively manage their finances and cash flow. It helps them track and evaluate the aging pattern of their accounts receivable, allowing them to identify potential issues in collecting payments promptly. Several types of aging categories are commonly used for organizing accounts receivable in the Bronx, New York. These categories are based on the number of days overdue, typically ranging from 0-30 days, 31-60 days, 61-90 days, and 90+ days. Each category represents a different level of delinquency or credit risk associated with outstanding invoices. Monitoring accounts receivable aging allows businesses to prioritize collection efforts effectively. For example, invoices that are within the 0-30 days category are considered current and less risky. These invoices are typically prioritized for regular follow-ups and reminders to ensure timely payment. The 31-60 days category signifies slightly overdue invoices, warranting increased attention and more persistent follow-ups to prevent further delays in payment. Invoices falling under the 61-90 days category indicate a higher level of delinquency, requiring a more assertive approach to collection, such as phone calls or escalation to a collections' agency. Lastly, the 90+ days category comprises highly overdue accounts receivable that pose a significant risk to a business's cash flow. These accounts often necessitate escalated actions, such as sending official demand notices or pursuing legal actions to secure payment. Overall, Bronx New York Aging of Accounts Receivable is a crucial financial management tool that enables businesses to effectively assess the creditworthiness of their customers and take appropriate measures for collecting outstanding payments. By organizing invoices into different aging categories, businesses in Bronx, New York can proactively mitigate financial risks, maintain a healthy cash flow, and ensure their financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Bronx New York Antigüedad De Las Cuentas Por Cobrar?

Creating forms, like Bronx Aging of Accounts Receivable, to take care of your legal matters is a challenging and time-consumming task. Many cases require an attorney’s involvement, which also makes this task not really affordable. Nevertheless, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website features over 85,000 legal documents crafted for a variety of cases and life situations. We make sure each document is compliant with the regulations of each state, so you don’t have to worry about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Bronx Aging of Accounts Receivable form. Simply log in to your account, download the form, and customize it to your requirements. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as simple! Here’s what you need to do before downloading Bronx Aging of Accounts Receivable:

- Make sure that your document is specific to your state/county since the rules for creating legal paperwork may differ from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Bronx Aging of Accounts Receivable isn’t something you were hoping to find, then use the header to find another one.

- Log in or register an account to start using our website and get the form.

- Everything looks great on your side? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and type in your payment details.

- Your template is ready to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!