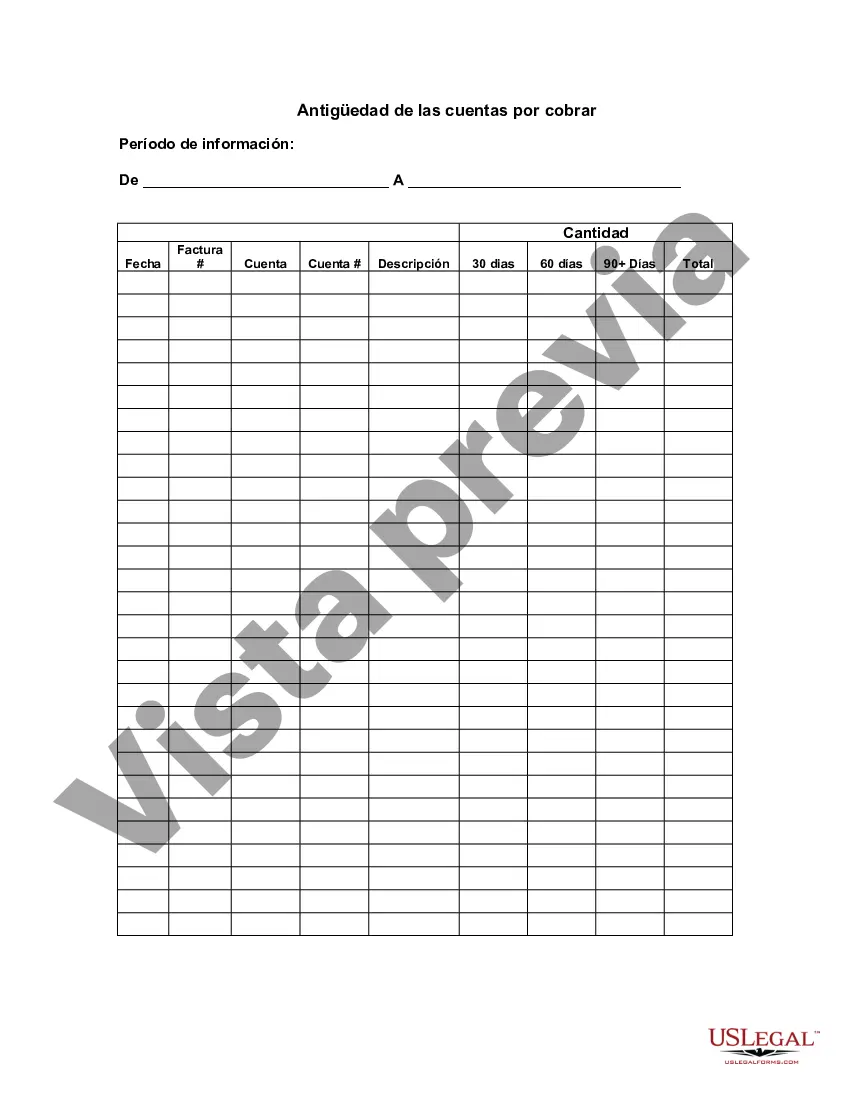

Chicago, Illinois Aging of Accounts Receivable is an essential financial management process that helps businesses in the city monitor, evaluate, and analyze their outstanding accounts receivable balances. By categorizing and tracking these balances according to specific time periods, companies gain valuable insights into their financial health, identify potential cash flow issues, optimize collections efforts, and make informed business decisions. The aging of accounts receivable in Chicago, Illinois involves the classification of outstanding invoices based on the length of time they have been outstanding. Typically, the accounts receivable is segmented into aging buckets, which are commonly defined as current, 30 days, 60 days, 90 days, and over 90 days. However, businesses may also choose to have additional aging categories depending on their specific needs. 1. Current: This category represents invoices that are still within the payable period. These invoices are up to date and have not exceeded the standard payment terms yet. 2. 30 Days: In this category, invoices that are overdue by up to 30 days are placed. These outstanding balances reflect invoices that should have been paid within the first month of issuance. 3. 60 Days: This group encompasses invoices that are past due by 31 to 60 days. Businesses pay closer attention to these balances as they indicate a delay in payment beyond the standard grace period. 4. 90 Days: Invoices that are overdue by 61 to 90 days fall under this aging bucket. These balances indicate a significant delay in payment, and businesses typically intensify collection efforts at this stage. 5. Over 90 Days: This category encapsulates invoices that have been outstanding for more than 90 days. Balances in this aging range are often considered high-risk and may require additional collection efforts, negotiation, or possible write-offs. By analyzing the Chicago, Illinois Aging of Accounts Receivable, businesses can gain a better understanding of their cash flow patterns, evaluate customer payment behavior, identify overdue accounts that need attention, and take necessary measures to improve their accounts receivable turnover. Proper aging analysis provides insights into potential revenue shortfalls, allows for proactive measures like implementing more efficient billing and collections systems, and helps in mitigating financial risk. Businesses in Chicago, Illinois utilize these practices to maintain healthy cash flows, enhance financial stability, and make informed decisions for future growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Chicago Illinois Antigüedad De Las Cuentas Por Cobrar?

Drafting papers for the business or personal demands is always a huge responsibility. When creating an agreement, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it stressful and time-consuming to create Chicago Aging of Accounts Receivable without expert assistance.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid Chicago Aging of Accounts Receivable by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be sure of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guideline below to obtain the Chicago Aging of Accounts Receivable:

- Look through the page you've opened and check if it has the document you need.

- To accomplish this, use the form description and preview if these options are presented.

- To find the one that suits your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any situation with just a few clicks!