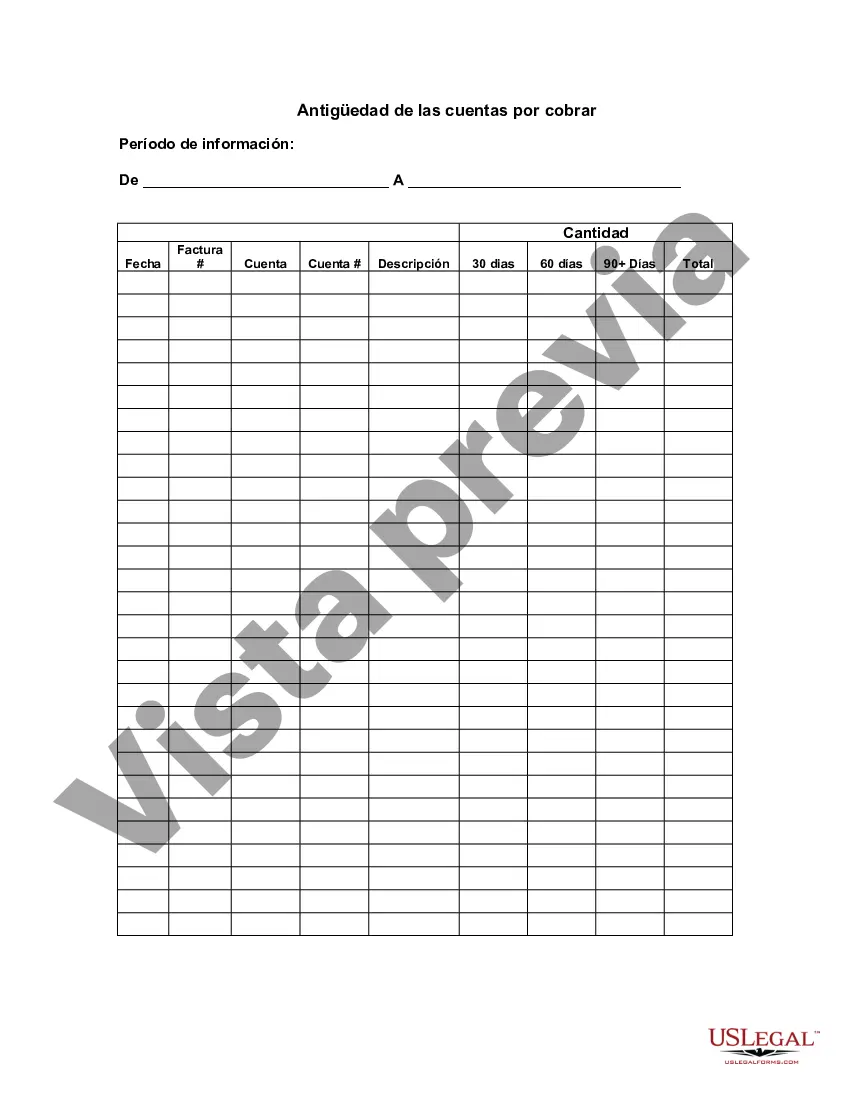

Cook Illinois Aging of Accounts Receivable is a financial management tool used to track and evaluate unpaid customer invoices within a designated time frame. It helps businesses determine the length of time it takes to collect outstanding payments and provides insights into the financial health of the company. Cook Illinois Aging of Accounts Receivable allows businesses to identify delinquent accounts, analyze cash flow patterns, and take necessary actions to improve collections. The process involves categorizing unpaid invoices based on the number of days outstanding, typically 30, 60, 90, and 120+ days. By classifying accounts receivable into these aging brackets, businesses can monitor overdue payments and prioritize collection efforts accordingly. It gives a clear snapshot of how long the company's outstanding invoices have been outstanding and helps identify potential problems with customers who consistently pay late. Cook Illinois Aging of Accounts Receivable offers valuable information for businesses such as the total outstanding amount, average days sales outstanding (DSO), and identifies potential bad debts. It enables businesses to analyze trends and patterns in payment delays, allowing them to adjust credit terms, collections strategies, or even implement stricter payment policies for specific customers or industries. There are various types of Cook Illinois Aging of Accounts Receivable, depending on the specific needs of the business. Some variations include historical aging reports, which provide a comprehensive overview of unpaid invoices over a prolonged period, and current aging reports, which focus on the most recent outstanding invoices to prioritize immediate collections efforts. Furthermore, companies may customize Cook Illinois Aging of Accounts Receivable reports based on specific customer segments or product categories. This customization allows businesses to determine which customer groups or products require more attention in terms of collections, providing valuable insights to streamline cash flow management. In summary, Cook Illinois Aging of Accounts Receivable is a crucial tool for businesses to effectively manage their outstanding invoices and improve cash flow. It helps track unpaid customer invoices, categorizes them based on the time frame, identifies delinquent accounts, and enables businesses to take appropriate actions to collect payments. By using this tool, companies can reduce bad debt, optimize collections strategies, and enhance overall financial performance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Cook Illinois Antigüedad De Las Cuentas Por Cobrar?

How much time does it normally take you to create a legal document? Because every state has its laws and regulations for every life scenario, locating a Cook Aging of Accounts Receivable suiting all local requirements can be stressful, and ordering it from a professional attorney is often pricey. Many web services offer the most popular state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. Apart from the Cook Aging of Accounts Receivable, here you can find any specific form to run your business or personal affairs, complying with your regional requirements. Experts check all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is fairly simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed sample, and download it. You can retain the file in your profile at any moment later on. Otherwise, if you are new to the platform, there will be a few more steps to complete before you get your Cook Aging of Accounts Receivable:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form using the related option in the header.

- Click Buy Now once you’re certain in the chosen file.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Change the file format if necessary.

- Click Download to save the Cook Aging of Accounts Receivable.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!

Form popularity

FAQ

La formula para hallar los dias que tarda una empresa en recaudar la cartera se define con la siguiente formula: (saldo de cartera x 360 dias) / ventas.

Suggested clip 49 seconds Como calcular el Periodo promedio de cobro (calcular e interpretar) YouTube Start of suggested clip End of suggested clip

Las cuentas por cobrar son uno de los conceptos mas importantes del activo circulante. Su importancia radica en forma directa con el giro del negocio y la competencia. Un ejemplo son las tiendas de autoservicio, en dicho caso no representan importancia ya que la venta en este giro de negocios es al contado.

Genera el Reporte de Cuentas por Cobrar en Alegra Contabilidad Haz clic en el menu "Reportes". Ubica la seccion "Reportes administrativos" y selecciona la opcion "Reporte Cuentas por cobrar". Selecciona el rango de fechas que deseas consultar. Haz clic en el boton "Generar reporte".

15 Consejos para administrar tus cuentas por cobrar Verifica el estatus de credito de tus clientes en potencia.Deja claro cuanto tiempo puedes esperar para recibir el pago.Se estricto con tu politica de credito.Detalla las condiciones de pago.Ofrece planes de pago.Haz un seguimiento de los pagos.

Para llegar a este calculo se debe, en primer lugar, determinar el promedio de cuentas por cobrar sumando el saldo al inicio del ano mas el saldo al final del ano y luego se divide entre dos. Posteriormente, se debe dividir el total de ventas netas a credito entre el saldo neto de cuentas por cobrar.

INFORME DE REGISTRO DE CUENTAS POR COBRAR Fecha de transaccion. Persona u organizacion que efectua la compra. Numero de cuenta. Articulos comprados (asi como su cantidad) Costo unitario y costo total de cada uno de los articulos. Numero de la transaccion o numero de factura de venta.

B) Antiguedad de cuentas por cobrar, el cual es un analisis de los debitos que integran cada uno de los saldos a cargo de clientes, tomando como base la fecha de la factura o la fecha de vencimiento. Con base a estos dos indicadores, se puede medir el desempeno del departamento de cobranza.

Las Cuentas por Cobrar a corto plazo deben presentarse en el balance general como activo circulante inmediatamente despues del efectivo y de las inversiones en valores negociables. Atendiendo a su origen se pueden formar dos Cuentas por Cobrar.

La antiguedad de saldos es la radiografia que revela la calidad de la cartera de credito; este documento que debe generarse o solicitarse a la par de la analitica de cuentas por cobrar, informa el tiempo de pago de todas aquellas entidades a las que se otorga credito; ilustra si los deudores cubren en tiempo sus