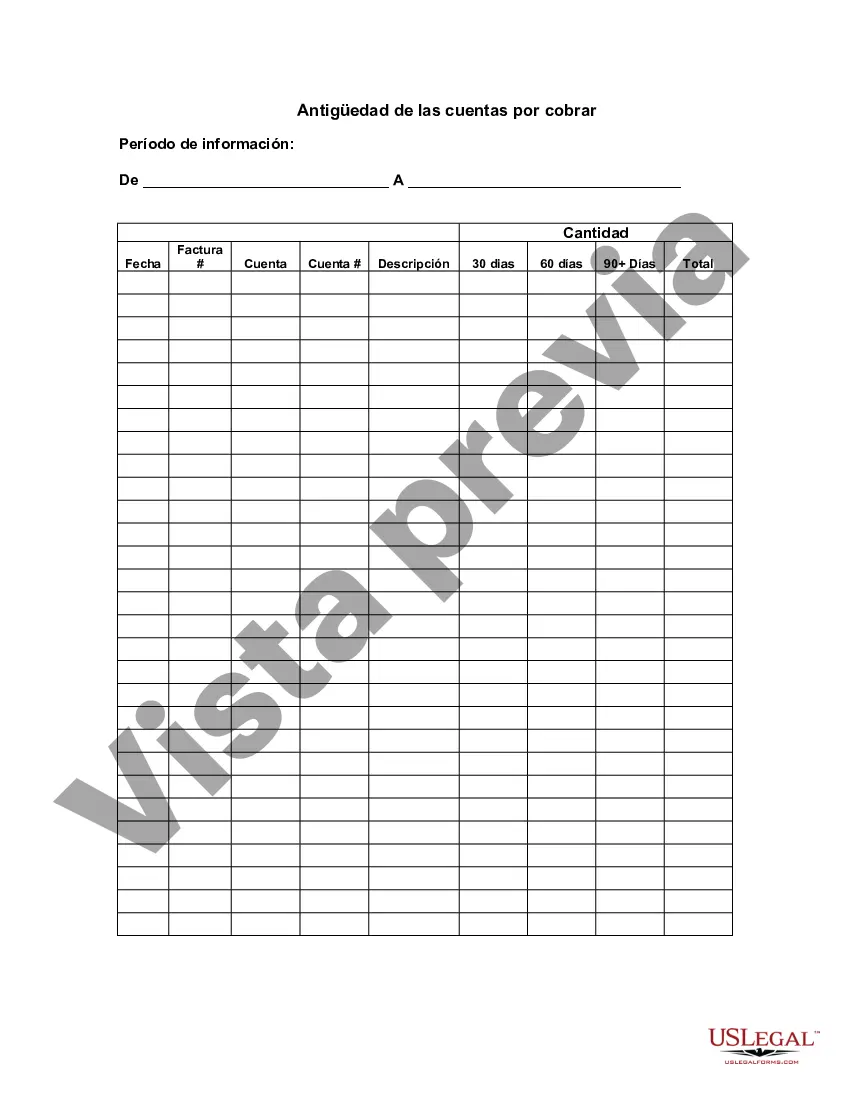

Fairfax Virginia Aging of Accounts Receivable is a financial management method used by businesses to analyze and manage their accounts receivable. It involves categorizing outstanding customer invoices based on the length of time they have been unpaid, which helps in assessing the financial health of a company and identifying potential collection issues. In Fairfax Virginia, just like in any other location, businesses utilize various types of Aging of Accounts Receivable to effectively monitor and control their accounts. Some common types include: 1. Current: This category represents invoices that have been recently issued and are still within the agreed-upon payment terms. Typically, these invoices are due within 30 days and are considered current. 2. 30 Days: This category comprises invoices that are 31 to 60 days past the due date. This stage often serves as an early warning sign of delayed payments or potential cash flow challenges that need to be addressed promptly. 3. 60 Days: In this category, invoices have reached 61 to 90 days past the due date. It indicates a more significant delay in payment and requires closer attention to prevent further financial strain. 4. 90 Days and Over: This category includes invoices that have remained unpaid for 91 days or more. It indicates severe delinquencies and may require businesses to take more serious actions such as initiating collection efforts or considering potential bad debts. The Fairfax Virginia Aging of Accounts Receivable process involves generating reports or utilizing accounting software with built-in features to segment customer invoices into these aging categories. By doing so, businesses can effectively track outstanding payments and devise appropriate strategies to minimize delinquencies. This process also helps businesses identify trends, such as specific customers or industries that consistently delay payment, enabling them to take proactive steps to improve their cash flow management and mitigate potential risks associated with unpaid invoices. In conclusion, Fairfax Virginia Aging of Accounts Receivable is a vital financial management practice for businesses in the region. It allows companies to categorize and monitor outstanding invoices based on aging intervals, enabling them to assess their financial health, identify potential collection issues, and take necessary actions to secure timely payments.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Fairfax Virginia Antigüedad De Las Cuentas Por Cobrar?

How much time does it normally take you to draw up a legal document? Since every state has its laws and regulations for every life situation, finding a Fairfax Aging of Accounts Receivable meeting all local requirements can be stressful, and ordering it from a professional attorney is often costly. Numerous online services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive online catalog of templates, gathered by states and areas of use. Apart from the Fairfax Aging of Accounts Receivable, here you can find any specific document to run your business or personal deeds, complying with your county requirements. Specialists verify all samples for their actuality, so you can be certain to prepare your paperwork properly.

Using the service is pretty easy. If you already have an account on the platform and your subscription is valid, you only need to log in, select the required form, and download it. You can pick the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra steps to complete before you obtain your Fairfax Aging of Accounts Receivable:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another document using the corresponding option in the header.

- Click Buy Now once you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Register for an account on the platform or log in to proceed to payment options.

- Make a payment via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the Fairfax Aging of Accounts Receivable.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the acquired template, you can find all the files you’ve ever downloaded in your profile by opening the My Forms tab. Give it a try!