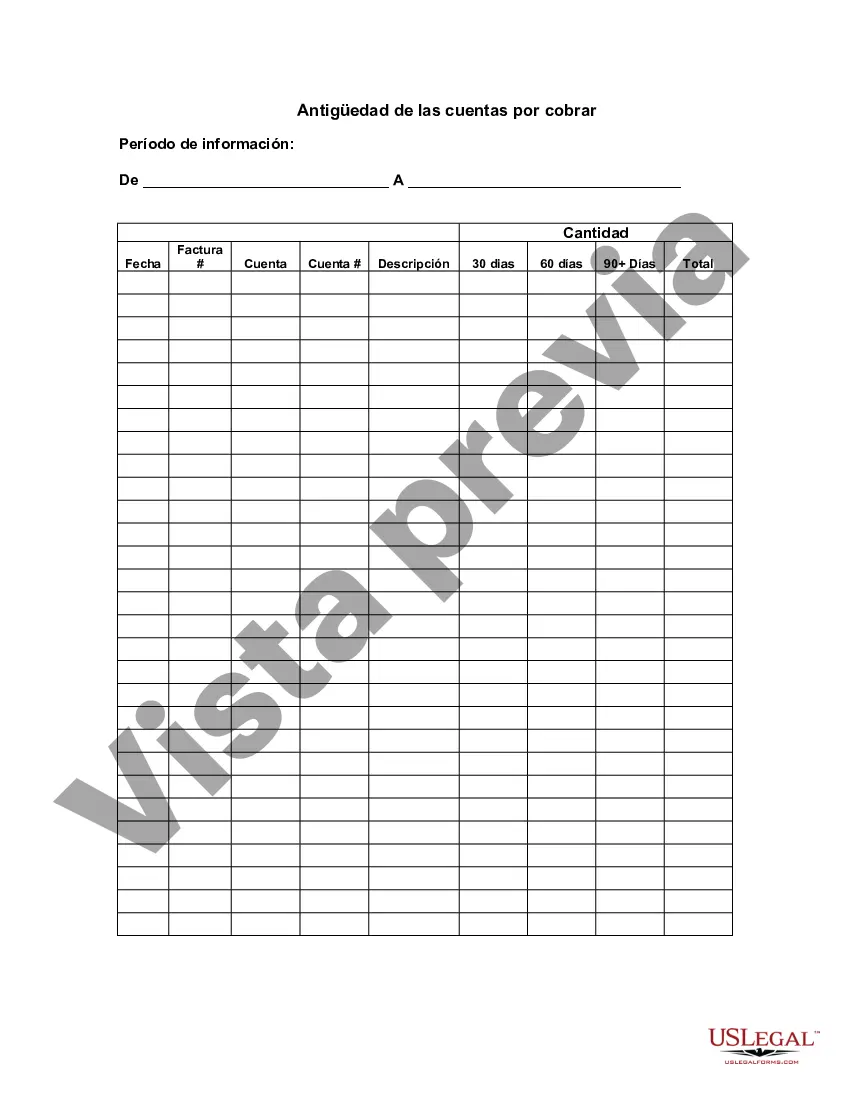

Franklin Ohio Aging of Accounts Receivable is a financial tool that helps businesses measure the efficiency of their credit and collection policies. It provides insights into the length of time it takes for customers to pay their outstanding invoices, allowing businesses to evaluate their cash flow and make informed decisions regarding credit extension and debt collection strategies. The aging of accounts receivable is typically divided into several categories based on the number of days outstanding. These categories, which aid in analyzing the payment patterns of customers, include: 1. Current: This category represents invoices that are unpaid but are within the agreed payment terms, typically 30 days or less. These invoices are considered current and reflect a healthy cash flow. 2. 1-30 days: Accounts receivable that falls under this category represents invoices that are between 1 and 30 days past the agreed payment terms. While slightly past due, these invoices are generally manageable and may not require immediate attention. 3. 31-60 days: This category includes invoices that are between 31 and 60 days past due. Receipt of payments becomes comparatively uncertain at this stage, warranting businesses to take proactive steps to collect outstanding debts. 4. 61-90 days: Accounts receivable spanning between 61 and 90 days past due highlight a growing concern as the chances of receiving payment at this point diminish. Close monitoring and implementation of stricter collection procedures are often necessary to recover the outstanding amounts. 5. Over 90 days: This category represents invoices that are more than 90 days past due. These aging accounts receivable require immediate attention and a dedicated effort to recover outstanding amounts. Businesses may have to consider employing debt collection agencies or pursuing legal action to receive payment. The Franklin Ohio Aging of Accounts Receivable provides businesses with a clear understanding of their outstanding invoices, enabling them to identify problem areas, evaluate customer payment behavior, and allocate resources to improve cash flow. By utilizing this financial tool effectively, businesses in Franklin Ohio can streamline their credit management processes, minimize bad debts, and maintain healthy financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Franklin Ohio Antigüedad De Las Cuentas Por Cobrar?

Dealing with legal forms is a necessity in today's world. Nevertheless, you don't always need to seek professional help to draft some of them from scratch, including Franklin Aging of Accounts Receivable, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to choose from in different types ranging from living wills to real estate papers to divorce documents. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find information materials and guides on the website to make any activities related to paperwork execution simple.

Here's how to find and download Franklin Aging of Accounts Receivable.

- Take a look at the document's preview and description (if available) to get a general idea of what you’ll get after getting the form.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Examine the related document templates or start the search over to find the right document.

- Hit Buy now and create your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase Franklin Aging of Accounts Receivable.

- Choose to save the form template in any available file format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Franklin Aging of Accounts Receivable, log in to your account, and download it. Needless to say, our website can’t take the place of a legal professional completely. If you need to cope with an exceptionally challenging case, we advise using the services of a lawyer to examine your form before signing and filing it.

With over 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and purchase your state-specific paperwork effortlessly!