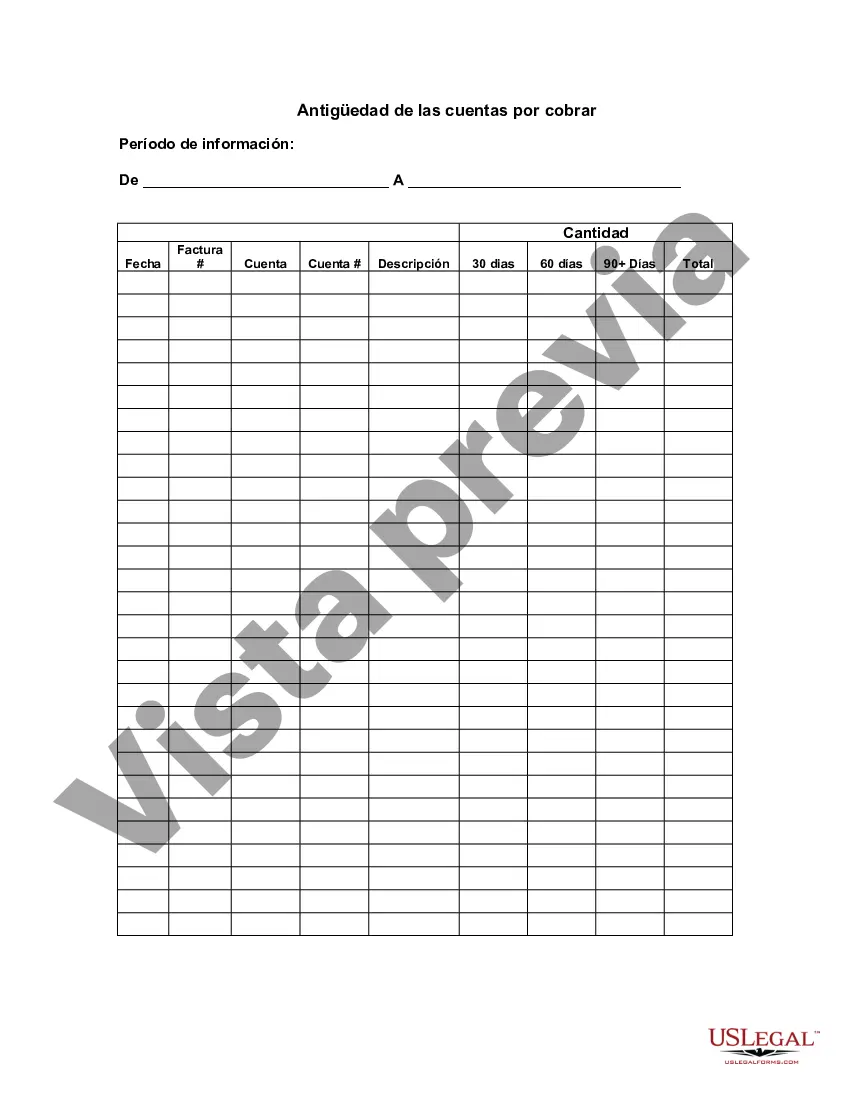

Harris Texas Aging of Accounts Receivable refers to a financial analysis process used to track and manage unpaid invoices or outstanding debts owed to a business within the Harris County area in Texas. It involves categorizing and monitoring the aging of customer accounts based on their payment due dates to identify the total amount of outstanding receivables and assess the level of credit risk. The process provides valuable insights into the financial health and efficiency of a business by assessing the timeliness of payments received from customers. By analyzing the aging of accounts receivable, businesses can determine the average collection period, evaluate their cash flow position, identify potential bad debt risks, and develop strategies to improve cash flow management. Different types of Harris Texas Aging of Accounts Receivable that can be utilized include: 1. Current: This category represents accounts receivable with payment dues that haven't passed the agreed-upon terms. Typically, these are invoices still within the grace period and are expected to be paid shortly. 2. 1-30 days: This category encompasses accounts receivable with payment due within the first 30 days from the billing date. It indicates that the payments are relatively current and within the acceptable payment terms. 3. 31-60 days: This category includes accounts receivable where payment is outstanding for a period ranging from 31 to 60 days. It implies a slight delay in payment. 4. 61-90 days: This category denotes accounts receivable where payment is overdue for a period ranging from 61 to 90 days. It indicates a significant delay in payment. 5. 91+ days: This category represents accounts receivable where payment has been outstanding for more than 90 days. It suggests a potential risk of non-payment or bad debt. By categorizing accounts receivable based on days outstanding, businesses can better prioritize their collection efforts, allocate resources efficiently, and pursue appropriate actions to recover overdue payments. Moreover, tracking the aging of accounts receivable assists in establishing credit policies, refining customer relationships, and improving overall financial management. With the Harris Texas Aging of Accounts Receivable analysis, businesses in Harris County can stay proactive in addressing their outstanding debts, ensuring a healthy cash flow, minimizing bad debt losses, and promoting sustainable growth within the local economy.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Harris Texas Antigüedad De Las Cuentas Por Cobrar?

Drafting papers for the business or individual demands is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to consider all federal and state laws of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these details make it tense and time-consuming to draft Harris Aging of Accounts Receivable without professional assistance.

It's possible to avoid spending money on lawyers drafting your paperwork and create a legally valid Harris Aging of Accounts Receivable on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary form.

In case you still don't have a subscription, adhere to the step-by-step guide below to get the Harris Aging of Accounts Receivable:

- Look through the page you've opened and verify if it has the sample you require.

- To do so, use the form description and preview if these options are available.

- To locate the one that meets your requirements, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any situation with just a couple of clicks!