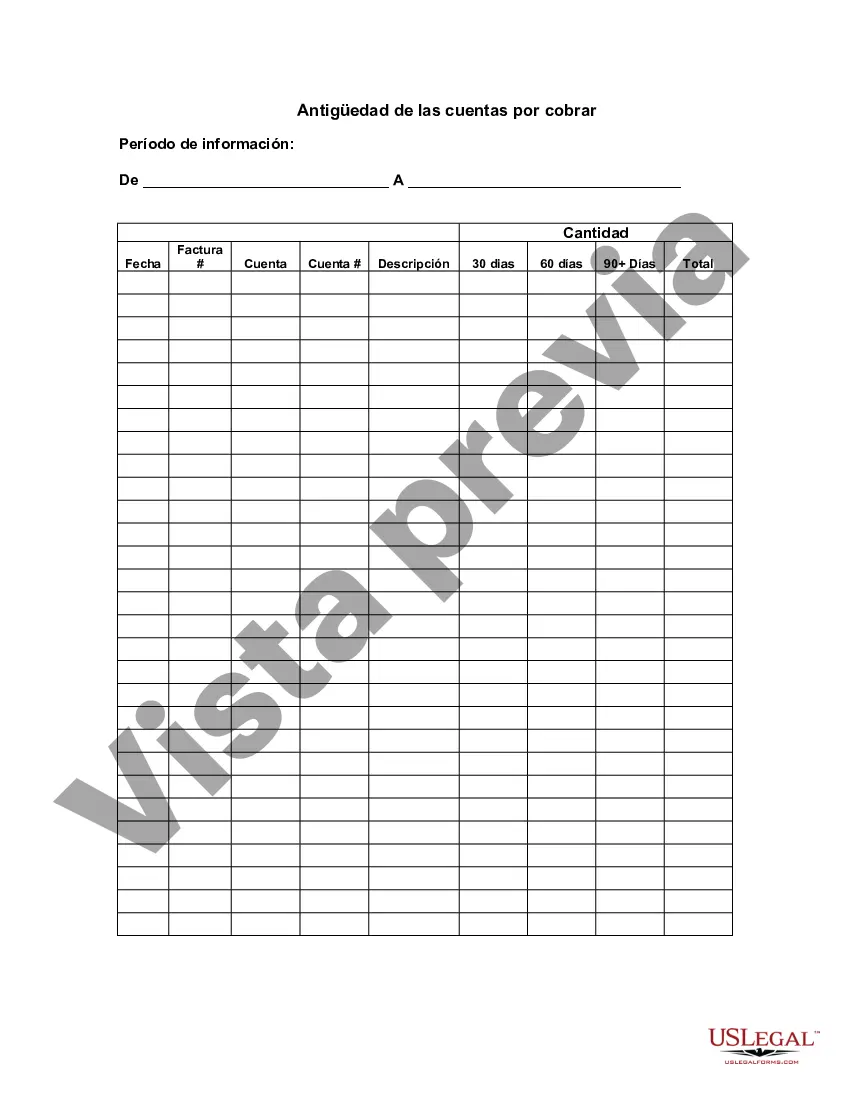

Hillsborough Florida Aging of Accounts Receivable is a financial management process that focuses solely on tracking and analyzing the time it takes for customers to pay outstanding invoices or bills in the Hillsborough County area. As a crucial metric in assessing a company's cash flow and overall financial health, this practice helps businesses in Hillsborough County by providing insight into their credit and collection policies, identifying potential cash flow issues, and ensuring timely invoice payments. Keyword: Hillsborough Florida Keyword: Aging of Accounts Receivable Businesses in Hillsborough County carry out the Aging of Accounts Receivable by categorizing outstanding invoices into different time frames based on when they were issued. These categories commonly include: 1. Current: This category encompasses invoices that are due and expected to be paid within the agreed-upon payment terms, usually within 30 days. 2. 30-60 days: In this category, invoices have surpassed the agreed-upon payment terms by 30 to 60 days, indicating a potential delay in payment from customers. 3. 60-90 days: These invoices are overdue by 60 to 90 days, indicating a more extended period of outstanding payment and a potentially higher risk of non-payment. 4. 90+ days: Invoices that have been overdue for more than 90 days fall into this category, indicating a significant delay in customer payment and a higher likelihood of facing collection challenges. The Aging of Accounts Receivable allows businesses in Hillsborough County to closely monitor and manage their outstanding receivables to ensure timely payment collections and address any potential risks. By consistently reviewing this aging report, businesses can identify customers who frequently pay late or demonstrate a pattern of non-payment, enabling them to take appropriate actions such as renegotiating payment terms or implementing stricter credit policies. Furthermore, this practice assists businesses in estimating future cash flows, as the Aging of Accounts Receivable highlights the expected timing of payment inflows. It also helps identify problematic trends, such as an increase in the average age of outstanding invoices, which can indicate potential cash flow difficulties or customer relationship issues. Overall, Hillsborough Florida Aging of Accounts Receivable is a critical financial management tool that empowers businesses in Hillsborough County to maintain healthy cash flow, manage customer credit risk, and proactively address any payment delays or collection challenges. By strategically analyzing the aging report, companies in this area can strengthen their financial stability and make informed business decisions for sustainable growth.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Hillsborough Florida Antigüedad De Las Cuentas Por Cobrar?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios demand you prepare formal paperwork that varies from state to state. That's why having it all collected in one place is so valuable.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any personal or business purpose utilized in your county, including the Hillsborough Aging of Accounts Receivable.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Hillsborough Aging of Accounts Receivable will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this quick guide to obtain the Hillsborough Aging of Accounts Receivable:

- Make sure you have opened the proper page with your regional form.

- Use the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and download the Hillsborough Aging of Accounts Receivable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs properly with the US Legal Forms!