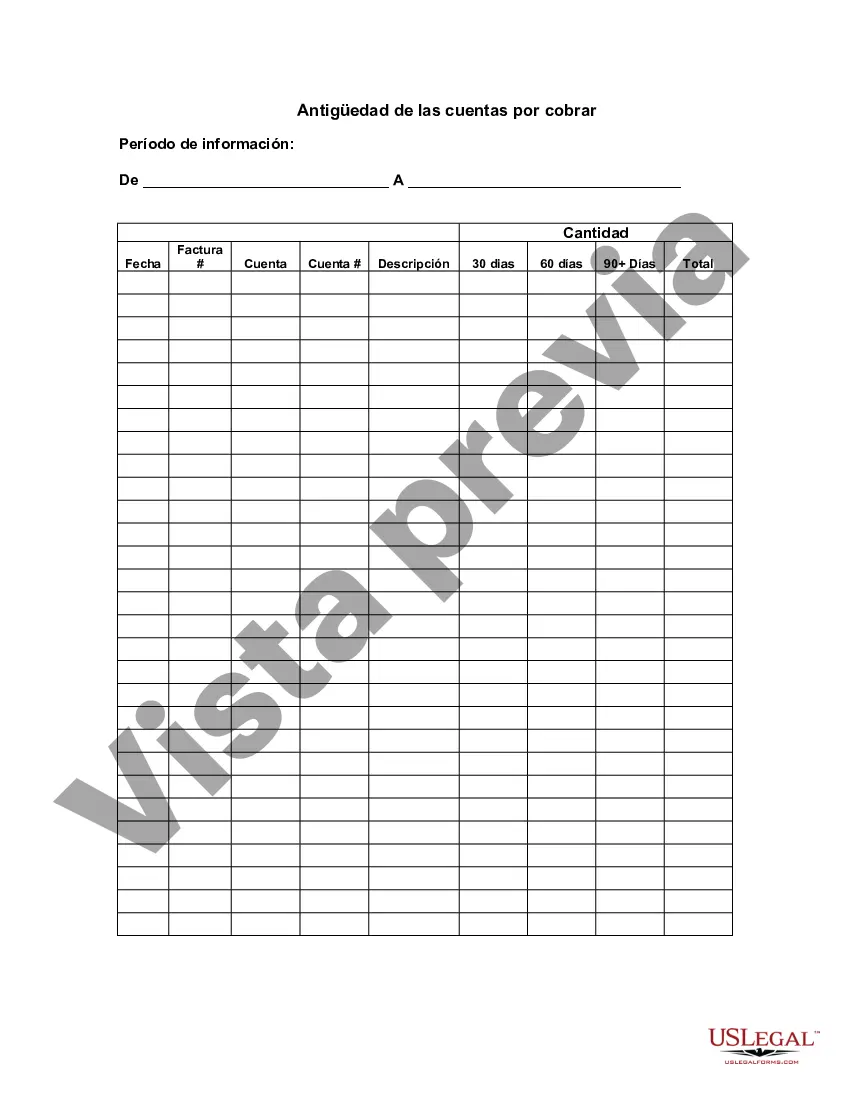

King Washington Aging of Accounts Receivable is a method used to assess and manage the payment behavior and outstanding balances of customers. This financial analysis tool helps businesses track and categorize their unpaid invoices, allowing them to understand the patterns of late payments and take necessary actions for recovery. The Aging of Accounts Receivable of King Washington involves classifying the outstanding invoice amounts into different time intervals, typically in 30-day increments. The purpose of this classification is to determine the length of time an invoice has been outstanding and identify potential risks or opportunities for collections. There are generally three types of King Washington Aging of Accounts Receivable: 1. Current Accounts: These are invoices that are still within the agreed payment terms and have not yet crossed their due dates. Current accounts indicate that customers have made their payments on time and are meeting their financial obligations promptly. 2. Aging Accounts: These are invoices that have exceeded their due dates and fall within specific timeframes. Typically, aging accounts are grouped into different categories such as 30 days past due, 60 days past due, 90 days past due, and so on. These categories help businesses identify and prioritize their collection efforts based on the severity of the delay. 3. Bad Debts or Uncollectible Accounts: These are accounts receivable that are considered highly unlikely or impossible to be collected. They are invoices that have surpassed a certain aging threshold and have little to no chance of being paid. Businesses may write off these bad debts as losses and make necessary adjustments to their financial statements. By analyzing the King Washington Aging of Accounts Receivable, businesses can gain valuable insights into their cash flow, customer payment patterns, and potential credit risks. It allows organizations to take proactive measures to improve collections, negotiate payment terms, or even engage debt collection agencies, if necessary. Overall, King Washington Aging of Accounts Receivable serves as a crucial financial tool to manage cash flow, monitor customer payment behaviors, and maintain a healthy accounts receivable turnover ratio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.King Washington Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out King Washington Antigüedad De Las Cuentas Por Cobrar?

Preparing documents for the business or personal needs is always a big responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state laws of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it tense and time-consuming to draft King Aging of Accounts Receivable without expert help.

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid King Aging of Accounts Receivable by yourself, using the US Legal Forms web library. It is the most extensive online catalog of state-specific legal templates that are professionally verified, so you can be certain of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to save the necessary document.

In case you still don't have a subscription, follow the step-by-step guide below to get the King Aging of Accounts Receivable:

- Examine the page you've opened and check if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that satisfies your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Pick the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a couple of clicks!