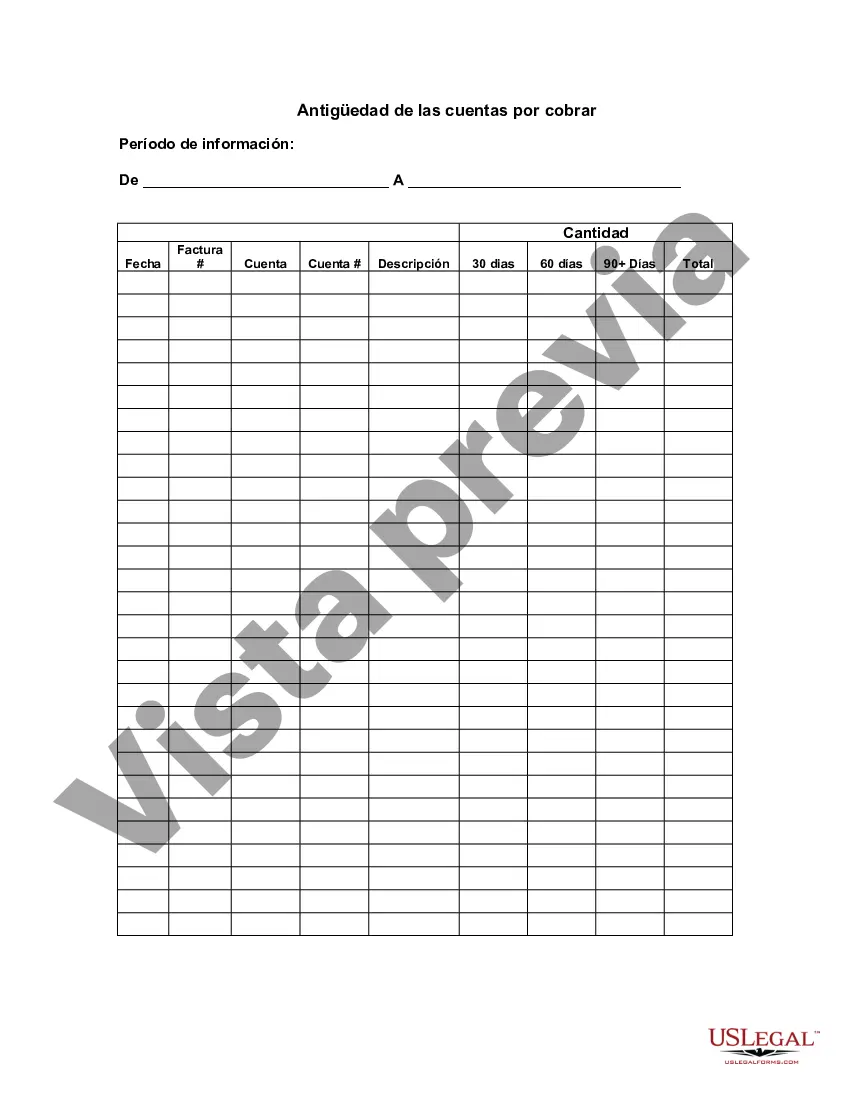

Los Angeles California Aging of Accounts Receivable refers to the process of tracking and analyzing the outstanding debts owed to a business or organization in the Los Angeles area. It is an essential part of financial management and allows businesses to monitor the collection of money owed to them. By determining the age of accounts receivable, companies can identify potential cash flow issues, evaluate customer payment patterns, and take appropriate actions to collect overdue payments. There are different types of Aging of Accounts Receivable methods used in Los Angeles, California. These include: 1. Standard Aging: This method categorizes outstanding invoices based on predefined time periods, usually 30, 60, 90, and 120 days past due. It helps businesses identify aging trends and prioritize collection efforts accordingly. 2. Aging by Customer Category: In this approach, accounts receivable aging is segregated by customer categories such as individual consumers, small businesses, corporate clients, or government entities. By analyzing these categories separately, businesses can target their collection strategies based on the payment behavior of each customer segment. 3. Aging by Sales Team: This method groups accounts receivable based on the sales team or representatives responsible for generating the sales. It allows businesses to assess the effectiveness of each sales team member in terms of collecting payments and identify areas that require improvement. 4. Aging by Product/Service: Here, accounts receivable aging is categorized by the products or services provided by the business. It helps identify any patterns or discrepancies in payment behavior associated with specific offerings, allowing businesses to strategize and take appropriate actions for better cash flow management. 5. Aging by Payment method: This method focuses on categorizing accounts receivable based on the payment methods chosen by customers, such as cash, checks, credit cards, or electronic transfers. It helps identify any delays or issues associated with certain payment methods and enables businesses to adjust their payment acceptance policies accordingly. Implementing an Aging of Accounts Receivable analysis in Los Angeles, California helps businesses in multiple ways. It enables them to anticipate potential cash flow problems, identify high-risk customers, negotiate better payment terms, and determine the need for external financing. By using various types of aging methods, businesses can gain valuable insights into their accounts receivable, allowing them to make informed decisions and ensure the financial stability and growth of their organization.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Los Angeles California Antigüedad De Las Cuentas Por Cobrar?

Drafting documents for the business or individual needs is always a huge responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's crucial to take into account all federal and state laws of the particular area. Nevertheless, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to generate Los Angeles Aging of Accounts Receivable without expert help.

It's possible to avoid wasting money on lawyers drafting your documentation and create a legally valid Los Angeles Aging of Accounts Receivable by yourself, using the US Legal Forms online library. It is the largest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to save the required form.

In case you still don't have a subscription, adhere to the step-by-step guide below to obtain the Los Angeles Aging of Accounts Receivable:

- Examine the page you've opened and verify if it has the document you need.

- To achieve this, use the form description and preview if these options are presented.

- To find the one that meets your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then sign in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or fill it out electronically.

The exceptional thing about the US Legal Forms library is that all the documentation you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal templates for any situation with just a couple of clicks!