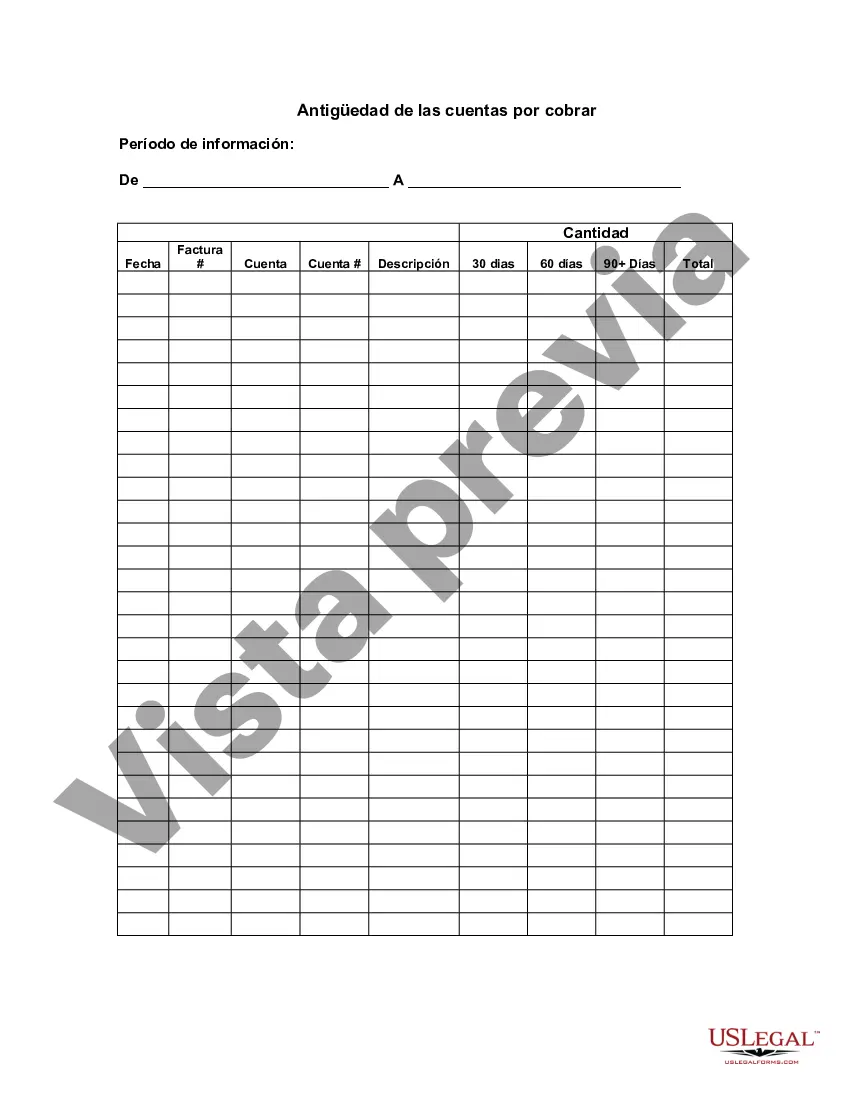

Maricopa, Arizona Aging of Accounts Receivable is a crucial financial concept used by businesses, including Maricopa-based companies, to evaluate the efficiency of their credit and collection processes. This analysis allows businesses to assess the average time it takes for their customers to pay their outstanding invoices, identify potential payment bottlenecks, and improve cash flow management. The Maricopa Arizona Aging of Accounts Receivable provides a comprehensive overview of the payment status of a company's accounts receivable. It classifies outstanding invoices into different time ranges, typically 30-day increments. Each time range represents a particular aging category, providing insights into the collection timeline and identifying delinquent accounts. In Maricopa, Arizona, some commonly used aging categories are: 1. Current: This category includes invoices that are due and payable within the current billing cycle, usually within 30 days. It comprises accounts that have not yet exceeded their due date. 2. 30 Days: This category contains invoices that have aged between 31 and 60 days. It indicates that the customer has exceeded the payment term by a month. 3. 60 Days: In this category, accounts receivable that have aged between 61 and 90 days are consolidated. These accounts signify the delay in payment by two months. 4. 90+ Days: This category consists of invoices that have exceeded 90 days since the due date. These accounts are considered significantly delinquent and might require additional actions such as collections or legal proceedings. Monitoring the Maricopa Arizona Aging of Accounts Receivable regularly provides businesses with valuable insights. By analyzing this data, companies can identify trends, evaluate customer payment patterns, and identify potential issues in their credit and collection procedures. This information can help them take appropriate measures to improve their cash flow, strengthen customer relationships, and minimize the risk of bad debts. In conclusion, the Maricopa Arizona Aging of Accounts Receivable is an essential tool for businesses in Maricopa, Arizona, to effectively manage their accounts receivable. It offers a detailed breakdown of outstanding invoices based on their payment timeline, allowing businesses to strategize and optimize their credit and collection procedures accordingly. Regular analysis of this data helps businesses maintain healthy cash flow and minimize the risk of bad debts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Maricopa Arizona Antigüedad De Las Cuentas Por Cobrar?

Whether you plan to open your business, enter into a deal, apply for your ID update, or resolve family-related legal issues, you must prepare certain paperwork corresponding to your local laws and regulations. Finding the right papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occasion. All files are collected by state and area of use, so picking a copy like Maricopa Aging of Accounts Receivable is quick and easy.

The US Legal Forms website users only need to log in to their account and click the Download key next to the required template. If you are new to the service, it will take you a couple of more steps to obtain the Maricopa Aging of Accounts Receivable. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law requirements.

- Look through the form description and check the Preview if available on the page.

- Use the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the file when you find the proper one.

- Select the subscription plan that suits you most to continue.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the Maricopa Aging of Accounts Receivable in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our website are multi-usable. Having an active subscription, you can access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date formal documents. Sign up for the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!