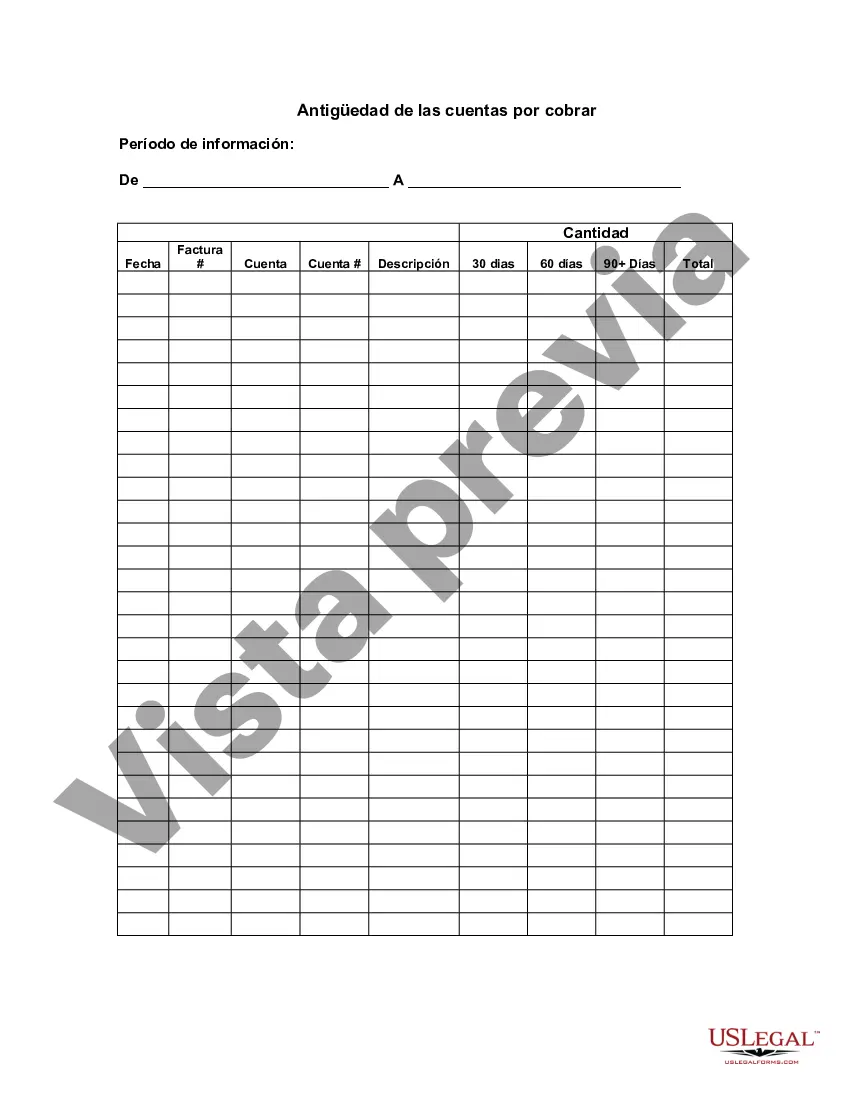

Lima Arizona Aging of Accounts Receivable is a financial analysis technique used by businesses to evaluate the overall health of their accounts receivable. It involves categorizing unpaid customer invoices according to the length of time they have been outstanding. This method provides valuable insights into the efficiency of a company's credit and collection processes. The primary goal of Lima Arizona Aging of Accounts Receivable is to monitor and effectively manage the outstanding debts owed to a business. By categorizing invoices into different time segments, companies can assess the risk associated with unpaid balances and take appropriate actions to collect overdue amounts. There are several types of Lima Arizona Aging of Accounts Receivable, each with its own time periods for classification. These classifications typically include: 1. Current: This category comprises invoices that are not overdue and fall within the agreed-upon payment terms, typically ranging from 0 to 30 days. 2. 30-60 Days: Invoices in this category are overdue by 30 to 60 days. It signals a slight delay in payment and may require proactive follow-up with customers to ensure timely settlement. 3. 61-90 Days: This category includes invoices that have been unpaid for 61 to 90 days. It signifies a higher risk of non-payment and necessitates more aggressive collection efforts, such as phone calls or payment reminders. 4. 91-120 Days: Invoices falling within this category have surpassed the 90-day threshold without payment. Businesses need to address these outstanding balances promptly to avoid further delay or potential write-offs. 5. 120+ Days: This category represents severely delinquent invoices that have remained unpaid for more than 120 days. Companies may need to take concerted efforts, such as employing collection agencies or pursuing legal action, to recover these overdue amounts. By analyzing the aging of accounts receivable in Lima Arizona, businesses can identify trends and patterns in payment behavior, assess the effectiveness of their credit policies, and pinpoint potential areas of improvement. This methodology helps companies make informed decisions regarding credit extensions, collection strategies, and financial forecasting. In summary, Lima Arizona Aging of Accounts Receivable is a crucial financial analysis technique that enables businesses to manage and track unpaid customer invoices based on their age. It helps organizations proactively address overdue amounts, mitigate risk, improve cash flow, and maintain healthy financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Pima Arizona Antigüedad De Las Cuentas Por Cobrar?

Do you need to quickly create a legally-binding Pima Aging of Accounts Receivable or maybe any other form to manage your personal or corporate matters? You can select one of the two options: contact a professional to draft a valid document for you or create it completely on your own. The good news is, there's an alternative solution - US Legal Forms. It will help you get neatly written legal documents without having to pay sky-high prices for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant form templates, including Pima Aging of Accounts Receivable and form packages. We provide templates for a myriad of use cases: from divorce paperwork to real estate documents. We've been on the market for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and get the necessary document without extra hassles.

- To start with, double-check if the Pima Aging of Accounts Receivable is adapted to your state's or county's regulations.

- If the form includes a desciption, make sure to verify what it's suitable for.

- Start the search over if the document isn’t what you were hoping to find by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and move forward to the payment.

- Choose the file format you would like to get your form in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already set up an account, you can easily log in to it, locate the Pima Aging of Accounts Receivable template, and download it. To re-download the form, simply go to the My Forms tab.

It's stressless to find and download legal forms if you use our catalog. Additionally, the templates we provide are updated by industry experts, which gives you greater peace of mind when writing legal matters. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Los reportes de antiguedad te brindan una descripcion general de los saldos pendientes de tus clientes, quienes estan atrasados en sus pagos, que cantidad esta pendiente y cuanto tiempo lleva vencida.

La formula para hallar los dias que tarda una empresa en recaudar la cartera se define con la siguiente formula: (saldo de cartera x 360 dias) / ventas.

Los informes antiguos de las cuentas por cobrar se consideran informes operacionales y son utilizados por los contadores para determinar los saldos vencidos de los clientes.

Las Cuentas por Cobrar a corto plazo deben presentarse en el balance general como activo circulante inmediatamente despues del efectivo y de las inversiones en valores negociables. Atendiendo a su origen se pueden formar dos Cuentas por Cobrar.

B) Antiguedad de cuentas por cobrar, el cual es un analisis de los debitos que integran cada uno de los saldos a cargo de clientes, tomando como base la fecha de la factura o la fecha de vencimiento. Con base a estos dos indicadores, se puede medir el desempeno del departamento de cobranza.

La antiguedad de saldos es la radiografia que revela la calidad de la cartera de credito; este documento que debe generarse o solicitarse a la par de la analitica de cuentas por cobrar, informa el tiempo de pago de todas aquellas entidades a las que se otorga credito; ilustra si los deudores cubren en tiempo sus

Para llegar a este calculo se debe, en primer lugar, determinar el promedio de cuentas por cobrar sumando el saldo al inicio del ano mas el saldo al final del ano y luego se divide entre dos. Posteriormente, se debe dividir el total de ventas netas a credito entre el saldo neto de cuentas por cobrar.

Genera el Reporte de Cuentas por Cobrar en Alegra Contabilidad Haz clic en el menu "Reportes". Ubica la seccion "Reportes administrativos" y selecciona la opcion "Reporte Cuentas por cobrar". Selecciona el rango de fechas que deseas consultar. Haz clic en el boton "Generar reporte".

INFORME DE REGISTRO DE CUENTAS POR COBRAR Fecha de transaccion. Persona u organizacion que efectua la compra. Numero de cuenta. Articulos comprados (asi como su cantidad) Costo unitario y costo total de cada uno de los articulos. Numero de la transaccion o numero de factura de venta.

Suggested clip 49 seconds Como calcular el Periodo promedio de cobro (calcular e interpretar) YouTube Start of suggested clip End of suggested clip