San Antonio Texas Aging of Accounts Receivable is a financial analysis tool used by businesses to monitor and assess the payment patterns of their customers. This technique helps organizations to effectively manage their cash flow and predict future inflows. By analyzing the aging of accounts receivable, businesses can identify any potential issues, such as customers delaying payments or defaulting on their payments, allowing them to take appropriate actions and minimize financial risks. In the context of San Antonio Texas, Aging of Accounts Receivable can be categorized into three main types: 1. San Antonio Texas Aging of Accounts Receivable by Time Period: This type involves categorizing outstanding invoices based on the number of days they have been overdue. Generally, the accounts are classified into different brackets such as current (0-30 days), 31-60 days, 61-90 days, and so on. By analyzing the aging of accounts receivable by time period, businesses can identify trends and patterns in late payments and devise suitable strategies to encourage prompt payment. 2. San Antonio Texas Aging of Accounts Receivable by Customer: This type focuses on segmenting outstanding invoices based on individual customers. By categorizing accounts receivable by customer, businesses can identify customers who consistently delay payments, enabling them to prioritize collections efforts and negotiate alternative payment terms if necessary. Moreover, this analysis helps in recognizing high-value customers who require personalized attention and proactive communication to maintain a healthy business relationship. 3. San Antonio Texas Aging of Accounts Receivable by Industry: This type involves classifying outstanding invoices based on the industries in which customers operate. By analyzing the aging of accounts receivable by industry, businesses can identify specific sectors that encounter payment delays more frequently. This information allows companies to tailor their credit policies, set realistic credit limits, and customize payment terms for industries that generally experience longer payment cycles. In conclusion, San Antonio Texas Aging of Accounts Receivable is a crucial financial analysis tool that helps businesses in monitoring and managing their cash flow effectively. By categorizing outstanding invoices based on time period, customer, and industry, organizations can identify payment patterns, prioritize collections efforts, and reduce financial risks associated with late or defaulted payments.

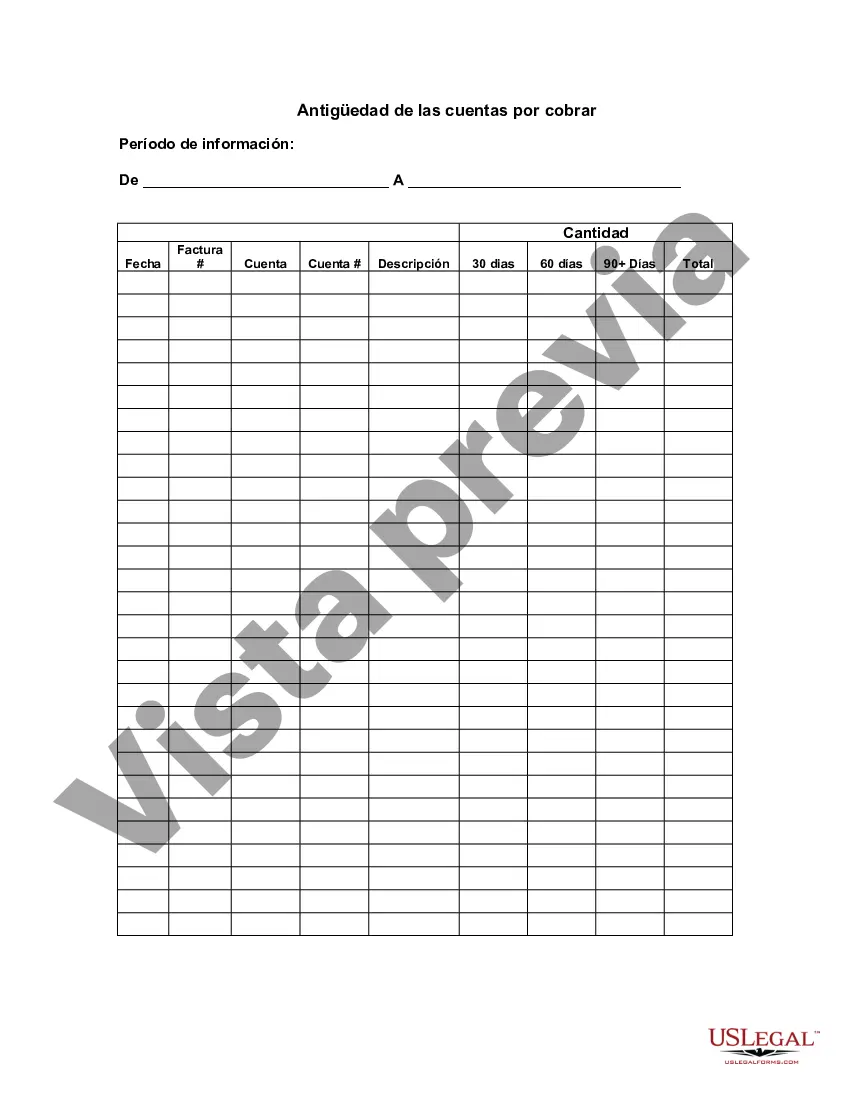

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out San Antonio Texas Antigüedad De Las Cuentas Por Cobrar?

Laws and regulations in every area differ throughout the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the San Antonio Aging of Accounts Receivable, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business occasions. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the San Antonio Aging of Accounts Receivable from the My Forms tab.

For new users, it's necessary to make several more steps to get the San Antonio Aging of Accounts Receivable:

- Examine the page content to make sure you found the appropriate sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the simplest and most economical way to get up-to-date templates for any legal purposes. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!