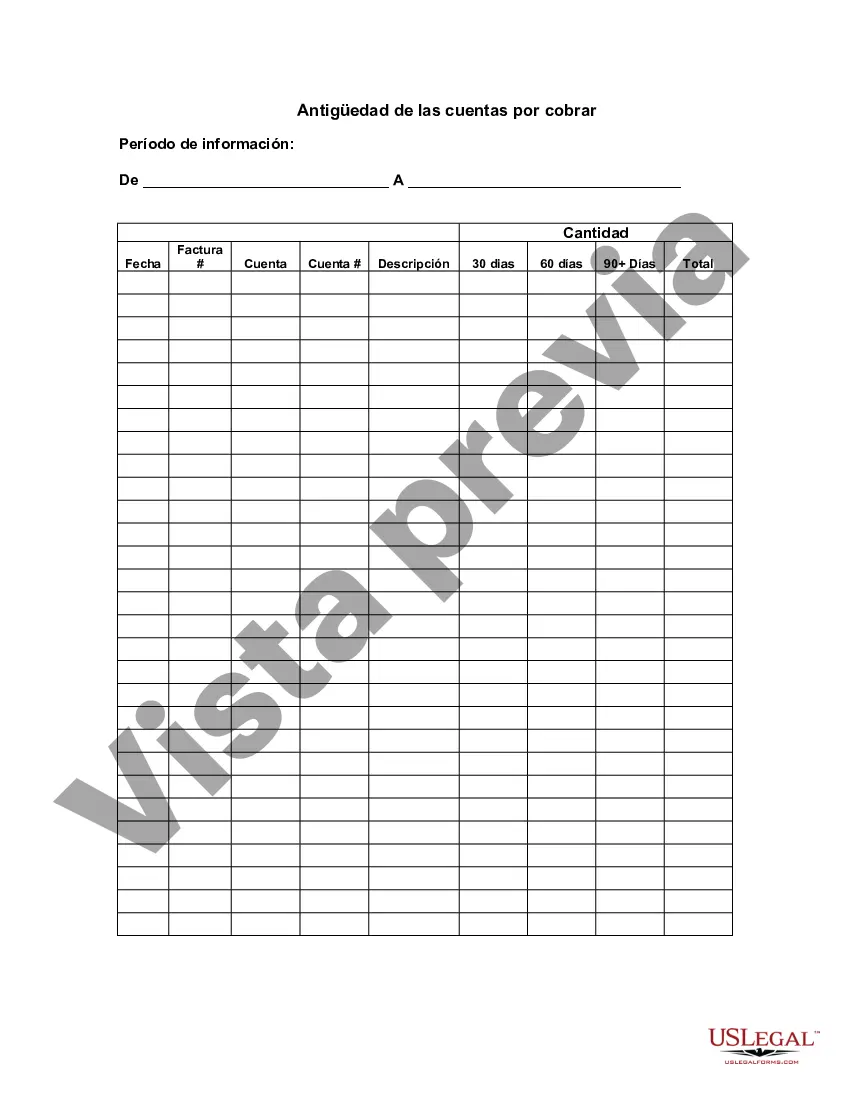

San Jose, California Aging of Accounts Receivable is a financial process that is crucial for businesses to effectively manage their cash flow and track overdue customer payments. This comprehensive analysis helps measure the time it takes for invoices to be paid, allowing businesses to evaluate their accounts receivable performance and take necessary actions to address any outstanding debts. Here are some relevant keywords related to the San Jose, California Aging of Accounts Receivable: 1. Accounts Receivable: The amounts owed to a business by its customers for goods or services rendered on credit. 2. Aging Analysis: The categorization of accounts receivable based on the length of time the invoice has remained unpaid. 3. Cash Flow Management: The process of monitoring and analyzing the inflow and outflow of cash within a business. 4. Overdue Invoices: Invoices that have exceeded their due date and have not been paid. 5. Collection Period: The average number of days it takes for a business to collect payment after issuing an invoice. 6. Credit Policy: Guidelines set by a business to determine its customers' credit worthiness and terms of payment. 7. Bad Debts: Unpaid invoices that are deemed uncollectible and are written off as losses. Regarding different types of San Jose, California Aging of Accounts Receivable, there are various methods businesses can adapt to categorize their accounts receivable based on timeframes. Some commonly used types include: 1. 30-Day Aging: Accounts receivable categorized based on invoices due within the past 30 days. 2. 60-Day Aging: Accounts receivable categorized based on invoices due within 31-60 days. 3. 90-Day Aging: Accounts receivable categorized based on invoices due within 61-90 days. 4. Over 90-Day Aging: Accounts receivable categorized based on invoices due for more than 90 days. By using the San Jose, California Aging of Accounts Receivable analysis, businesses can identify customers with outstanding debts, quantify their overdue amounts, and prioritize collections efforts accordingly. This process enables businesses to maintain healthy cash flow, minimize bad debt losses, and strengthen their overall financial stability.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Jose California Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out San Jose California Antigüedad De Las Cuentas Por Cobrar?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios demand you prepare official documentation that varies from state to state. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any individual or business objective utilized in your region, including the San Jose Aging of Accounts Receivable.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the San Jose Aging of Accounts Receivable will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the San Jose Aging of Accounts Receivable:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template meets your requirements.

- Search for another document using the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Select the suitable subscription plan, then log in or create an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the San Jose Aging of Accounts Receivable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!