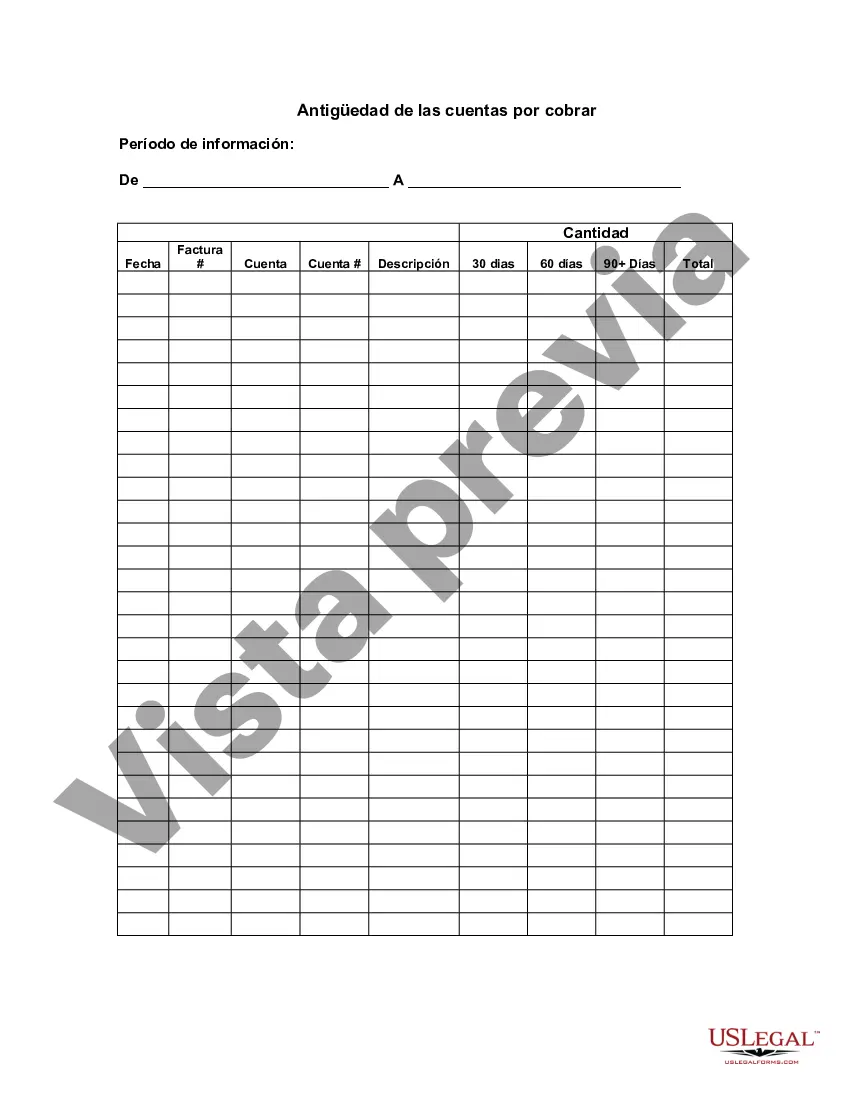

Travis Texas Aging of Accounts Receivable refers to the process of analyzing and categorizing outstanding customer invoices based on their due dates to determine the length of time the amount has been unpaid. This analysis helps businesses assess their cash flow and identify potential risks associated with overdue payments. In Travis Texas, Aging of Accounts Receivable can be classified into various types based on the time period the invoices have remained unpaid. These types include: 1. Current: This category represents invoices that are due within the current billing cycle. These invoices are within the agreed-upon payment terms and are yet to exceed their due dates. 2. 30-Day Aging: This category includes invoices that are overdue by up to 30 days. These invoices indicate that payment has not been received within the agreed-upon timeframe but are still within a tolerable grace period. 3. 60-Day Aging: In this category, invoices have remained unpaid for a period between 31 and 60 days. These can be considered as moderately overdue invoices that demand more immediate attention from the accounts receivable department. 4. 90-Day Aging: This category encompasses invoices that have been unpaid for a period between 61 and 90 days. At this stage, the delay in payment starts to significantly impact the business's cash flow, and the accounts receivable team must take prompt actions to encourage payment. 5. 90+ Day Aging: This category represents invoices that have surpassed the 90-day mark and remain unpaid for an extended period. These invoices are considered highly delinquent and require immediate resolution to mitigate any potential bad debt losses. Travis Texas Aging of Accounts Receivable enables businesses to monitor the creditworthiness of their customers, identify patterns of late payment, and initiate appropriate collection efforts. By dividing accounts receivable based on specific aging categories, businesses gain valuable insights into the financial health of their customer base and identify potential collection issues. This process aids in developing a proactive approach to managing outstanding invoices and maintaining a healthy cash flow.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Travis Texas Antigüedad De Las Cuentas Por Cobrar?

Whether you intend to open your company, enter into a deal, apply for your ID update, or resolve family-related legal issues, you need to prepare certain documentation corresponding to your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The service provides users with more than 85,000 expertly drafted and checked legal documents for any personal or business occurrence. All files are grouped by state and area of use, so opting for a copy like Travis Aging of Accounts Receivable is fast and straightforward.

The US Legal Forms library users only need to log in to their account and click the Download button next to the required template. If you are new to the service, it will take you a couple of additional steps to obtain the Travis Aging of Accounts Receivable. Follow the guidelines below:

- Make certain the sample fulfills your personal needs and state law requirements.

- Look through the form description and check the Preview if there’s one on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to get the file when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Travis Aging of Accounts Receivable in the file format you prefer.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are reusable. Having an active subscription, you can access all of your earlier acquired paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documents. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!