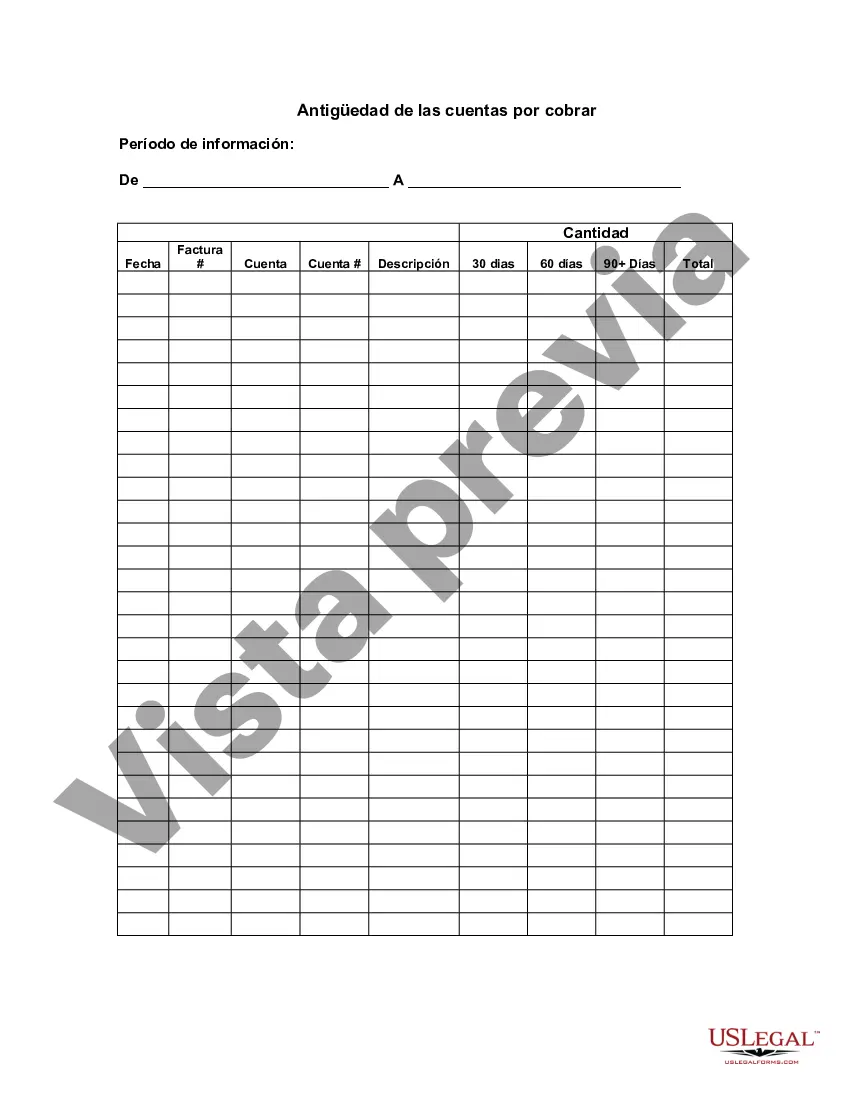

Description: Wake North Carolina Aging of Accounts Receivable is a financial management tool used by businesses in Wake County, North Carolina to track and analyze the payment patterns of their outstanding accounts receivable. This method allows businesses to categorize their unpaid invoices based on the length of time they have been outstanding, providing valuable insights into their cash flow and overall financial health. With Wake North Carolina Aging of Accounts Receivable, businesses can identify and manage overdue payments more effectively. By sorting invoices into different aging buckets, typically ranging from 30 to 90+ days, businesses gain a clear understanding of which customers have outstanding balances and how long those balances have remained unpaid. This categorization enables businesses to prioritize their collection efforts and take appropriate actions to recover the overdue payments. By utilizing Wake North Carolina Aging of Accounts Receivable, businesses can also identify any recurring late-payments trends or problematic customers that may require closer attention. This analysis helps businesses in devising strategies to improve their collections processes, including implementing stricter credit policies, offering flexible payment options, or providing incentives for early settlement. Additionally, the system of Wake North Carolina Aging of Accounts Receivable provides useful metrics for businesses to assess their financial performance and measure the effectiveness of their credit management practices. Key indicators such as average collection period, aged accounts receivable turnover, and past-due percentages offer insights into the efficiency of cash flow management, customer payment habits, and credit risk assessment. In Wake County, North Carolina, there are two common types of Wake North Carolina Aging of Accounts Receivable: 1. Summary Aging: This type presents an overview of the outstanding accounts receivable balances based on predefined aging periods. Typically, summary aging will categorize the accounts into buckets like current, 30 days, 60 days, and 90+ days, allowing businesses to quickly assess the overall picture of their receivables. 2. Detailed Aging: This more comprehensive type provides a detailed breakdown of each customer's outstanding balances according to the aging periods. It includes individual invoices with specific due dates, allowing businesses to identify which invoices are overdue and take appropriate actions to resolve any outstanding issues. In conclusion, Wake North Carolina Aging of Accounts Receivable is an essential financial management tool for businesses in Wake County, North Carolina, enabling them to effectively manage and monitor their outstanding accounts receivable balances. By categorizing unpaid invoices into different aging buckets, businesses gain insights into their cash flow, identify late-payment trends, and make informed decisions to optimize their collections processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Wake North Carolina Antigüedad De Las Cuentas Por Cobrar?

Drafting paperwork for the business or individual demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's essential to take into account all federal and state regulations of the specific area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it stressful and time-consuming to generate Wake Aging of Accounts Receivable without expert help.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Wake Aging of Accounts Receivable by yourself, using the US Legal Forms online library. It is the greatest online collection of state-specific legal templates that are professionally cheched, so you can be certain of their validity when choosing a sample for your county. Earlier subscribed users only need to log in to their accounts to download the necessary form.

In case you still don't have a subscription, adhere to the step-by-step instruction below to get the Wake Aging of Accounts Receivable:

- Look through the page you've opened and verify if it has the sample you need.

- To do so, use the form description and preview if these options are presented.

- To locate the one that satisfies your needs, utilize the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the selected document in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and easily get verified legal forms for any scenario with just a few clicks!