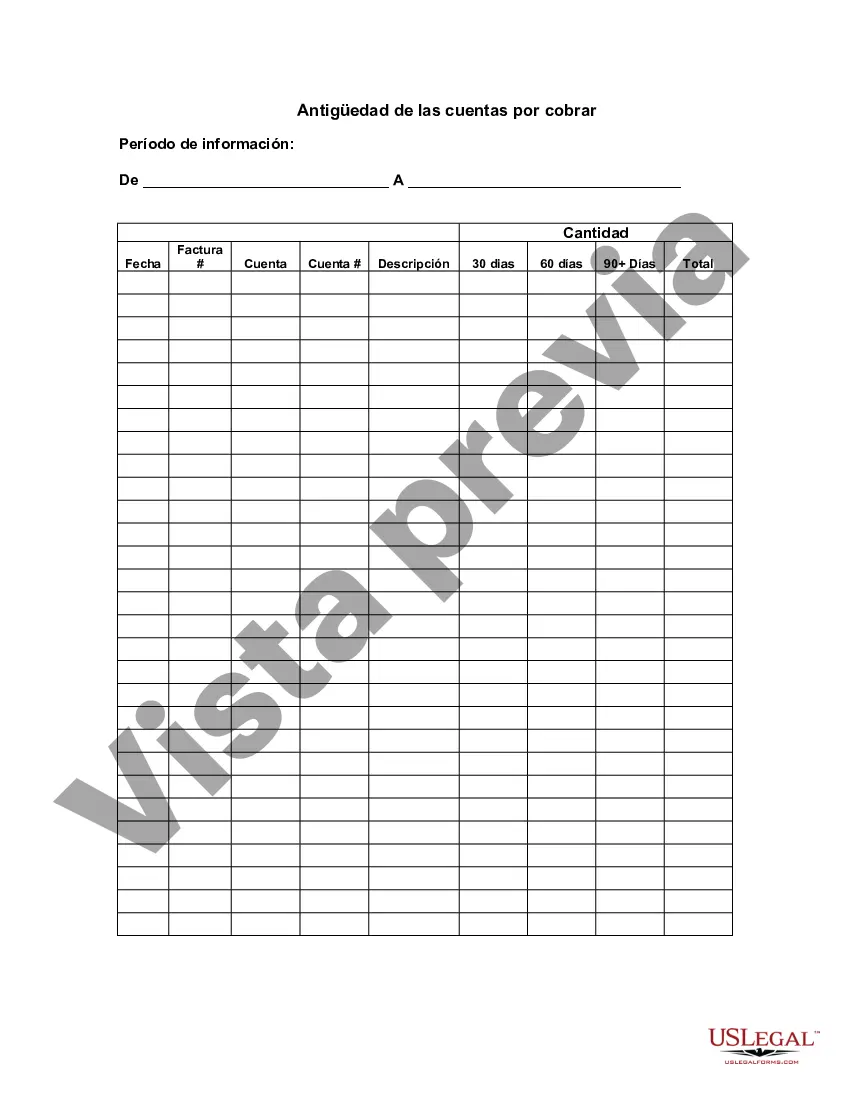

Wayne, Michigan Aging of Accounts Receivable: A Comprehensive Analysis In Wayne, Michigan, aging of accounts receivable refers to the process of categorizing and tracking unpaid invoices or funds owed to a business over a specific period. This financial analysis technique helps organizations manage cash flow effectively and identifies potential risks associated with overdue payments. By evaluating the aging of accounts receivable, businesses can gain insights into their customers' payment habits, identify collection issues, and take necessary actions to ensure financial stability. The aging of accounts receivable in Wayne, Michigan can be divided into several types, which are as follows: 1. Current Accounts: This category includes invoices or payments that are due within the current billing period, typically within 30 days. These accounts are not yet past due and have no associated penalties or interest charges. 2. 30-60 Days: This category encompasses invoices or payments that are 30 to 60 days past their due date. These accounts indicate a slight delay in payment and may warrant reminders or follow-ups to prevent further delay. 3. 60-90 Days: Accounts receivable falling within this range are considered moderately overdue. Businesses need to pay closer attention to these accounts as they indicate a potential risk for delayed or non-payment by the customer. Appropriate actions, such as phone calls, collection letters, or negotiation, may be required to recover the overdue amount. 4. 90+ Days: This category represents accounts that are significantly past due, usually exceeding 90 days. These accounts are at high risk of becoming bad debts or uncollectible. Prompt actions, such as engaging debt collection agencies or pursuing legal options, might be necessary to recover the outstanding amount. Keywords related to the Wayne, Michigan aging of accounts receivable might include: Wayne Michigan, accounts receivable, aging, analysis, tracking, unpaid invoices, cash flow management, financial analysis, overdue payments, payment habits, collection issues, financial stability, types, current accounts, 30-60 days, 60-90 days, 90+ days, risk assessment, penalties, interest charges, reminders, follow-ups, non-payment, bad debts, uncollectible, debt collection agencies, legal options. By effectively utilizing the aging of accounts receivable process in Wayne, Michigan, businesses can maintain better control over their cash flow, improve collection efficiency, and make informed decisions to mitigate financial risks.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Antigüedad de las cuentas por cobrar - Aging of Accounts Receivable

Description

How to fill out Wayne Michigan Antigüedad De Las Cuentas Por Cobrar?

Draftwing documents, like Wayne Aging of Accounts Receivable, to take care of your legal affairs is a tough and time-consumming process. A lot of cases require an attorney’s involvement, which also makes this task expensive. However, you can take your legal matters into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms intended for a variety of scenarios and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to be concerned about potential legal issues compliance-wise.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Wayne Aging of Accounts Receivable template. Simply log in to your account, download the template, and customize it to your needs. Have you lost your form? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is just as easy! Here’s what you need to do before getting Wayne Aging of Accounts Receivable:

- Ensure that your template is specific to your state/county since the regulations for writing legal papers may vary from one state another.

- Learn more about the form by previewing it or going through a quick intro. If the Wayne Aging of Accounts Receivable isn’t something you were hoping to find, then take advantage of the search bar in the header to find another one.

- Sign in or create an account to begin using our website and download the form.

- Everything looks good on your end? Click the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment information.

- Your template is all set. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!