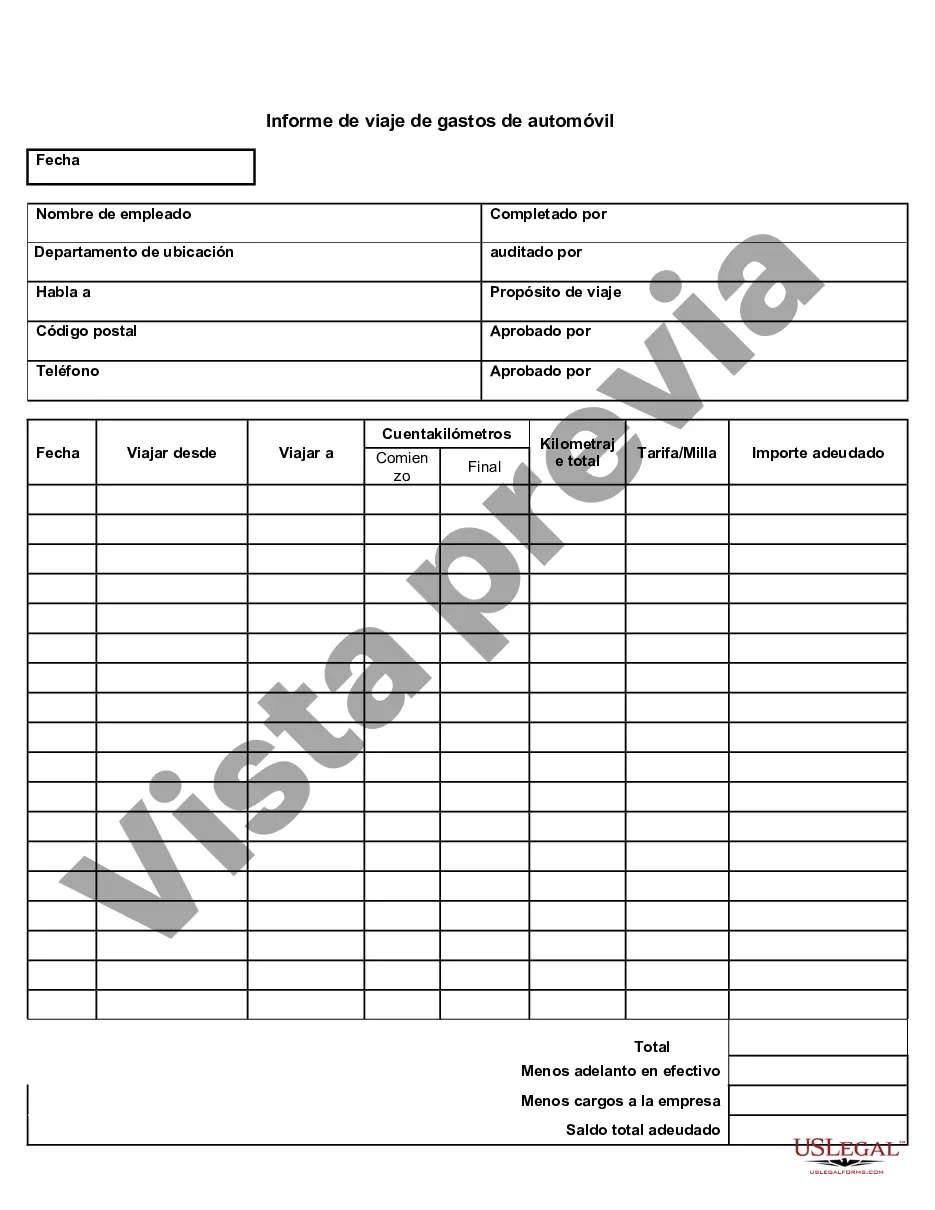

Wake North Carolina Auto Expense Travel Report is a detailed document that provides information on the expenses incurred during auto travel within the Wake County, North Carolina area. This report includes a breakdown of various auto-related expenses and serves as a comprehensive record for individuals or organizations who need to track their travel expenses accurately. The Wake North Carolina Auto Expense Travel Report captures various key elements, including mileage, fuel costs, toll fees, parking fees, maintenance expenses, rental charges, and other relevant expenses associated with auto travel. It provides a detailed account of the purpose of the trip, the dates of travel, the starting and ending destinations, and any additional details deemed necessary by the traveler or organization. Keywords: Wake North Carolina, Auto Expense Travel Report, auto travel, expenses, tracking, breakdown, mileage, fuel costs, toll fees, parking fees, maintenance expenses, rental charges, comprehensive record, accurate, purpose of the trip, dates of travel, starting and ending destinations, detailed account. Different types of Wake North Carolina Auto Expense Travel Reports may include: 1. Individual Travel Report: This type of report is generated by individuals who need to track their auto travel expenses within Wake County, North Carolina, for personal reasons such as tax deductions or reimbursement purposes. 2. Business Travel Report: Organizations and companies often require employees to submit auto expense travel reports to claim reimbursement for business-related travel within Wake County. This report may also include additional details such as client meetings, purpose of the trip, or project-related expenses. 3. Governmental Travel Report: Government entities or agencies may have specific requirements for reporting auto expenses. This type of report is often used by government employees who travel within Wake County, North Carolina, for official purposes. It may include additional sections for budget allocation, government vehicle usage, or grant-funded projects. 4. Non-Profit Organization Travel Report: Non-profit organizations operating within Wake County may have their own specific reporting requirements. This type of report might include details about travel expenses related to community outreach programs, fundraising events, or volunteer activities. Keywords: Individual Travel Report, Business Travel Report, Governmental Travel Report, Non-Profit Organization Travel Report, tax deductions, reimbursement, personal reasons, business-related travel, client meetings, project-related expenses, official purposes, government employees, budget allocation, government vehicle usage, grant-funded projects, non-profit organizations, community outreach programs, fundraising events, volunteer activities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Informe de viaje de gastos de automóvil - Auto Expense Travel Report

Description

How to fill out Wake North Carolina Informe De Viaje De Gastos De Automóvil?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare formal paperwork that differs from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Wake Auto Expense Travel Report.

Locating forms on the platform is amazingly straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Wake Auto Expense Travel Report will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guideline to get the Wake Auto Expense Travel Report:

- Ensure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and download the Wake Auto Expense Travel Report on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the simplest and most reliable way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!