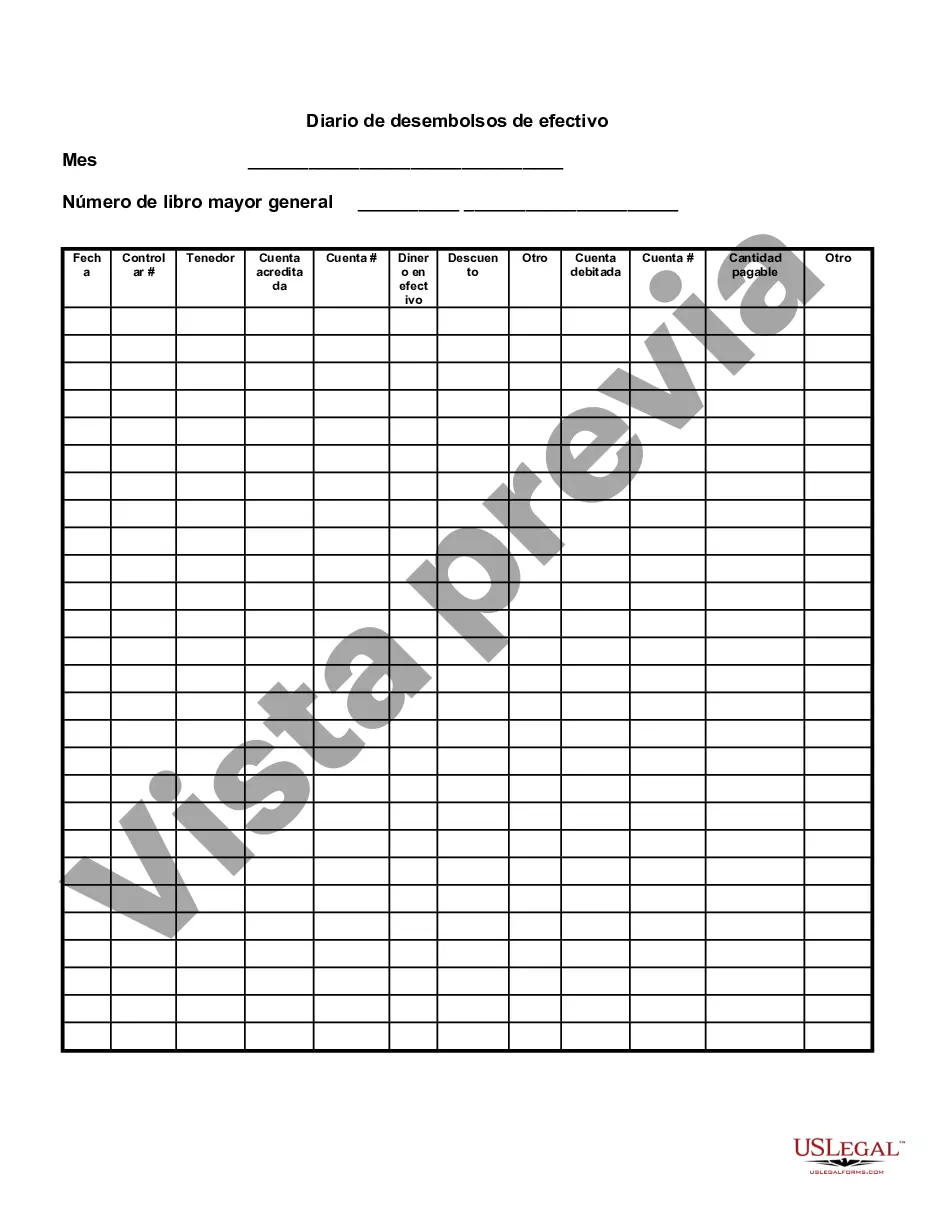

The Cuyahoga Ohio Cash Disbursements Journal is a financial document that records all cash transactions made by an organization or business in the Cuyahoga County, Ohio area. It serves as a detailed record of all cash expenditures made for various purposes. The Cash Disbursements Journal is used to track the outflow of cash, such as payments made for goods, services, or expenses incurred. It helps businesses and organizations monitor their spending and maintain accurate financial records. The Cuyahoga Ohio Cash Disbursements Journal typically includes relevant keywords such as: 1. Payments: This refers to the actual cash or check payments made by the organization. 2. Expenses: It records all the expenses incurred by the business, including utilities, rent, salaries, supplies, and more. 3. Vendors: The journal records the names of vendors that the organization or business has made payments to. 4. Dates: Each transaction is recorded with the date when the payment was made. 5. Description: A brief description of the purpose or nature of the payment is included in the journal. 6. Check numbers: If payment is made by check, the check number is noted in the journal. 7. Account codes: Some organizations use account codes to classify and categorize their expenditures. These account codes may also be included in the journal. Apart from the general Cash Disbursements Journal, there can be specialized versions or types depending on the specific needs of a business or organization. These specialized journals may include: 1. Expense Journal: This journal focuses solely on recording expenses made by the organization. It provides a detailed overview of different types of expenses and helps track spending patterns. 2. Vendor Payment Journal: This journal specifically focuses on payments made to vendors. It helps businesses keep a comprehensive record of all vendor payments, ensuring accurate and timely payments are made. 3. Petty Cash Journal: In cases where businesses use petty cash to make small and immediate purchases, a separate journal, known as the Petty Cash Journal, is used. It tracks cash disbursements from the petty cash fund. In conclusion, the Cuyahoga Ohio Cash Disbursements Journal is an essential financial tool for businesses and organizations in the area. It helps them maintain accurate records of all cash expenditures, monitor spending patterns, and ensure financial transparency. The different types of cash disbursement journals include the general Cash Disbursements Journal, Expense Journal, Vendor Payment Journal, and Petty Cash Journal, each serving specific purposes for financial management.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Cuyahoga Ohio Diario De Desembolsos De Efectivo?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to draft some of them from scratch, including Cuyahoga Cash Disbursements Journal, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 templates to pick from in different categories varying from living wills to real estate papers to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities associated with paperwork completion straightforward.

Here's how to locate and download Cuyahoga Cash Disbursements Journal.

- Go over the document's preview and description (if provided) to get a basic information on what you’ll get after getting the document.

- Ensure that the template of your choosing is adapted to your state/county/area since state laws can affect the legality of some records.

- Examine the related document templates or start the search over to find the right file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and purchase Cuyahoga Cash Disbursements Journal.

- Select to save the form template in any offered format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the appropriate Cuyahoga Cash Disbursements Journal, log in to your account, and download it. Of course, our website can’t take the place of a legal professional completely. If you need to deal with an exceptionally complicated situation, we recommend using the services of an attorney to examine your document before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of customers. Join them today and get your state-compliant documents effortlessly!