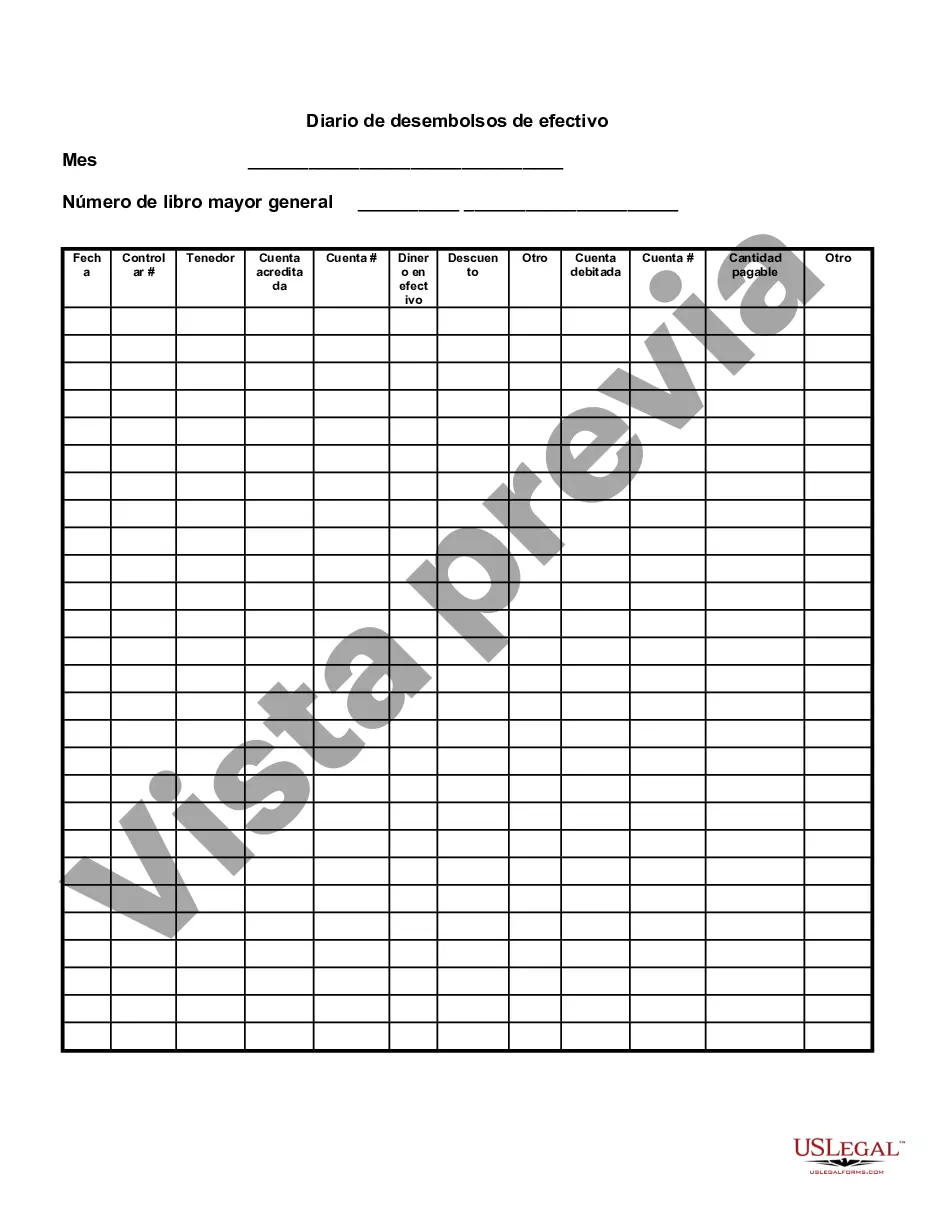

Kings New York Cash Disbursements Journal is a vital financial record used by businesses to track and record all outgoing cash payments. It serves as an essential tool for maintaining accurate and organized financial records. With the help of this journal, businesses can keep a close eye on their cash flow and track expenses to ensure financial stability and control. This particular cash disbursements journal is specifically designed and widely used by businesses operating in New York. It adheres to the specific legal and regulatory requirements of the state, ensuring compliance and accuracy in financial reporting. Kings New York Cash Disbursements Journal offers a user-friendly format that simplifies the recording of cash disbursements and enhances the efficiency of financial record-keeping processes. Keywords: Kings New York Cash Disbursements Journal, financial record, outgoing cash payments, accurate, organized, cash flow, expenses, financial stability, control, New York, legal requirements, regulatory compliance, financial reporting, user-friendly, efficiency, financial record-keeping. Different Types of Kings New York Cash Disbursements Journal: 1. General Cash Disbursements Journal: This type of cash disbursements journal is used to record all types of outgoing cash payments made by a business, including regular expenses, bills, employee salaries, vendor payments, and other miscellaneous disbursements. 2. Payroll Cash Disbursements Journal: This specific journal is used solely for recording cash disbursements related to employee wages, salaries, benefits, and payroll taxes. It helps businesses maintain accurate payroll records and ensures compliance with labor laws and regulations. 3. Expense Cash Disbursements Journal: This type of cash disbursements journal specifically focuses on tracking and recording business expenses, such as office supplies, utilities, rent, insurance payments, advertising costs, and other operational expenditures. It provides a detailed breakdown of all expenses, enabling businesses to analyze spending patterns and identify cost-saving opportunities. Keywords: General Cash Disbursements Journal, Payroll Cash Disbursements Journal, Expense Cash Disbursements Journal, outgoing cash payments, regular expenses, bills, employee salaries, vendor payments, miscellaneous disbursements, payroll records, labor laws, compliance, business expenses, office supplies, utilities, rent, insurance payments, advertising costs, operational expenditures, spending patterns, cost-saving opportunities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Kings New York Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Kings New York Diario De Desembolsos De Efectivo?

Preparing legal documentation can be difficult. Besides, if you decide to ask an attorney to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Kings Cash Disbursements Journal, it may cost you a fortune. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the latest version of the Kings Cash Disbursements Journal, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Kings Cash Disbursements Journal:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the right one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the document format for your Kings Cash Disbursements Journal and download it.

Once done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!