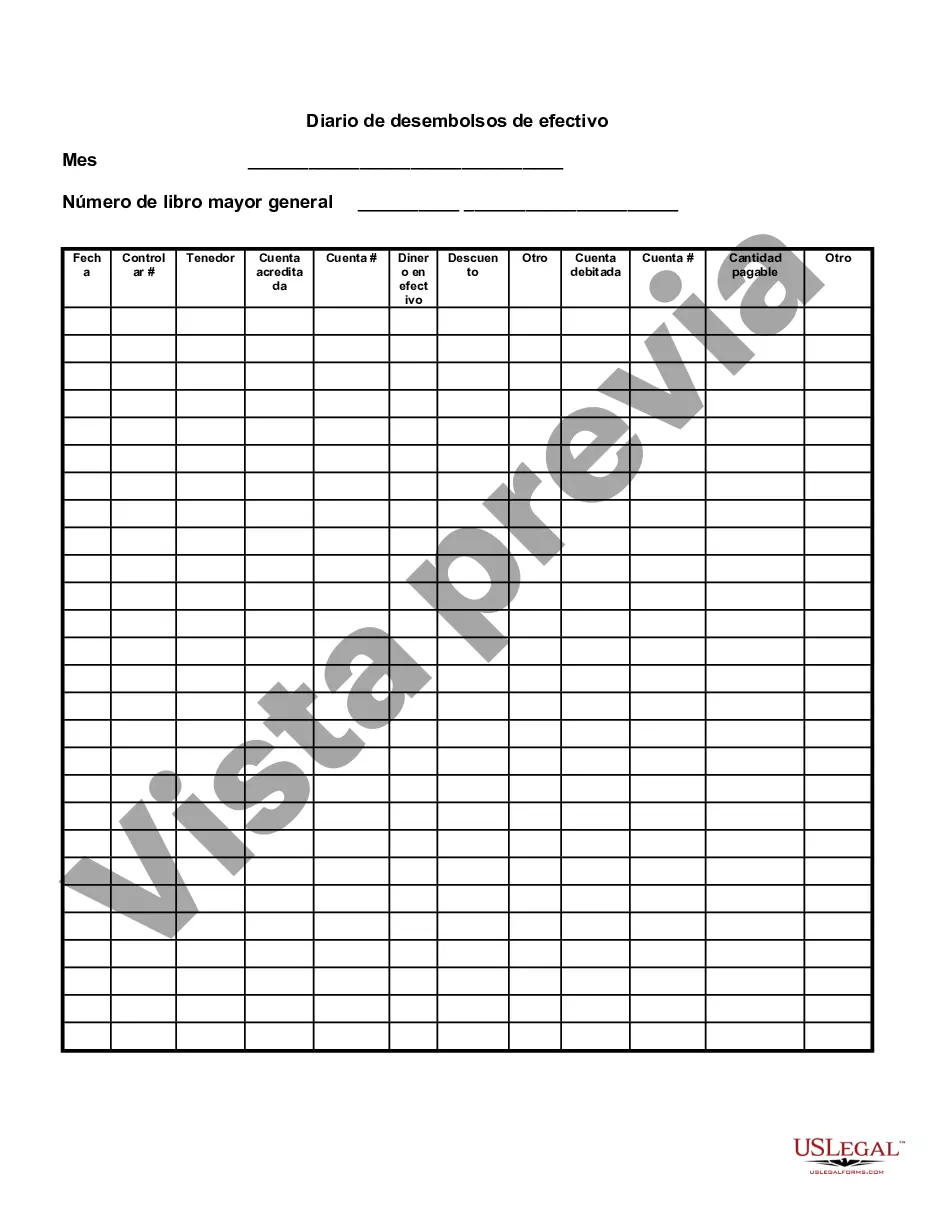

The Middlesex Massachusetts Cash Disbursements Journal is a document that serves as a comprehensive register of all outgoing cash transactions for organizations located in Middlesex County, Massachusetts. It is an essential financial tool used by companies to record and track their expenses, ensuring accurate financial management. In Middlesex Massachusetts, there are typically two types of Cash Disbursements Journals employed: the General Cash Disbursements Journal and the Payroll Cash Disbursements Journal. The General Cash Disbursements Journal focuses on documenting various expenditures made by an organization, including payments to vendors, suppliers, utility providers, and other business-related expenses. Every cash disbursement made by the company is recorded in this journal, providing a detailed account of each transaction. This journal aids in the analysis of expenditure patterns, tracking spending habits, and identifying areas where cost-cutting measures can be implemented. On the other hand, the Payroll Cash Disbursements Journal is used exclusively for recording employee wage payments, taxes, benefits, and other payroll-related expenses. It ensures accurate recording of salaries, wages, and deductions for each employee, facilitating smooth payroll management and adherence to applicable labor laws. Both types of Cash Disbursements Journals share common characteristics and essential fields. These include the transaction date, payee/vendor name, purpose of payment, payment method (such as cash, check, or electronic transfer), amount disbursed, and any relevant account codes or categories. This journal acts as a supporting document for the cash disbursement entry made in the general ledger, providing a transparent and traceable trail of all expenditures. In Middlesex Massachusetts, organizations are mandated to maintain accurate and up-to-date Cash Disbursements Journals as part of their financial record-keeping obligations. These journals play a crucial role during audits, tax reporting, and financial analysis, ensuring the integrity and transparency of an organization's financial operations. To summarize, the Middlesex Massachusetts Cash Disbursements Journal is a vital component of financial management, enabling businesses to accurately record and track their cash outflows. It includes the General Cash Disbursements Journal and the Payroll Cash Disbursements Journal, each serving a specific purpose in documenting different types of expenses. By diligently maintaining these journals, organizations in Middlesex Massachusetts can ensure efficient financial control and compliance with regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Middlesex Massachusetts Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Middlesex Massachusetts Diario De Desembolsos De Efectivo?

Preparing legal documentation can be difficult. In addition, if you decide to ask a lawyer to write a commercial agreement, papers for ownership transfer, pre-marital agreement, divorce paperwork, or the Middlesex Cash Disbursements Journal, it may cost you a fortune. So what is the most reasonable way to save time and money and create legitimate documents in total compliance with your state and local laws? US Legal Forms is an excellent solution, whether you're looking for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked forms for any use case gathered all in one place. Therefore, if you need the current version of the Middlesex Cash Disbursements Journal, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Middlesex Cash Disbursements Journal:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the right one in the header.

- Click Buy Now once you find the required sample and choose the best suitable subscription.

- Log in or register for an account to pay for your subscription.

- Make a payment with a credit card or through PayPal.

- Choose the file format for your Middlesex Cash Disbursements Journal and save it.

Once finished, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the documents ever purchased many times - you can find your templates in the My Forms tab in your profile. Try it out now!