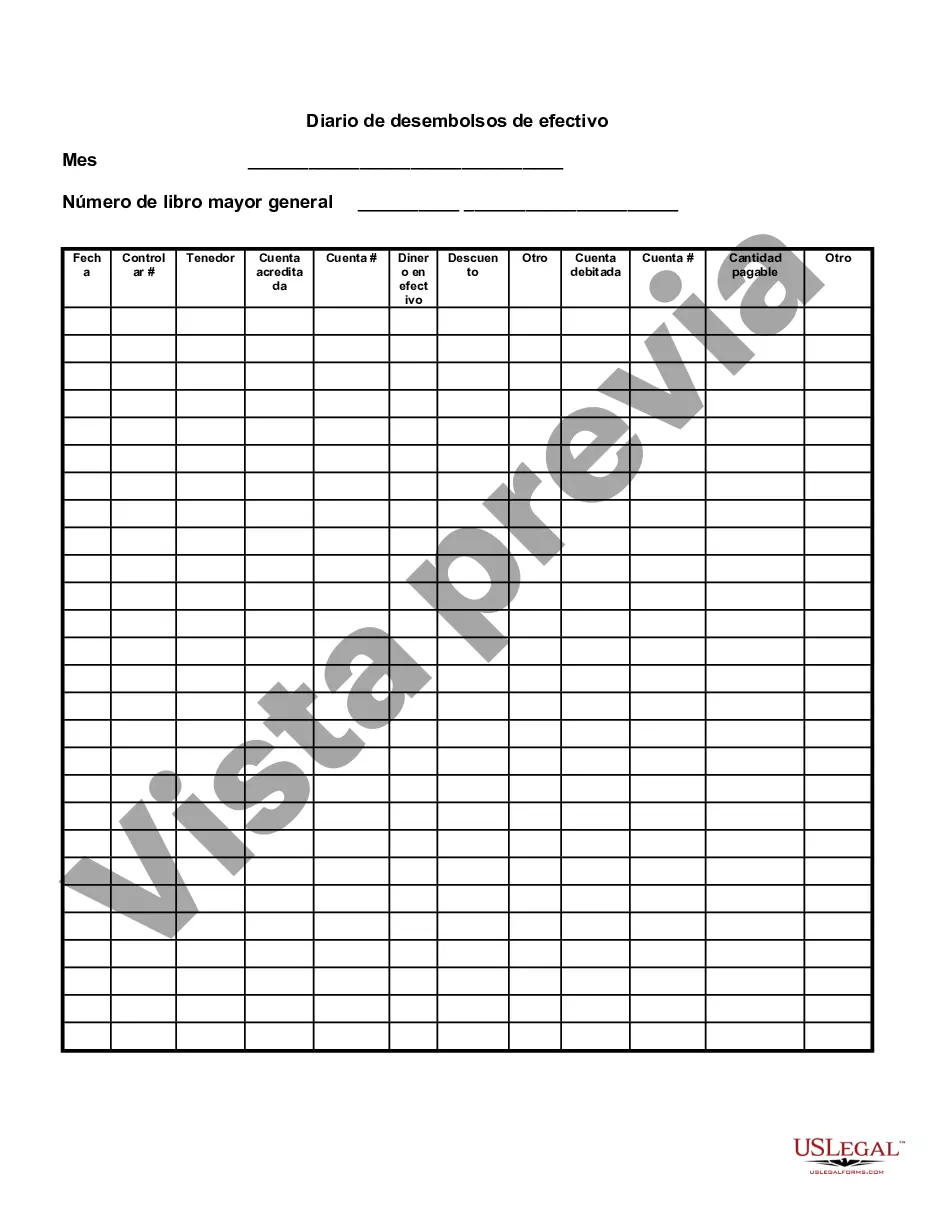

The Philadelphia Pennsylvania Cash Disbursements Journal is a vital accounting record that tracks all outgoing cash transactions for businesses operating in Philadelphia, Pennsylvania. It serves as a clear and organized log of all payments made by the company, ensuring accurate financial management and facilitating effective budgeting. As an essential component of the accounting process, the Philadelphia Pennsylvania Cash Disbursements Journal records each disbursement, providing details such as the date, payment recipient, purpose, and amount of each transaction. Keywords related to this topic may include: 1. Cash Disbursements Journal: The primary accounting ledger used to document outgoing cash transactions. 2. Philadelphia, Pennsylvania: The location where the journal is specifically designed for businesses operating. 3. Accounting record: A systematic and detailed account of financial transactions within a specific period. 4. Outgoing cash transactions: Payments made by the company, such as salary payments, utility bills, vendor payments, and other relevant expenses. 5. Financial management: The process of planning, organizing, and controlling the financial resources of an organization. 6. Budgeting: The process of creating a financial plan for a specific period, outlining expected revenues and expenses. 7. Payment recipient: The individual or organization receiving the payment from the company. 8. Transaction details: Specifics such as date, purpose, and amount of each disbursement. It should be noted that there is generally only one type of Cash Disbursements Journal for Philadelphia, Pennsylvania. However, variations may exist depending on the specific industry or business type. For example, a retail business may have a separate Cash Disbursements Journal for inventory-related expenses, while a service-based business may focus more on employee salaries and professional fees. Therefore, while the primary purpose and structure of the Philadelphia Pennsylvania Cash Disbursements Journal remain constant, the level of detail and categories may differ according to the specific needs of each business.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Philadelphia Pennsylvania Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Philadelphia Pennsylvania Diario De Desembolsos De Efectivo?

If you need to get a trustworthy legal form supplier to find the Philadelphia Cash Disbursements Journal, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed template.

- You can search from more than 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to find and execute different documents.

- US Legal Forms is a trusted service offering legal forms to millions of users since 1997.

Simply type to look for or browse Philadelphia Cash Disbursements Journal, either by a keyword or by the state/county the form is intended for. After finding the needed template, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to get started! Simply find the Philadelphia Cash Disbursements Journal template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately ready for download as soon as the payment is processed. Now you can execute the form.

Taking care of your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our extensive variety of legal forms makes this experience less expensive and more affordable. Create your first business, organize your advance care planning, draft a real estate contract, or complete the Philadelphia Cash Disbursements Journal - all from the convenience of your home.

Join US Legal Forms now!