Lima, Arizona Cash Disbursements Journal serves as a financial record that tracks all outgoing cash transactions within the locality of Lima, Arizona. This accounting document is essential for businesses, organizations, and government agencies to maintain accurate financial records and have a comprehensive overview of their expenditures. Keywords: Lima, Arizona, cash disbursements, journal, outgoing cash transactions, financial record, businesses, organizations, government agencies, accurate financial records, expenditures. Different types of Lima, Arizona Cash Disbursements Journals include: 1. General Cash Disbursements Journal: This type of journal encompasses all cash transactions made by various entities such as businesses, non-profit organizations, and government agencies in Lima, Arizona. It records expenses related to payroll, utilities, supplies, services, and other operational expenses. 2. Petty Cash Disbursements Journal: This journal specifically focuses on tracking small cash payments made for minor expenses, such as office supplies, small repairs, and travel expenses. It assists in maintaining control over petty cash by recording the date, purpose, and amount of each disbursement. 3. Accounts Payable Cash Disbursements Journal: This journal keeps a detailed record of outgoing cash payments to vendors, suppliers, or creditors, reflecting the amounts owed and the due dates. It helps businesses manage their payable accounts and ensures timely payments to avoid any late fees or penalties. 4. Payroll Cash Disbursements Journal: This journal is designed to record all cash disbursements related to employee wages, salaries, benefits, and taxes. It assists businesses in tracking personnel expenses and ensures accurate and compliant payroll management in Lima, Arizona. 5. Operating Expense Cash Disbursements Journal: This journal focuses on maintaining a comprehensive record of all cash payments related to the day-to-day operational expenses of a business or organization. It includes categories such as rent, utilities, insurance, advertising, and other essential expenses incurred in Lima, Arizona. By utilizing the appropriate type of Lima, Arizona Cash Disbursements Journal, businesses, organizations, and government agencies can effectively track and manage their outgoing cash transactions, maintain accurate financial records, and ensure financial stability and compliance within the local jurisdiction.

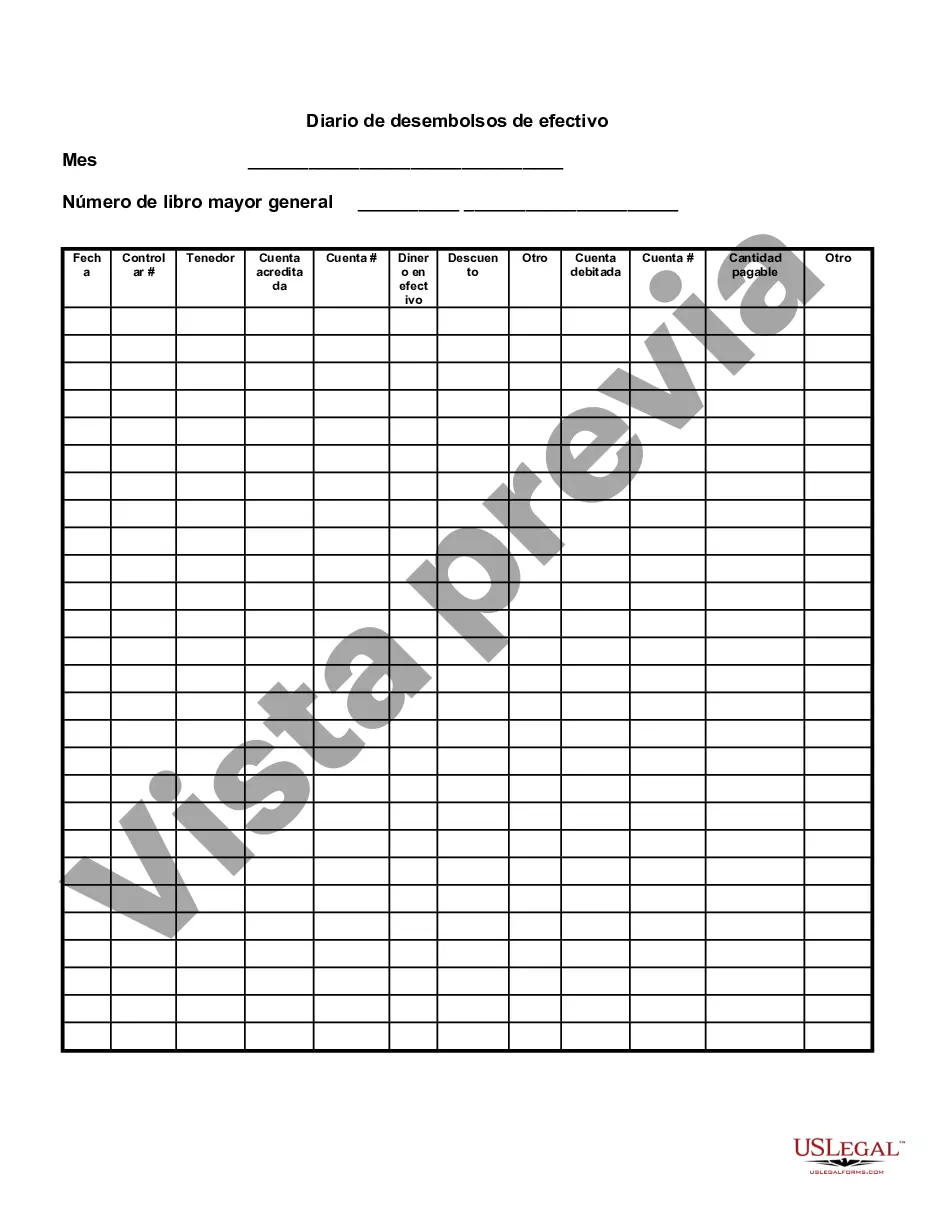

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Pima Arizona Diario De Desembolsos De Efectivo?

If you need to find a reliable legal document supplier to obtain the Pima Cash Disbursements Journal, consider US Legal Forms. No matter if you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the needed form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support make it easy to get and complete different paperwork.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

You can simply select to look for or browse Pima Cash Disbursements Journal, either by a keyword or by the state/county the document is intended for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to get started! Simply locate the Pima Cash Disbursements Journal template and check the form's preview and short introductory information (if available). If you're confident about the template’s legalese, go ahead and click Buy now. Create an account and choose a subscription option. The template will be immediately ready for download as soon as the payment is completed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes these tasks less costly and more reasonably priced. Set up your first business, organize your advance care planning, create a real estate contract, or execute the Pima Cash Disbursements Journal - all from the convenience of your sofa.

Sign up for US Legal Forms now!