The Sacramento California Cash Disbursements Journal is an important accounting document used to record all cash payments made by an organization or business located in Sacramento, California. It serves as a comprehensive record of all outgoing cash transactions, ensuring accuracy and accountability in financial reporting. The Cash Disbursements Journal allows businesses to track and manage their expenses efficiently, keeping a detailed record of each payment made. It includes relevant keywords such as "Sacramento California," indicating that it solely focuses on businesses operating within this geographical region. Different types of Sacramento California Cash Disbursements Journals may include: 1. General Cash Disbursements Journal: This type of journal records all types of cash payments made by the business, ranging from bills, utilities, employee wages, office supplies, rent, tax payments, and other regular expenses. 2. Payroll Cash Disbursements Journal: This specific journal is used to record all cash payments related to employee wages, salaries, commissions, bonuses, and any other payments associated with labor or workforce expenses. 3. Vendor Cash Disbursements Journal: This journal is exclusively dedicated to recording cash payments made to vendors or suppliers for purchasing goods or services. It includes entries for raw materials, inventory purchases, equipment, or any other business-related expenses paid to external parties. 4. Expense Cash Disbursements Journal: This type of journal is used to record various expenses incurred by the business, such as travel expenses, marketing costs, entertainment expenses, or any other miscellaneous expenditures. 5. Petty Cash Disbursements Journal: This specialized journal records all smaller cash payments made from the petty cash fund, typically used for small and immediate expenses like office supplies, taxi fares, or minor repairs. Maintaining accurate and organized cash disbursements records in Sacramento, California, is crucial for businesses to ensure compliance with financial regulations and have a clear overview of their expenses. By utilizing relevant keywords, businesses can easily identify the specific type of cash disbursements journal they need to keep track of their payments effectively.

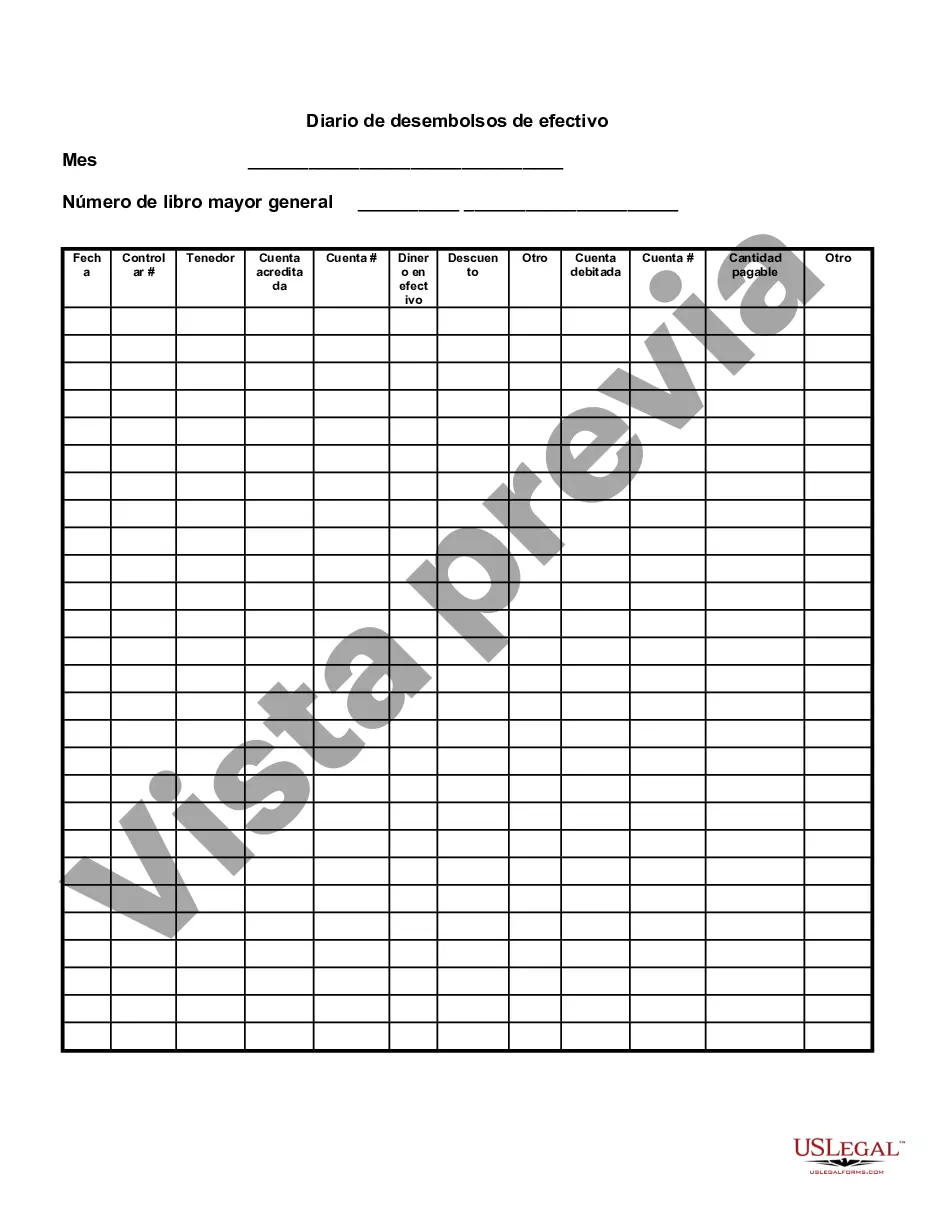

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Sacramento California Diario De Desembolsos De Efectivo?

A document routine always accompanies any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and lots of other life situations require you prepare official documentation that differs from state to state. That's why having it all accumulated in one place is so valuable.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any individual or business objective utilized in your county, including the Sacramento Cash Disbursements Journal.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Afterward, the Sacramento Cash Disbursements Journal will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Sacramento Cash Disbursements Journal:

- Make sure you have opened the right page with your regional form.

- Make use of the Preview mode (if available) and scroll through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now when you locate the necessary template.

- Select the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Sacramento Cash Disbursements Journal on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the templates available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!