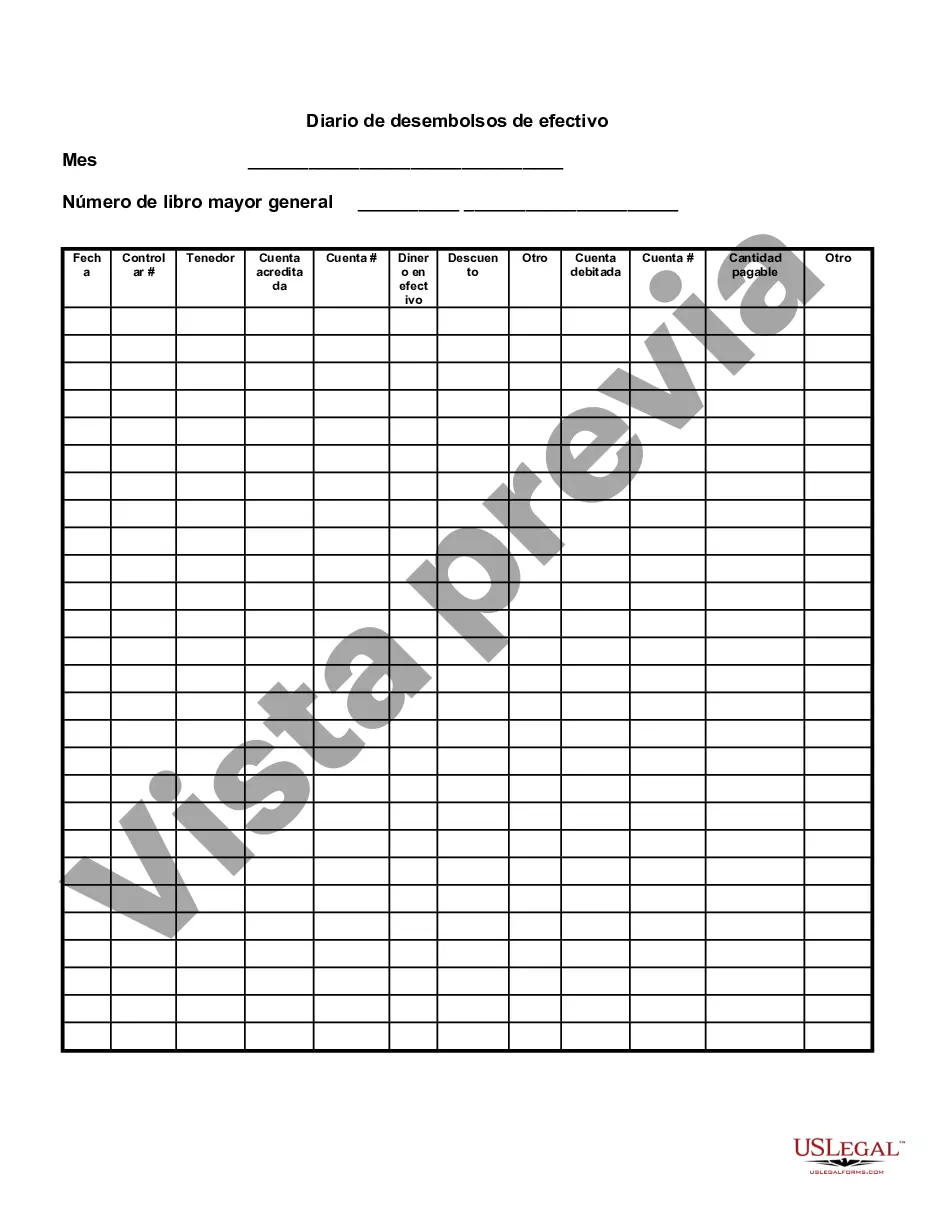

The San Antonio Texas Cash Disbursements Journal is a financial record used by businesses in San Antonio, Texas to track and document outgoing cash transactions. It serves as an essential tool for monitoring and managing cash flows, ensuring accurate accounting and financial reporting. The Cash Disbursements Journal captures various types of cash payments made by a company, such as vendor payments, utility bills, rent expenses, loan repayments, employee wages, and other operational expenses. Each entry in the journal usually includes the date of payment, payee or recipient, purpose of the payment, payment method used (e.g., cash, check, electronic transfer), and the amount disbursed. This comprehensive information enables businesses to maintain an organized record of all cash outflows, facilitating efficient bookkeeping and financial analysis. In San Antonio, Texas, businesses may encounter different types of Cash Disbursements Journals that cater to specific needs or industries. These could include: 1. General Cash Disbursements Journal: This is the most commonly used journal by businesses in San Antonio, Texas. It encompasses a wide range of cash transactions, covering various categories of expenses and payments. 2. Payroll Cash Disbursements Journal: Specifically designed to record and track employee wages, salaries, bonuses, and related payroll expenses. This journal helps businesses in San Antonio, Texas maintain accurate payroll records and comply with relevant tax regulations. 3. Accounts Payable Cash Disbursements Journal: Primarily used to document payments made to vendors, suppliers, and other creditors. This journal streamlines the accounts payable process, ensuring timely and accurate payment to maintain good relationships with business partners. 4. Petty Cash Disbursements Journal: Typically used to monitor and track small, regular, and miscellaneous cash expenses incurred by a business in San Antonio, Texas. This journal maintains transparency and control over petty cash funds, which are often used for small purchases or reimbursement of employee expenses. Overall, the San Antonio Texas Cash Disbursements Journal is an essential financial record-keeping tool for businesses in the area. By tracking and documenting cash outflows accurately, businesses can effectively manage their finances, make informed decisions, and ensure compliance with accounting standards and tax regulations specific to San Antonio, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out San Antonio Texas Diario De Desembolsos De Efectivo?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for professional help to create some of them from the ground up, including San Antonio Cash Disbursements Journal, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to choose from in different types ranging from living wills to real estate paperwork to divorce papers. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and tutorials on the website to make any activities related to document completion simple.

Here's how to purchase and download San Antonio Cash Disbursements Journal.

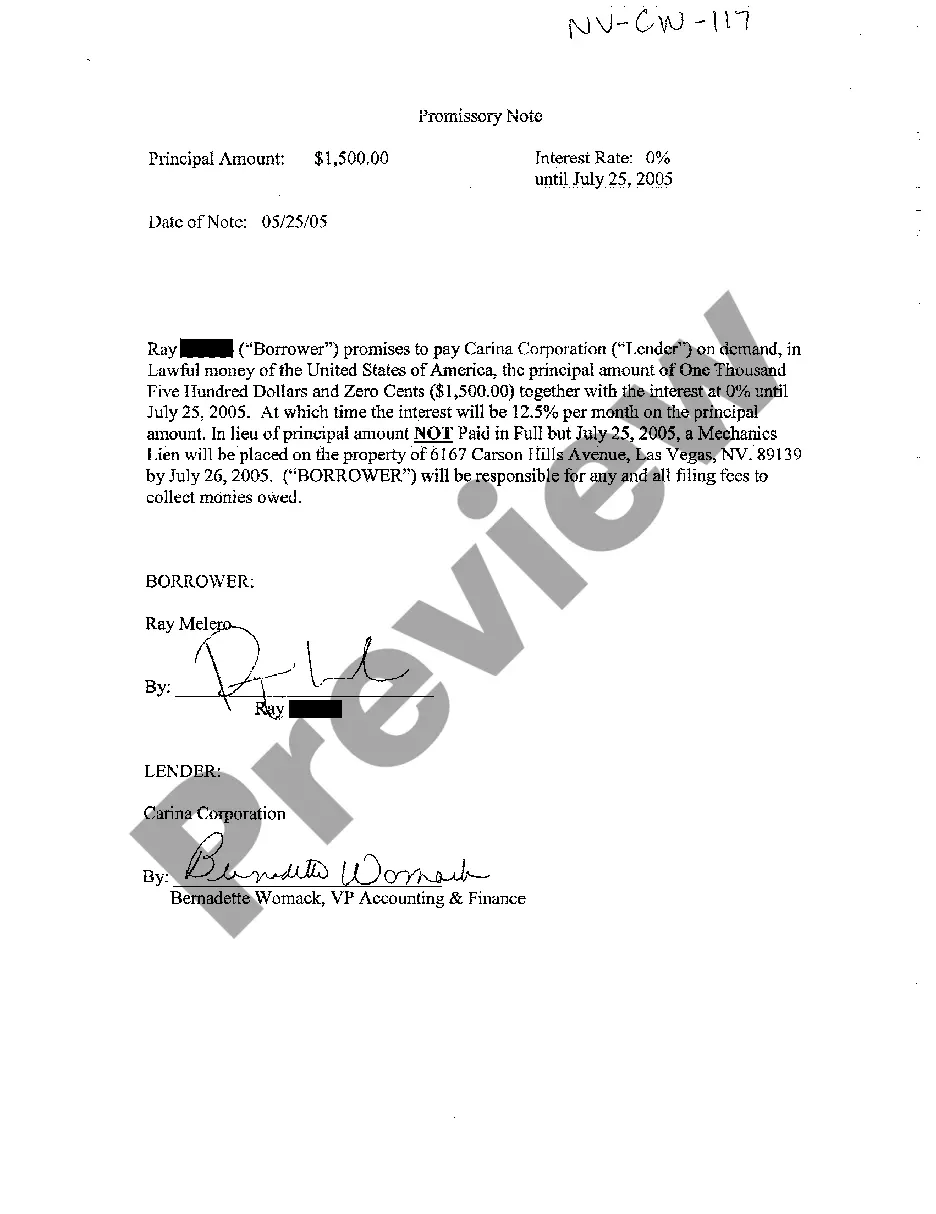

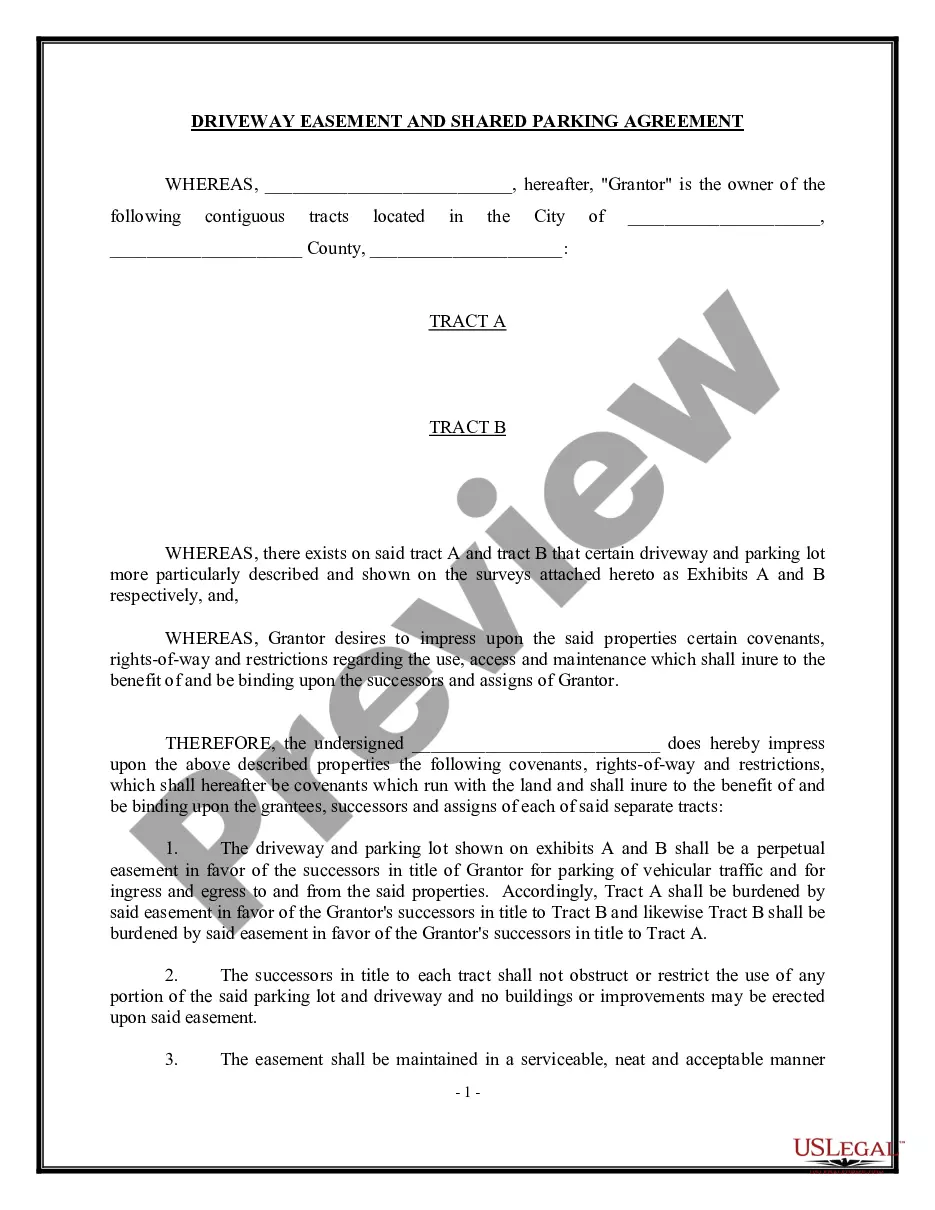

- Take a look at the document's preview and description (if provided) to get a general idea of what you’ll get after getting the form.

- Ensure that the document of your choice is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the similar forms or start the search over to locate the appropriate file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Pick the pricing {plan, then a suitable payment gateway, and purchase San Antonio Cash Disbursements Journal.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed San Antonio Cash Disbursements Journal, log in to your account, and download it. Needless to say, our platform can’t replace an attorney entirely. If you have to deal with an extremely complicated case, we recommend using the services of a lawyer to check your form before executing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and get your state-specific paperwork effortlessly!