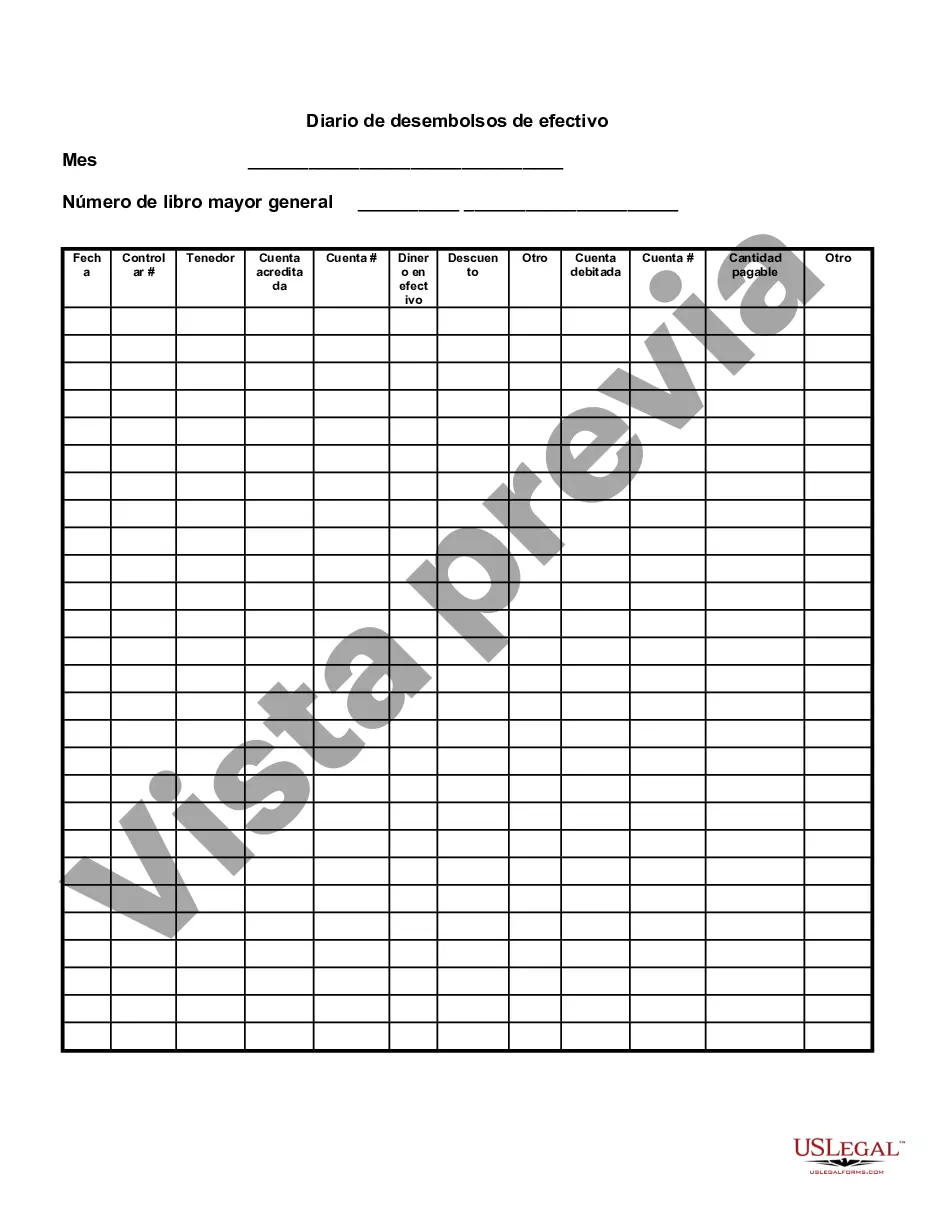

The Suffolk New York Cash Disbursements Journal is a record-keeping tool used by businesses in Suffolk County, New York, to track and document all cash payments made by the company. It is an essential component of the accounting process that helps maintain accurate financial records and ensure proper management of expenses. The Cash Disbursements Journal is typically organized in a columnar format, with several key fields that provide essential information about each payment. Some relevant keywords associated with this journal include: 1. Cash disbursements: The journal focuses specifically on the outflows of cash from the company, including payments made to suppliers, vendors, employees, or other parties. 2. Check number: Each cash payment is assigned a unique check number, which facilitates easy referencing and identification of individual transactions. 3. Date: The date of the payment is recorded to ensure chronological order and accurate bookkeeping. 4. Payee: The name of the recipient or payee of the payment is recorded, enabling easy tracking and verification. 5. Invoice number: In case of payments to suppliers or vendors, the associated invoice number is often included for better documentation and reconciliation purposes. 6. Description: A brief description of the purpose or nature of the payment is provided to provide additional details and context. 7. Amount: The monetary value of each payment is recorded, ensuring accurate reporting of expenses and budget management. 8. Account number: The relevant account number is specified to ensure proper classification and allocation of expenses to respective accounts within the company's chart of accounts. It is important to note that while there might not be different types of Suffolk New York Cash Disbursements Journals, variations may exist based on the specific needs and preferences of each business, as well as any software or accounting systems utilized. Some businesses may choose to incorporate additional columns or fields tailored to their unique requirements, such as department or project codes, tax information, or payment method details. In summary, the Suffolk New York Cash Disbursements Journal is an indispensable tool for businesses operating in Suffolk County, New York, to accurately track and document cash payments. It ensures transparent financial management, reliable expense tracking, and simplifies the reconciliation process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Suffolk New York Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Suffolk New York Diario De Desembolsos De Efectivo?

If you need to find a trustworthy legal paperwork provider to find the Suffolk Cash Disbursements Journal, look no further than US Legal Forms. Whether you need to launch your LLC business or take care of your asset distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate form.

- You can select from more than 85,000 forms categorized by state/county and situation.

- The self-explanatory interface, variety of learning materials, and dedicated support make it easy to locate and complete different paperwork.

- US Legal Forms is a reliable service offering legal forms to millions of customers since 1997.

Simply type to search or browse Suffolk Cash Disbursements Journal, either by a keyword or by the state/county the document is intended for. After finding the necessary form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to get started! Simply find the Suffolk Cash Disbursements Journal template and take a look at the form's preview and description (if available). If you're confident about the template’s legalese, go ahead and hit Buy now. Register an account and select a subscription plan. The template will be immediately ready for download once the payment is processed. Now you can complete the form.

Taking care of your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Create your first company, arrange your advance care planning, draft a real estate agreement, or execute the Suffolk Cash Disbursements Journal - all from the convenience of your home.

Join US Legal Forms now!