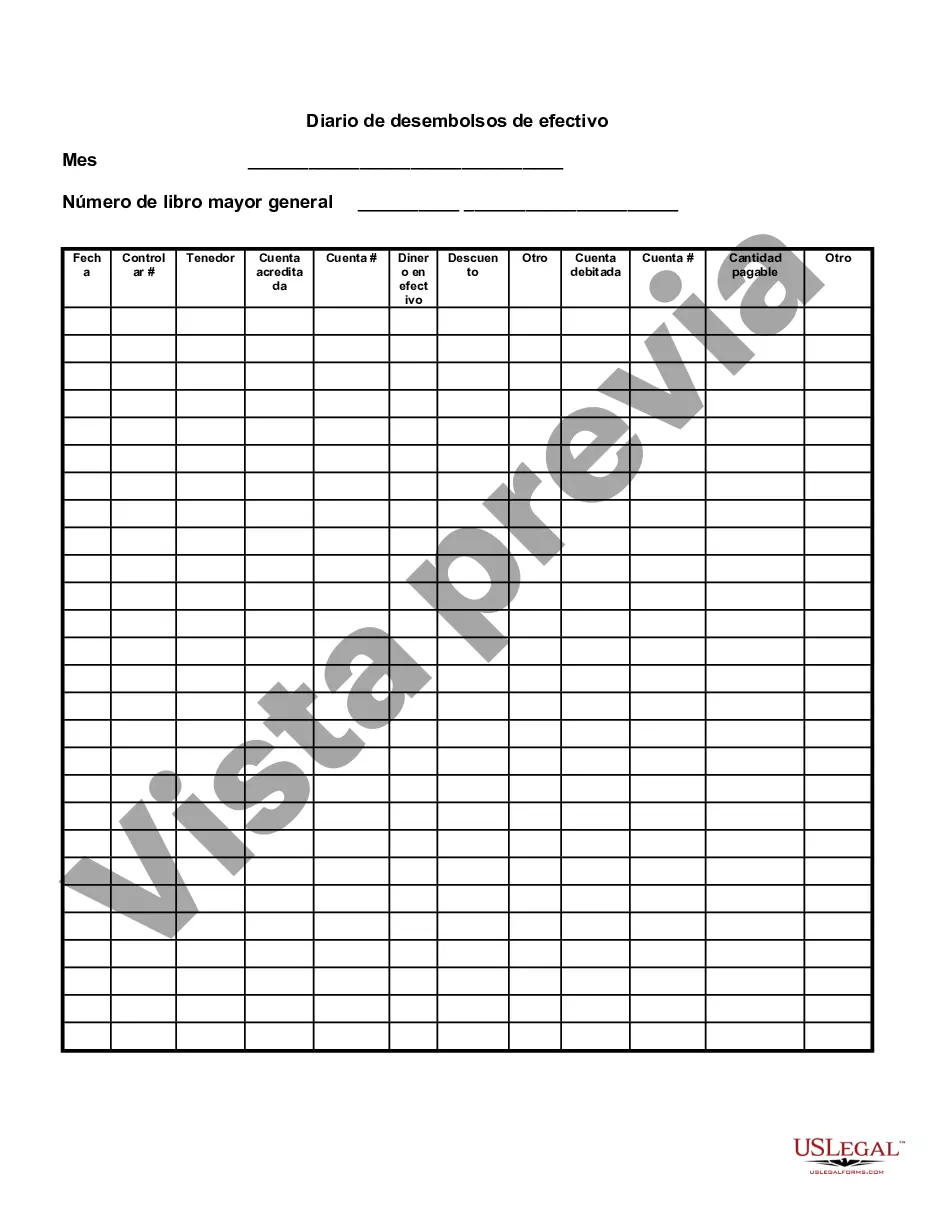

Description: The Wake North Carolina Cash Disbursements Journal is a crucial tool in financial accounting that records all cash payments made by an organization or business based in Wake, North Carolina. It serves as a comprehensive and detailed log that helps monitor and track all outgoing cash transactions effectively. This journal is essential in maintaining accurate financial records, promoting transparency, and organizing the cash flow system. It aids in reducing errors and fraudulent activities while providing a clear overview of the cash disbursements within a specified period. The information recorded in the journal includes the date of transaction, description of the payment, the payee's details, and the amount disbursed. There are various types of Cash Disbursements Journals utilized in Wake, North Carolina, depending on the specific requirements and nature of the business: 1. General Cash Disbursements Journal: This type of journal captures all general and miscellaneous cash outflows made by the organization. It includes payments related to office supplies, repairs, maintenance, utility bills, and other operational expenses. 2. Payroll Disbursements Journal: This journal focuses specifically on recording payments related to employee salaries, wages, bonuses, benefits, and any other payroll-related disbursements. It ensures accurate tracking of personnel expenses, tax withholding, and deductions. 3. Purchases Cash Disbursements Journal: Used primarily in retail or wholesale businesses, this journal tracks payments made to suppliers for inventory purchases. It includes details such as the supplier's name, invoice number, payment terms, and the amount disbursed to maintain accurate purchase records. 4. Expense Cash Disbursements Journal: This type of journal is used to record specific expenses incurred by the organization, such as rent payments, advertising costs, travel expenses, legal fees, and other miscellaneous expenses not covered by the general cash disbursements journal. Effectively utilizing a Cash Disbursements Journal helps businesses and organizations in Wake, North Carolina maintain control over their cash outflows, identify potential discrepancies, track expenses, and adhere to financial regulations. It serves as a valuable tool for accountants, auditors, and financial managers in ensuring accurate financial reporting and maintaining a robust financial system.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Diario de desembolsos de efectivo - Cash Disbursements Journal

Description

How to fill out Wake North Carolina Diario De Desembolsos De Efectivo?

Creating legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to create some of them from the ground up, including Wake Cash Disbursements Journal, with a platform like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories ranging from living wills to real estate paperwork to divorce documents. All forms are arranged according to their valid state, making the searching experience less frustrating. You can also find detailed resources and guides on the website to make any activities associated with paperwork execution simple.

Here's how you can locate and download Wake Cash Disbursements Journal.

- Go over the document's preview and outline (if provided) to get a general idea of what you’ll get after downloading the document.

- Ensure that the document of your choice is specific to your state/county/area since state laws can impact the validity of some documents.

- Examine the related document templates or start the search over to locate the appropriate document.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the pricing {plan, then a suitable payment method, and purchase Wake Cash Disbursements Journal.

- Select to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can locate the appropriate Wake Cash Disbursements Journal, log in to your account, and download it. Needless to say, our website can’t replace a lawyer entirely. If you need to cope with an extremely challenging situation, we advise getting a lawyer to examine your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to platform for many different legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork with ease!