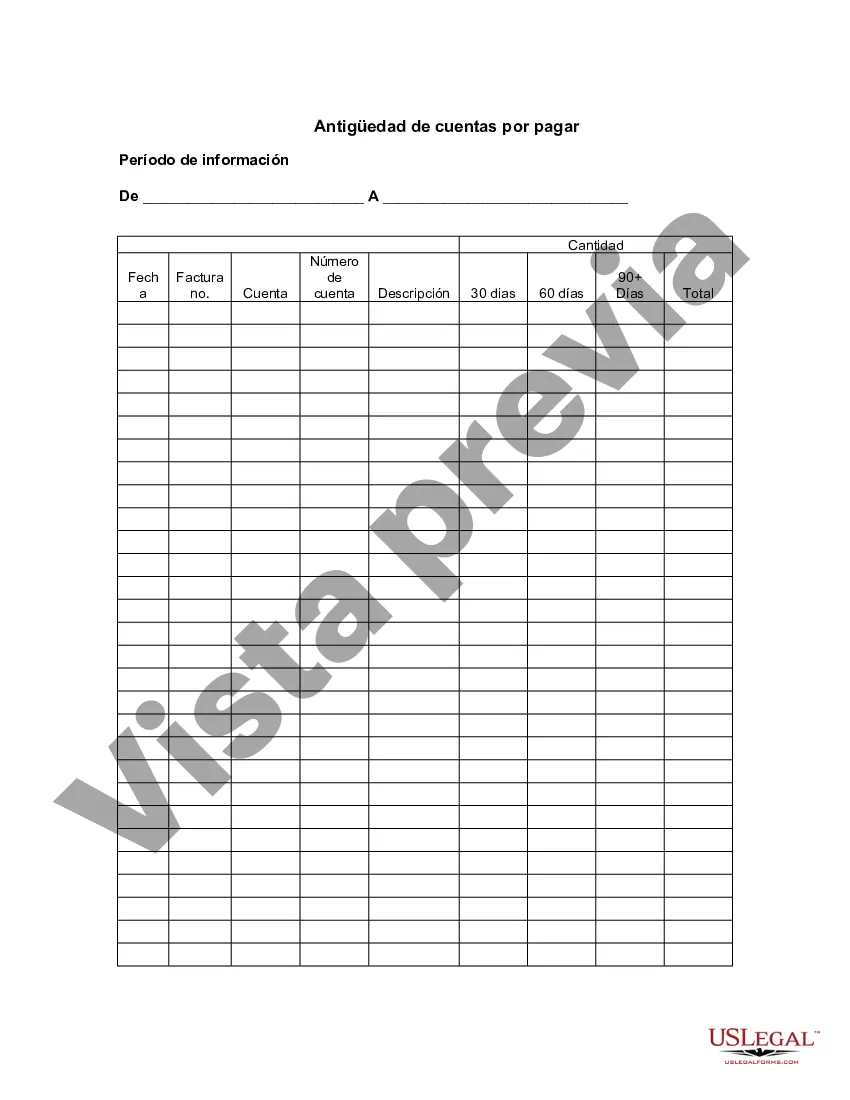

Bexar Texas Aging of Accounts Payable refers to a financial management process that helps businesses in Bexar County, Texas, track and analyze their outstanding payments to vendors, suppliers, and creditors. It provides insights into the time it takes for the company to pay its debts, identifies potential cash flow issues, and assists in maintaining good relationships with suppliers. The Bexar Texas Aging of Accounts Payable is divided into several categories or types, each representing the period of time that has elapsed since the invoice or bill was issued. These categories include: 1. Current: This category comprises payments that are due within the current billing cycle or have been paid promptly. These payments typically represent the accounts payable that are in good standing and do not cause immediate concern about cash flow. 2. 30-Day Aging: This category includes invoices or bills that are 30 days past their due date. It indicates a slight delay in payment but is still within an acceptable timeframe. Monitoring this category helps identify potential bottlenecks in accounts payable processing or potential payment delays. 3. 60-Day Aging: This category includes invoices or bills that are 60 days past their due date. It highlights a noticeable delay in payment and requires more attention from the business to ensure timely settling of debts. Businesses should analyze this category closely to identify reasons for delays and implement strategies to manage cash flow efficiently. 4. 90-Day Aging: Invoices or bills that have been unpaid for 90 days or more fall under this category. These are referred to as overdue payments and need immediate attention. Businesses must investigate the reasons for such delays, communicate with vendors to negotiate payment terms, and take necessary steps to improve cash flow. The Bexar Texas Aging of Accounts Payable not only helps in managing financial obligations but also aids in analyzing vendor relationships, negotiating favorable terms, and identifying potential cost reductions or payment optimizations. Businesses in Bexar County can utilize this financial tool to ensure financial stability, enhance cash flow management, and maintain healthy relationships with their suppliers, vendors, and creditors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Bexar Texas Antigüedad De Cuentas Por Pagar?

Draftwing forms, like Bexar Aging of Accounts Payable, to manage your legal matters is a tough and time-consumming process. Many cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal matters into your own hands and manage them yourself. US Legal Forms is here to save the day. Our website comes with more than 85,000 legal forms crafted for different scenarios and life circumstances. We make sure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already familiar with our website and have a subscription with US, you know how easy it is to get the Bexar Aging of Accounts Payable template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Bexar Aging of Accounts Payable:

- Ensure that your document is compliant with your state/county since the rules for creating legal documents may vary from one state another.

- Find out more about the form by previewing it or reading a quick description. If the Bexar Aging of Accounts Payable isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Sign in or register an account to start using our service and get the form.

- Everything looks good on your side? Hit the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment details.

- Your form is good to go. You can try and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our rich collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!