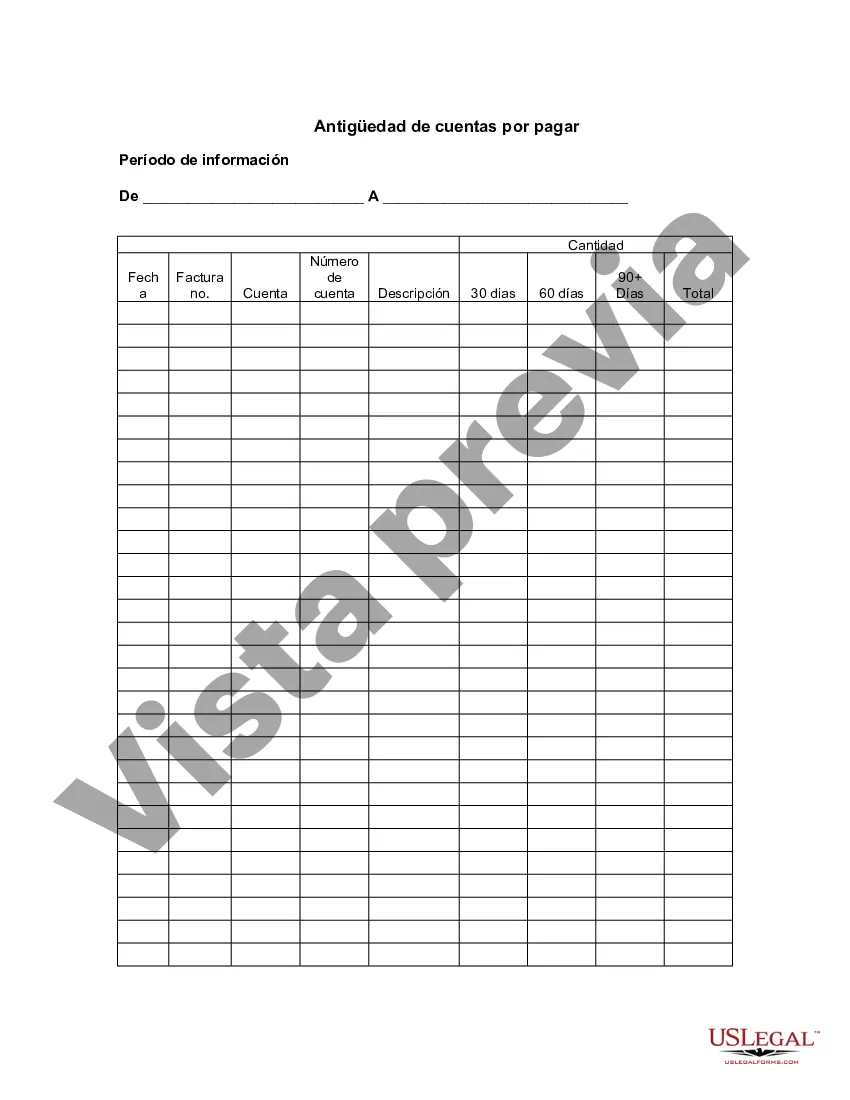

Chicago, Illinois, Aging of Accounts Payable refers to the process of categorizing and analyzing outstanding accounts payable for businesses located in the city of Chicago, the third-largest city in the United States and a key economic hub. The Aging of Accounts Payable is a crucial financial management tool used by businesses to track the age of their unpaid invoices and monitor the efficiency of their payables process. It allows businesses to identify outstanding invoices that are overdue for payment, pinpoint potential cash flow issues, and maintain healthy vendor relationships. In Chicago, there are primarily two types of Aging of Accounts Payable: 1. Vendor Aging of Accounts Payable: Vendor Aging of Accounts Payable provides a comprehensive overview of the unpaid invoices owed to different vendors by a Chicago-based business. This report categorizes outstanding invoices based on their age, typically divided into timeframes such as 30 days, 60 days, 90 days, and beyond. By analyzing this report, businesses can identify vendors they owe money to, prioritize payments based on urgency, negotiate payment terms, and strengthen vendor relationships. 2. Customer Aging of Accounts Payable: Customer Aging of Accounts Payable represents the unpaid invoices owed to a Chicago-based business by its customers. This report is crucial for tracking the collection of outstanding payments and managing cash flow. By categorizing unpaid invoices based on their age, businesses can follow up with customers who have overdue invoices, assess the effectiveness of their credit policies, implement collection strategies, and make informed decisions regarding credit limits and future sales to customers. Businesses in Chicago use various software systems and financial tools to generate Aging of Accounts Payable reports. These include popular accounting software like QuickBooks, SAP, and Sage, which provide built-in functionalities to generate detailed aging reports customized to the business's specific needs. Understanding the Aging of Accounts Payable in Chicago, Illinois, is essential for businesses aiming to maintain healthy cash flow, manage vendor and customer relationships effectively, and ensure the overall financial stability of their operations. By regularly monitoring and analyzing these reports, businesses can make informed financial decisions, improve payment processes, and optimize their cash flow management strategies in the dynamic and vibrant city of Chicago.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Chicago Illinois Antigüedad De Cuentas Por Pagar?

Creating forms, like Chicago Aging of Accounts Payable, to take care of your legal affairs is a tough and time-consumming process. Many cases require an attorney’s involvement, which also makes this task not really affordable. However, you can get your legal issues into your own hands and handle them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal forms intended for different scenarios and life circumstances. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls compliance-wise.

If you're already aware of our services and have a subscription with US, you know how straightforward it is to get the Chicago Aging of Accounts Payable template. Go ahead and log in to your account, download the form, and customize it to your requirements. Have you lost your form? No worries. You can find it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as straightforward! Here’s what you need to do before downloading Chicago Aging of Accounts Payable:

- Ensure that your document is compliant with your state/county since the regulations for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Chicago Aging of Accounts Payable isn’t something you were looking for, then take advantage of the search bar in the header to find another one.

- Log in or create an account to begin utilizing our website and get the document.

- Everything looks good on your end? Hit the Buy now button and choose the subscription plan.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can try and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of businesses and individuals are already benefiting from our rich collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!