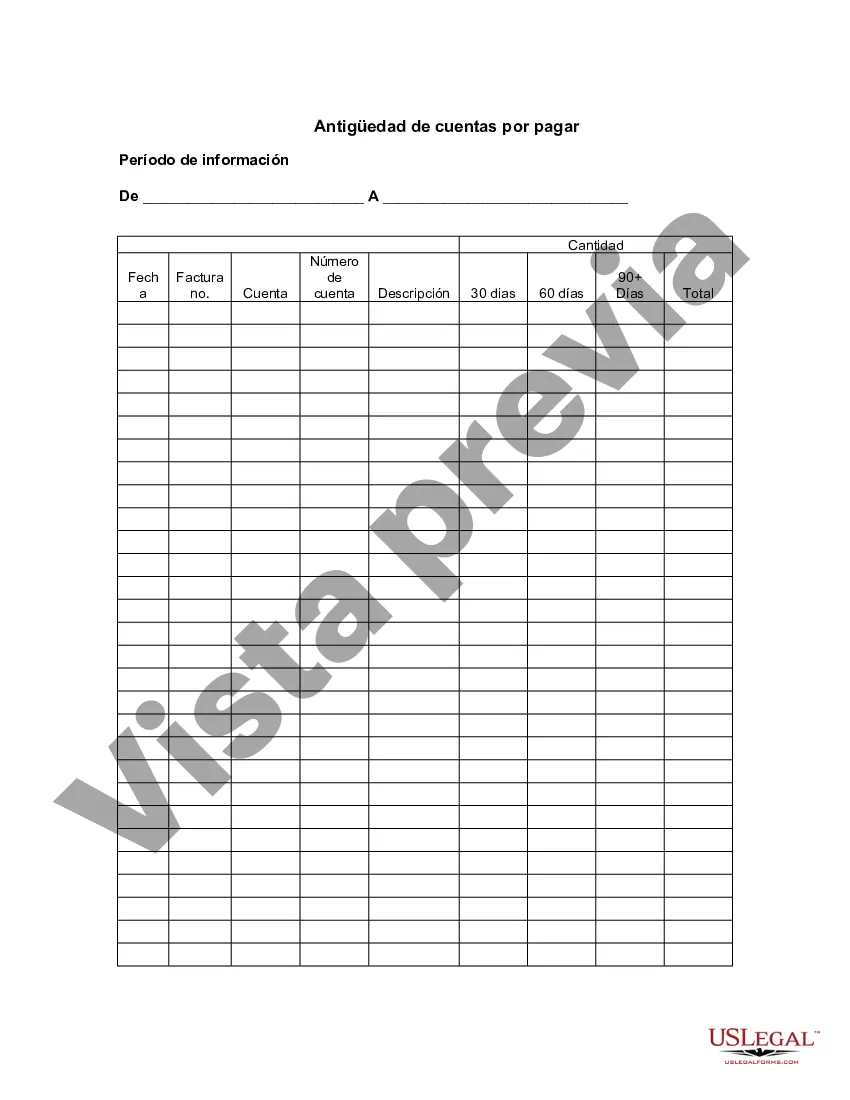

Cuyahoga Ohio Aging of Accounts Payable is a financial management technique that helps businesses in Cuyahoga, Ohio, track and evaluate their outstanding payments to vendors and suppliers. This process involves categorizing unpaid invoices according to their due dates and analyzing how long they have been outstanding. The process of Cuyahoga Ohio Aging of Accounts Payable allows businesses to assess the effectiveness of their cash flow management and identify potential issues with timely payment to vendors. By categorizing outstanding invoices into different time intervals, such as 30 days, 60 days, 90 days, and so on, businesses can determine which invoices are overdue and take necessary actions to rectify the situation. The analysis of Cuyahoga Ohio Aging of Accounts Payable provides valuable insights into the financial health and efficiency of a business. It helps identify any bottlenecks in the payment process, late-paying customers, or outdated invoicing systems that may affect cash flow. By closely monitoring the aging of accounts payable, businesses can take proactive measures to improve financial stability and avoid unnecessary penalties or strained relationships with suppliers. Different types of Cuyahoga Ohio Aging of Accounts Payable may include: 1. Current Accounts Payable: This category includes invoices that are due within the current payment period, typically less than 30 days. 2. Aging 30 Days: This category comprises invoices that have been outstanding for 30 days or less. 3. Aging 60 Days: Invoices that have surpassed the 30-day period but are still unpaid after 60 days fall into this category. 4. Aging 90 Days: This category includes invoices that have gone unpaid for 90 days or longer. 5. Past Due Accounts Payable: This category encompasses invoices that have exceeded their due dates and remain unpaid, regardless of the specific time period. By analyzing the different types of Cuyahoga Ohio Aging of Accounts Payable, businesses can identify which categories require immediate attention or potential collection efforts. This information can guide business owners and financial managers in making informed decisions regarding cash flow management, payment prioritization, and vendor communication. In conclusion, Cuyahoga Ohio Aging of Accounts Payable is an essential financial management technique that enables businesses to evaluate and control their outstanding payments. By categorizing unpaid invoices according to their due dates, businesses gain valuable insights into their cash flow management and identify potential issues that may impact financial stability. Monitoring the aging of accounts payable helps businesses take proactive measures to improve payment efficiency, maintain supplier relationships, and ensure healthy financial operations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Cuyahoga Ohio Antigüedad De Cuentas Por Pagar?

Creating legal forms is a must in today's world. Nevertheless, you don't always need to look for professional help to create some of them from scratch, including Cuyahoga Aging of Accounts Payable, with a service like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce documents. All forms are arranged based on their valid state, making the searching process less overwhelming. You can also find information resources and tutorials on the website to make any activities associated with paperwork completion straightforward.

Here's how to find and download Cuyahoga Aging of Accounts Payable.

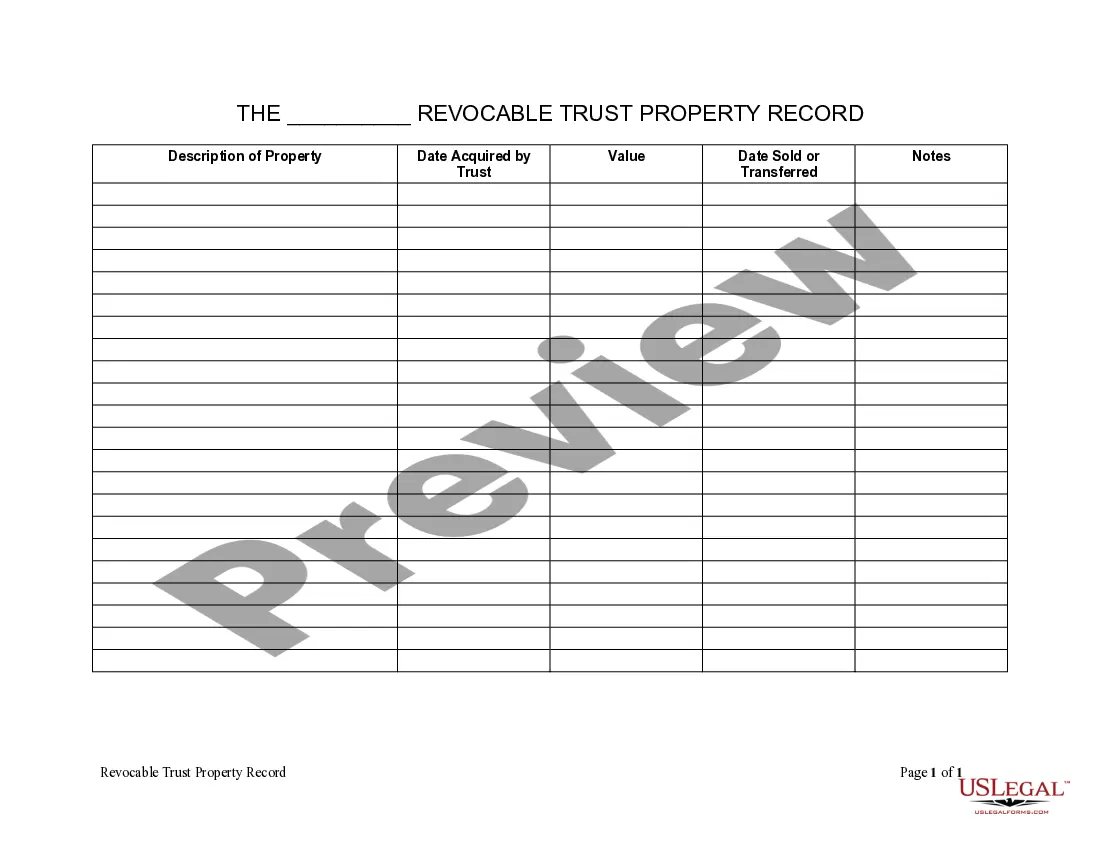

- Take a look at the document's preview and outline (if available) to get a general information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is specific to your state/county/area since state regulations can impact the legality of some documents.

- Check the related forms or start the search over to find the right file.

- Hit Buy now and create your account. If you already have an existing one, select to log in.

- Choose the option, then a suitable payment gateway, and buy Cuyahoga Aging of Accounts Payable.

- Choose to save the form template in any available format.

- Visit the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can find the needed Cuyahoga Aging of Accounts Payable, log in to your account, and download it. Of course, our website can’t replace a legal professional completely. If you have to deal with an exceptionally challenging situation, we advise getting an attorney to check your form before signing and submitting it.

With more than 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of customers. Become one of them today and get your state-compliant documents with ease!