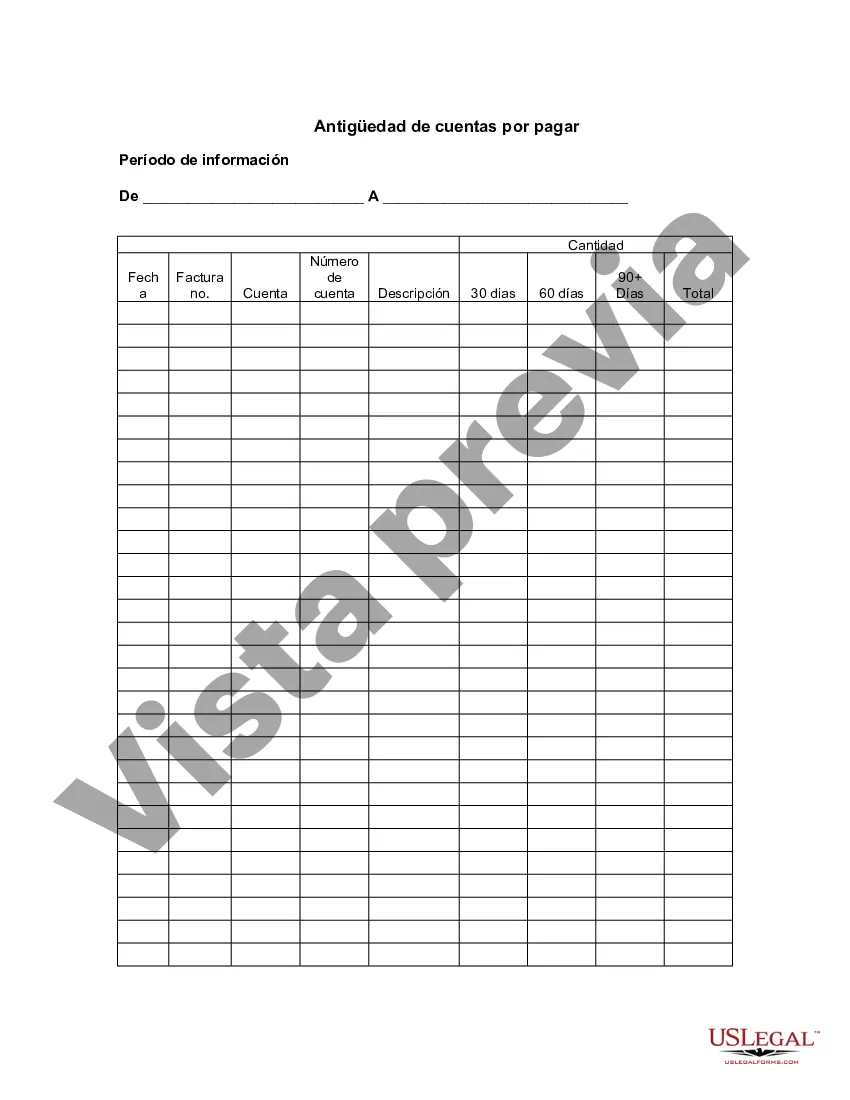

Fairfax Virginia Aging of Accounts Payable is a financial management practice that helps businesses in Fairfax, Virginia, track and analyze the ongoing payments owed to suppliers and vendors. By implementing this procedure, companies are able to monitor their financial obligations and gain insights into their cash flow management. In this process, the accounts payable department categorizes outstanding invoices based on their due dates. This helps to classify the bills into different aging buckets, which include a range of days that have passed since the invoice was issued. The standard aging buckets are usually 0-30 days, 31-60 days, 61-90 days, and 90+ days. The objective of overseeing the aging of accounts payable is to provide a clear picture of the company's financial health. The analysis aids in identifying potential liquidity issues, ensuring timely payments to maintain positive relationships with suppliers, and preventing late payment penalties or interest charges. By utilizing Fairfax Virginia Aging of Accounts Payable, businesses can effectively manage their working capital and optimize their cash flow management strategy. Monitoring the aging of accounts payable enables companies to forecast payment obligations accurately, negotiate favorable payment terms, and develop efficient cash management policies. Different types of Fairfax Virginia Aging of Accounts Payable include: 1. Traditional Aging of Accounts Payable: This method is widely used by businesses to classify invoices based on the due date ranges. It helps in identifying the outstanding bills, providing an overview of the payment schedule. 2. Weighted Average Aging of Accounts Payable: In this method, invoices are assigned a weighted value based on their due dates. This approach allows companies to weigh the aging of high-value invoices more heavily, enabling them to prioritize payments accordingly. 3. Vendor-Specific Aging of Accounts Payable: This type of aging analysis focuses on individual vendors or suppliers. It helps businesses identify and address payment delays or discrepancies specific to certain vendors and build strong relationships with key suppliers. 4. Industry-Specific Aging of Accounts Payable: This approach involves comparing a company's accounts payable aging to industry benchmarks or averages. By doing so, businesses can gain insights into their financial performance relative to their competitors, enabling them to identify areas of improvement. Fairfax Virginia Aging of Accounts Payable is a crucial financial management practice that empowers businesses to efficiently manage their payment obligations. By utilizing this method and its various types, companies can enhance their cash flow management, establish positive relationships with suppliers, and bolster their overall financial health.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Fairfax Virginia Antigüedad De Cuentas Por Pagar?

A document routine always goes along with any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare formal documentation that varies throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business objective utilized in your region, including the Fairfax Aging of Accounts Payable.

Locating templates on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Fairfax Aging of Accounts Payable will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this simple guide to get the Fairfax Aging of Accounts Payable:

- Make sure you have opened the right page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you find the required template.

- Decide on the appropriate subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Fairfax Aging of Accounts Payable on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most reliable way to obtain legal paperwork. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!