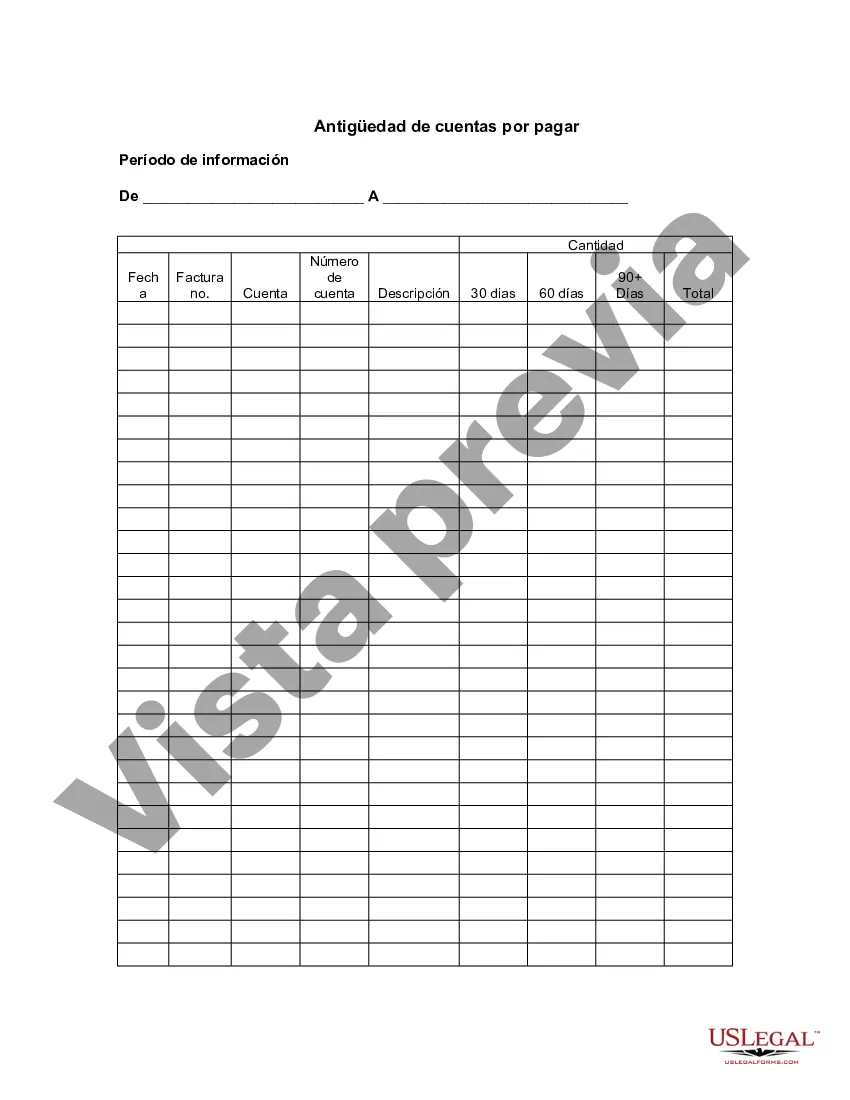

Los Angeles, California Aging of Accounts Payable is a financial analysis tool used by businesses to determine the average time it takes for a company to pay off its debts to suppliers or vendors in the Los Angeles area. By analyzing this information, businesses can assess their financial health, identify any potential cash flow issues, and develop strategies to improve payment efficiency. There are different types of Aging of Accounts Payable in Los Angeles, California, which include: 1. Current Accounts Payable: This category represents payments that are due within the next 30 days or less. It primarily includes recent invoices that haven't reached their due date yet. 2. 30-60 Days Aging Accounts Payable: This category represents payments that are due between 31 and 60 days. It includes invoices that have surpassed their due date by up to two months. 3. 61-90 Days Aging Accounts Payable: This category represents payments that are due between 61 and 90 days. It includes invoices that have surpassed their due date by around three months. 4. Over 90 Days Aging Accounts Payable: This category represents payments that are past due by over 90 days. It includes invoices that haven't been paid for more than three months, indicating potential financial hardships or liquidity challenges. Businesses must closely monitor their Aging of Accounts Payable in Los Angeles, California to maintain positive relationships with suppliers and vendors. By paying bills promptly, they demonstrate reliability and trustworthiness, ensuring that they can continue to receive products or services without disruptions. Neglecting to manage Aging of Accounts Payable can have detrimental consequences, including strained relationships with suppliers, possible late payment fees, and even legal actions. In extreme cases, businesses may face a disruption in the supply chain, leading to production delays or inventory shortages. To effectively manage Los Angeles, California Aging of Accounts Payable, businesses can implement various strategies. These include negotiating favorable payment terms with suppliers, improving cash flow management, implementing automated payment systems to streamline processes, and regularly reviewing and reconciling accounts payable to identify discrepancies or errors. In conclusion, Los Angeles, California Aging of Accounts Payable is a crucial financial analysis tool for businesses to assess payment efficiency and maintain healthy relationships with suppliers and vendors. It involves categorizing outstanding debts based on their age, allowing businesses to identify potential cash flow issues and take corrective measures to improve their financial standing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Antigüedad de cuentas por pagar - Aging of Accounts Payable

Description

How to fill out Los Angeles California Antigüedad De Cuentas Por Pagar?

Whether you plan to start your company, enter into a deal, apply for your ID renewal, or resolve family-related legal issues, you must prepare certain documentation meeting your local laws and regulations. Finding the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 professionally drafted and verified legal templates for any personal or business occurrence. All files are collected by state and area of use, so picking a copy like Los Angeles Aging of Accounts Payable is fast and easy.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to obtain the Los Angeles Aging of Accounts Payable. Adhere to the guidelines below:

- Make sure the sample fulfills your personal needs and state law regulations.

- Read the form description and check the Preview if available on the page.

- Utilize the search tab specifying your state above to locate another template.

- Click Buy Now to obtain the sample when you find the right one.

- Choose the subscription plan that suits you most to continue.

- Log in to your account and pay the service with a credit card or PayPal.

- Download the Los Angeles Aging of Accounts Payable in the file format you need.

- Print the copy or fill it out and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you are able to access all of your previously purchased paperwork at any moment in the My Forms tab of your profile. Stop wasting time on a endless search for up-to-date official documentation. Join the US Legal Forms platform and keep your paperwork in order with the most extensive online form collection!